Torrent Pharma, SBI, Coal India, are in radar this week

"Get the lowdown on the market rollercoaster this week. From volatile swings to rate cut speculations, discover winners, losers, and what lies ahead.

Markets nosedived on Friday to end a volatile week essentially flat. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly report.

Weekly Recap

Late-week tailspin

- Indices retreated sharply on Friday from the all-time highs they hit midway through the week, closing the week 0.25% higher than last Friday’s levels.

- The India VIX also leaped up by 36% through the week, spiking by over 8% on Friday alone.

- The broader markets performed better this week, with the Nifty Bank advancing by 2% and the Midcap index rising by 1%.

Freaky Friday

- Let’s talk about Friday, which saw broad-based declines in market sentiment and spikes in volatility.

- This can largely be chalked up to anticipation of US macro figures, Q4 earnings reports here, pre-election jitters, and profit-booking as indices approached fresh highs.

Rate cut hopes?

- US non-farm payroll and employment data came in weaker than expected for April, after markets in India closed, with hiring coming in below estimates for the month.

- As unemployment ticked up slightly, talks turned once again to the Fed hopefully cutting rates.

The winners

- Mahindra & Mahindra zoomed into the lead this week, posting an impressive 7.3% gain after the firm announced that its overall sales jumped 13% in April.

- In fact, many auto manufacturers performed well, propelling the Nifty Auto index to a record high this week as auto sales soared in April.

Also Read: April 2024 Auto Sales Data: Industry Analysis & Outlook

- Power Grid also fared well, up 6.3%, powered by soaring energy demand amidst India’s heatwave and successful large interstate transmission bids.

The losers

- IT heavyweight HCL Technologies tanked through the week, closing 8.6% lower in a beleaguered period for the sector at large.

- The fall, due to muted earnings growth, far eclipsed the week’s other top loser Apollo Hospitals, whose Advent deal raised strong concerns on the sale’s low valuations.

Meanwhile…

- Crude oil prices fell on Wednesday to their lowest levels since mid-March (before recovering somewhat due to geopolitical risks) on higher-than-expected US inventories.

- Europe’s economy showed signs of recovery again as the bloc grew by a better-than-forecast 0.3%, led by Ireland, Spain, Germany, France, and Italy’s strong performances.

Market Brief

Sectors

Stocks

Other Key Data

Market Outlook

Sectors To Watch: FMCG, Pharma, PSU Bank

Our take

- While there remain good reasons to be optimistic about Indian markets, volatility may stick around a while as investors process a mixed bag of Q4 earnings reports.

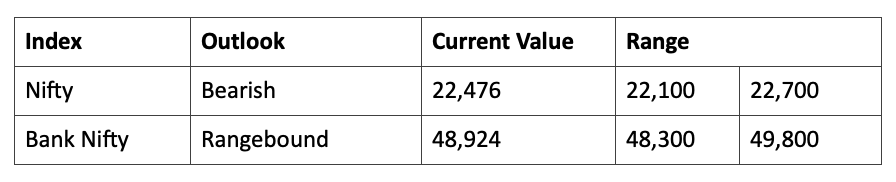

- With technical indicators pointing towards near-term bearishness, we anticipate the Nifty to trade between 22,100 and 22,700 levels in the coming week.

Stay ahead in the world of finance with the most relevant business news and market updates. With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey