April 2024 Auto Sales Data: Industry Analysis & Outlook

Discover key trends in April 2024's auto sales across two-wheelers, utility vehicles, and commercial segments. Learn which brands led the market and the projected industry outlook.

The automotive sector has continued its impressive streak of robust sales, a trend that's been dominant for almost two years. April's sales data brought a wave of optimism among automakers, showcasing their resilience against the backdrop of a broader economic slowdown. Both two-wheelers (2W) and passenger vehicles (PVs) have shown impressive sales figures, indicating strong consumer demand in these sectors.

Robust Demand for Two-Wheelers

The two-wheeler segment, particularly at the premium end, reported significant growth. Bajaj Auto's domestic sales saw a 19% year-over-year increase, while TVS Motor Company and Hero MotoCorp saw growth of 29% and 34%, respectively. Royal Enfield also posted a commendable growth of 9%, underscoring a sustained consumer interest in higher-end motorcycles.

Increasing Preference for Utility Vehicles

The demand for utility vehicles (UVs) has seen a significant rise. In April, total domestic sales for cars, sedans, and UVs increased by about 2%. This growth is notable, especially considering the high sales volume from the previous year, where around 338,341 vehicles were dispatched. Leading this surge, Maruti Suzuki experienced a 53.9% increase in its UV segment, spurred by the introduction of new models, while Mahindra & Mahindra saw an 18.2% increase in sales.

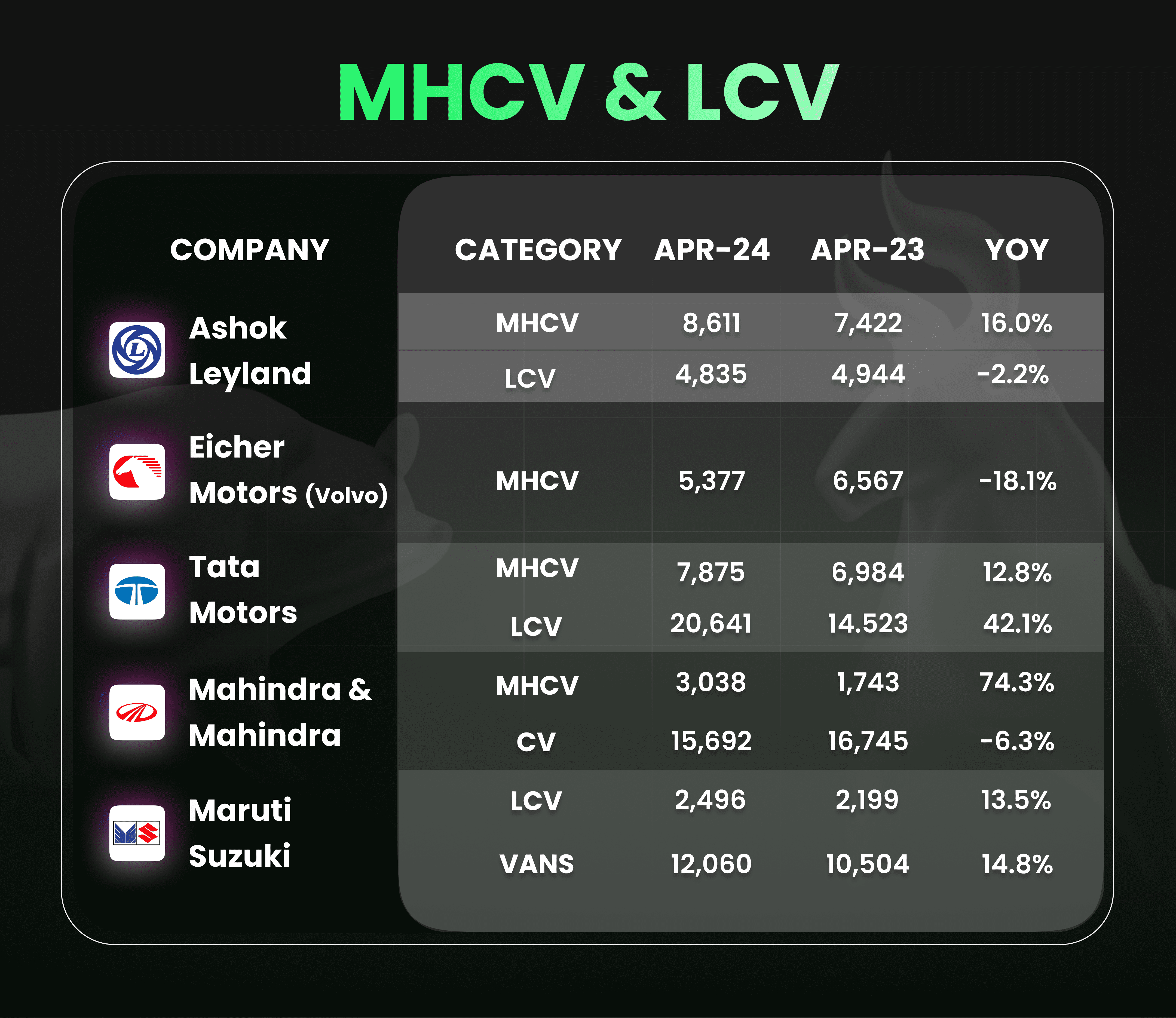

Commercial Vehicles Gain Momentum

Meanwhile, in the commercial vehicle segment, Tata Motors, the market leader, reported a 33% increase in sales, reaching 28,516 units last month. This upward trend was mirrored across the industry as several automakers in this segment reported higher sales.

Tractor Demand Remains Muted

Despite the general upbeat trend, the tractor segment faced challenges, likely influenced by the ongoing election, low reservoir levels, and moderate agricultural output. Escorts noted a slight drop of 1.2% in sales, while Mahindra & Mahindra saw a 1.7% increase.

The Road Ahead

With expectations of a near- to above-normal monsoon this year, sentiments in the tractor market are predicted to improve post-election. Furthermore, the potential for an above-normal monsoon bodes well for the two-wheeler segment, potentially sustaining the current positive momentum. The commercial vehicle sector may face some uncertainty due to slower economic activities around the general election period.

As we move forward, the focus will remain on the evolving market dynamics and how external factors like weather and economic policies will impact consumer demand in the auto industry.

Stay ahead in the world of finance with the most relevant business news and market updates. With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey.