Weekly Market Recap: Sensex, Nifty plunge up to 1.9% | Market Insights & Outlook | Liquide

Unpack a tumultuous week on Dalal Street with our insights on market sell-offs, sector performances, and future outlook.

Markets slid downward throughout this trading week which saw volatility spikes and fear take hold of Dalal Street. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly report.

Unhappy campers on D-Street

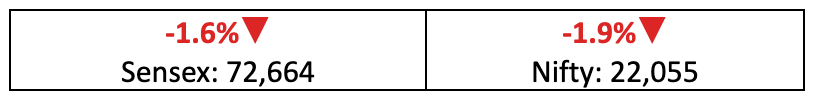

- The name of the trading game this week was sell-offs, with the bears asserting themselves this week (as we anticipated) to drive indices 1.9% lower than last week’s closing levels.

- The India VIX fear gauge soared by 37% this week to its highest levels in over a year.

What gives?

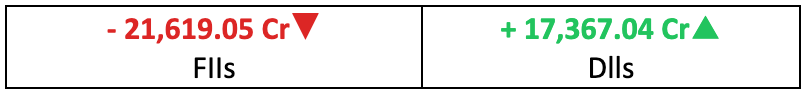

- Indian markets completely ignored global market trends this week. The intense sell-off can partially be chalked up to pre-election nerves besides persistent FII selling.

- Moreover, the age-old concern around valuations with a mixed picture on earnings, combined with options expiry, resulted in significant profit-booking during the week.

Also Read: What Led to the Five-Day Fall in Sensex and Nifty?

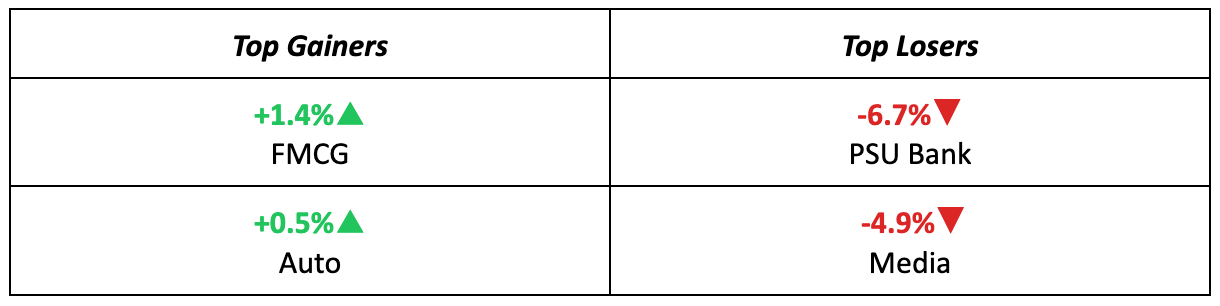

The winners

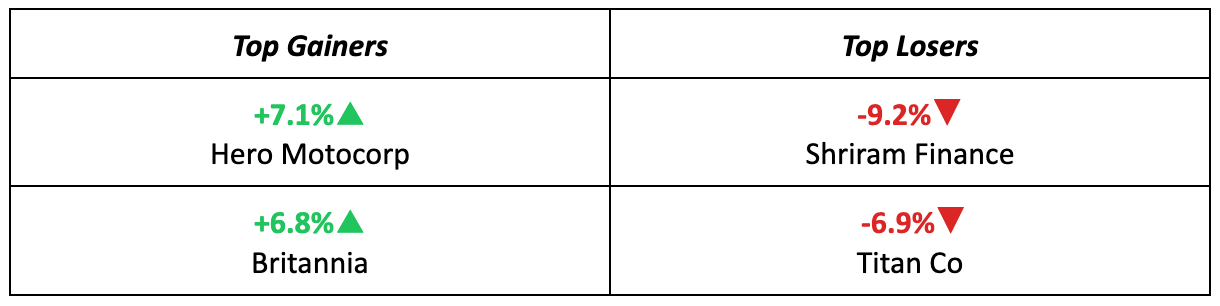

- Hero Motocorp posted a stunning 7.1% gain (all the more impressive due to how broader market activity went) on consensus-beating Q4 earnings and a ₹40/share dividend.

- Britannia also lifted the FMCG sector with its 6.8% gain, on results that were in-line with estimates that also showed improving market share ahead of the likely strong monsoon.

The losers

- PSU banks were all hit hard this week, with the sector tanking by 6.7% through the week, catalyzed by the RBI’s draft on tighter norms for infra project financing.

- Titan also fell by a significant 6.9% this week, on account of deteriorating margins and a subdued earnings outlook.

Meanwhile…

- The media sector was in a frenzy (partly driving the sector’s 4.9% fall) on a new National Broadcasting Policy that could strongly curtail freedom of expression and content.

- The Bank of England held rates steady this week, while higher-than-expected jobless claims for the week in the US offered fresh hopes of rate cuts by the Fed.

Market Brief

Market Outlook

Our take

- The earnings picture, combined with the ticking countdown to election results at home, made this trading week a turbulent one, and these risks may linger next week.

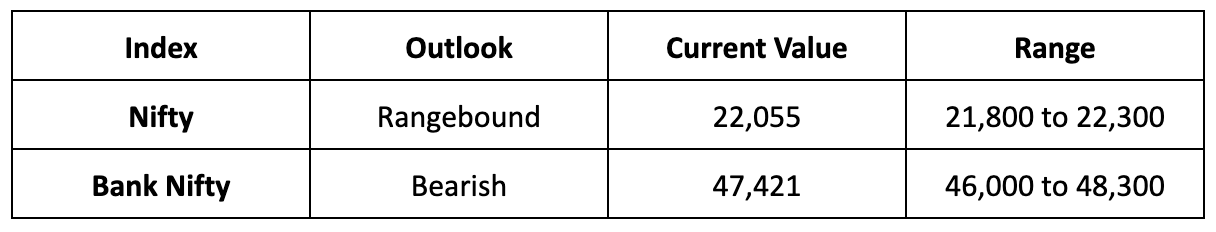

- As such, we expect the Nifty to be rangebound next week and anticipate a trading range of 21,800-22,300.

- Going forward, market movements will be influenced by the forthcoming US inflation data and electoral events at home.

Stay ahead in the world of finance with the most relevant business news and market updates. With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey