Stock Market Crash | What Led to the Five-Day Fall in Sensex and Nifty?

Unravel the factors behind the 5-day fall in Sensex and Nifty, including political factors, foreign investments, and corporate earnings. Learn more about future market trends.

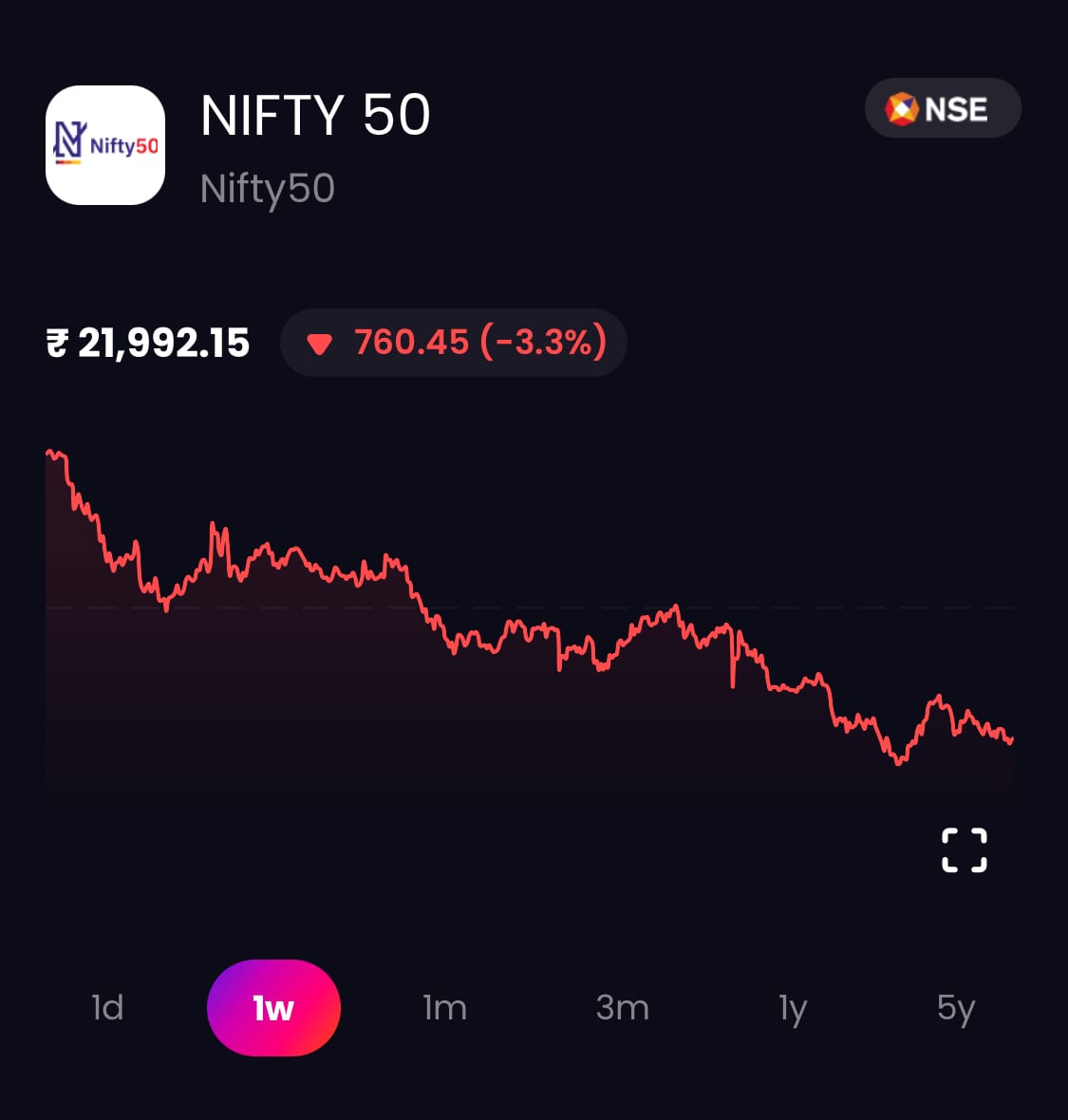

This week has been challenging for stock market investors as key Indian indices like the BSE Sensex and Nifty 50 took significant hits. Particularly on Thursday, market figures were daunting, with the BSE Sensex plummeting below the 72,500 mark and Nifty slipping past the critical 22,000 level, marking the fifth consecutive day of declines.

By the way, we had anticipated this bearish trend in our weekly report released on May 06. Read the full report here: Weekly Market Recap & Outlook by Liquide

Political and Economic Uncertainties Fuelling Market Volatility

Several factors contributed to the unsettling atmosphere in the stock market:

Election Woes

The ongoing general elections have seen a slightly lower voter turnout in the first three phases compared to 2019, with a turnout ratio of 65.68%. While the consensus view is that Prime Minister Narendra Modi will be re-elected, financial markets are keenly observing the size of the victory for the sitting government. Increased market volatility is largely due to concerns that the BJP-led National Democratic Alliance may secure a weaker-than-expected majority.

Foreign Portfolio Investors Pulling Back

May has witnessed a foreign outflow of Rs 5,076 crore, adding to the Rs 8,671 crore outflow in April. Apart from the high US bond yields and the uncertainty around elections, the outperformance of the Chinese and Hong Kong markets also contributed to FPI selling.

Over the past month, the Nifty index has declined by nearly 3.5%, in contrast to gains of 4.2% in the Shanghai Composite and 8.2% in the Hang Seng. The Chinese and Hong Kong markets' attractive P/E ratios of around 10x starkly contrast with India's higher valuations, about twice as much.

Mixed Bag of Q4 Earnings

The Q4 earnings for FY24 have been mostly in line, lacking positive surprises. While companies like Reliance Industries, Axis Bank, Ultratech Cement and HDFC Bank have surpassed profit estimates, others like HCL Technologies, Larsen & Toubro and Titan have not met expectations.

Geopolitical Tensions and Fed Rate Concerns

The ongoing geopolitical tensions in West Asia and the Russia-Ukraine war continue to be areas of concern. Additionally, the delay in the expected rate cuts by the US Fed amidst ongoing inflation concerns has made investors cautious, preferring selective bullish positions.

Looking Ahead: Monitoring Market Trends and Potential Recoveries

Stock market shifts can often cause undue alarm, especially during election periods, even though historical data suggests that markets do not accurately forecast political outcomes. Consider this: if political results truly governed market reactions, wouldn't this trend have been apparent five years earlier? Reflecting on the 2019 elections, market behavior was just as erratic as it is today, with daily market fluctuations largely disconnected from electoral events.

In 2019, when anxieties were high (despite it being a clear victory for the ruling government), the Sensex fluctuated between 37,000 and 39,000 levels. Fast forward to 2024, and despite similar anxieties, the Sensex stands markedly higher, between 72,000 to 73,000 levels. Interestingly, despite polls favoring the BJP, media influence seems to amplify market anxieties disproportionately to ground realities. Markets may respond to perceived changes faster than real events occur.

So, instead of panicking, use these market corrections to reassess and recalibrate investment strategies. A recommended approach during such volatile times is systematic investment in diversified asset class Baskets. Don’t attempt to predict electoral outcomes based on market trends. Instead, relax, “SIP” your coffee, and watch the election campaign unfold until 4th June.

Stay tuned for more updates and analyses. With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey.