NSE, BSE Special Trading Session on Saturday, May 18

NSE and BSE special trading session this Saturday, May 18th! Get a complete schedule and understand the critical changes in trading operations as markets test their disaster recovery protocols.

Indian stock markets will remain open this Saturday, May 18, 2024, as the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE) will conduct a special live trading session featuring an intraday transition from the Primary Site (PR) to the Disaster Recovery Site (DR) in both the Equity and Equity Derivatives Segments. This is part of BSE and NSE compliance with SEBI's framework for a Business Continuity Plan (BCP) and Disaster Recovery Site (DRS) for stock Exchanges.

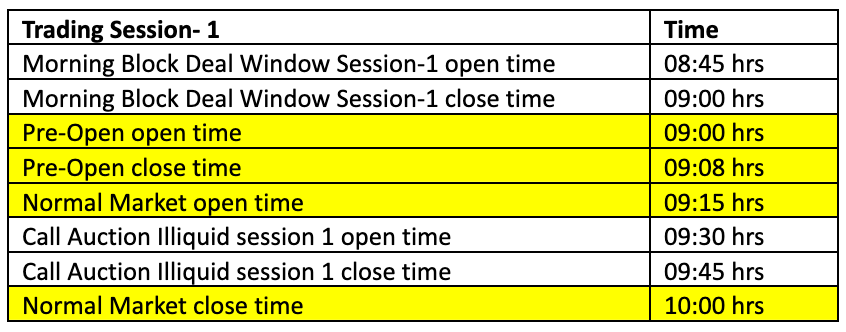

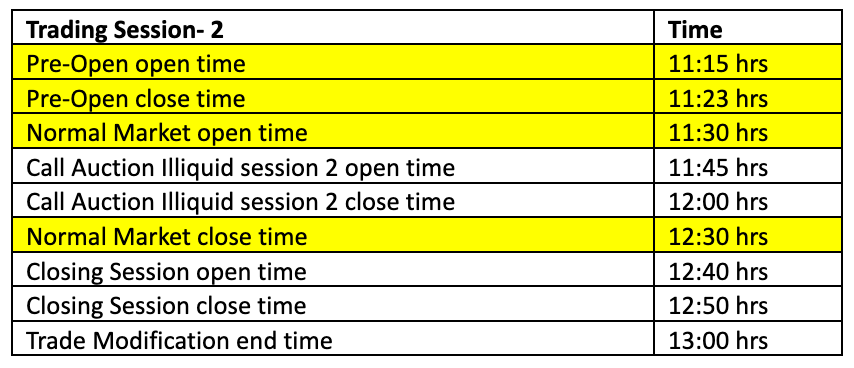

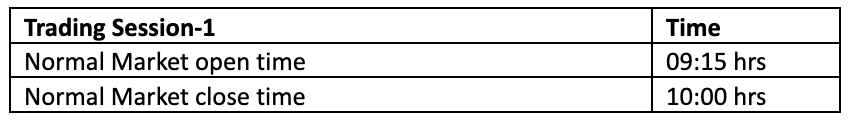

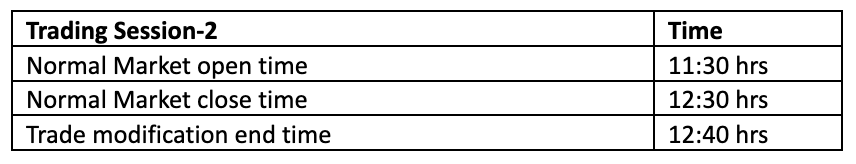

Time Schedule for May 18 Trading Sessions

CAPITAL MARKET SEGMENT

Live trading from Primary Site:

Live trading from DR Site:

FUTURES & OPTIONS (F&O) SEGMENT

Live trading from Primary Site:

Live trading from DR Site:

Guidelines for Investors during the Special Session

- Price Bands: A maximum price band of 5% applies to all securities, including those with derivative products. Securities already in 2% or lower bands will continue in those bands.

- Mutual Funds and Futures Contracts: All close-ended Mutual Funds and futures contracts will also observe a 5% price band.

- Order Handling: No flexing of securities or futures contracts shall be applicable on that day. Orders not executed by the end of the first session will be cancelled and not carried over.

- Settlement and Trading Adjustments: May 18 is a settlement holiday, and May 20 is a trading holiday on account of Parliamentary Elections. Therefore, credits and profits from May 17 will settle on May 21, 2024.

- AMO Orders: After-market orders (AMO) placed post-close on Friday, May 17, will be processed on May 18.

Investors are advised to note the specific conditions and trading limitations during this session to align their trading strategies accordingly.

Frequently Asked Questions (FAQs)

What is the purpose of this special trading session?

This session tests the NSE and BSE's ability to handle sudden and unforeseen events and quickly switch operations to a Disaster Recovery site. Previously conducted on March 2, these sessions are critical in validating the resilience of operational frameworks under the oversight of SEBI and its technical advisory committee.

Why is the DR site transition happening during live trading?

The live DR site transition is part of a disaster recovery strategy to test system robustness in real-time, ensuring seamless operation shifts during actual emergencies. This enhances market stability and reliability.

How does the special session affect the settlement cycle?

The special Saturday session temporarily alters the settlement cycle, with 17th May purchases not sellable on 18th May and settling on 21st May, to accommodate this unique event. Traders must adjust their strategies accordingly.

Stay ahead in the world of finance with the most relevant business news and market updates. Access in-depth market analysis, expert advice, and real-time updates through the Liquide App. Download it today from the Google Play Store or Apple App Store and begin your journey towards informed and successful investing.