India's Metal Industry Boom: China's Policy, Price Hikes, and Future Projections

Indian metal stocks soar on robust domestic demand and China's policies; major steel companies like NMDC and Tata Steel log significant gains.

Introduction

The Indian metal industry is in the midst of a remarkable rally, which has piqued the interest of investors and analysts alike. The BSE Metal index has surged in ten out of its last twelve trading sessions, reaching a nearly 17-month high. To gain a deeper understanding of what’s driving this phenomenal rally, let's explore the triggers behind the surge in metal stocks.

China's Policy Initiatives and Domestic Price Hikes

A key driver of the soaring metal stocks is China's recent policy initiatives aimed at boosting its property sector. These initiatives encompass reduced mortgage rates, decreased down-payment requirements for homebuyers, and extensions of debt deadlines for real estate developers. This has instilled confidence in the market, with expectations of increased steel demand.

Within the domestic market, there's a robust demand, leading steel mills to introduce multiple price hikes since August 2023. Steel prices, which had been affected by worldwide price variances and disruptions due to the monsoons, seem to have bottomed out and are now displaying a steady rise.

Despite these favourable conditions, there are concerns about the profitability of metal companies in FY24 due to rising raw material prices, particularly a 14% month-on-month increase in coking coal prices in August. Moreover, the global steel demand outlook remains uncertain, especially in developed countries. However, there is optimism that these markets may recover gradually.

Steel Prices and Demand Surge

Amidst robust domestic demand and a surge in steel prices, the Indian steel market has undergone significant transformations. An ICICI Securities report disclosed that in the week ending August 30, Hot Rolled Coil (HRC) prices in the traders' market soared by Rs 270 per metric tonne. This substantial increase was propelled by optimistic expectations of heightened demand and reduced channel inventory.

Major steel producers proactively responded to evolving market conditions by increasing prices for long steel products, marking the third such increase in a single month. Notably, secondary rebar prices experienced an impressive month-on-month surge, averaging 10%.

On the international front, India's export prices demonstrated strength with a notable week-on-week uptick of $10 per metric tonne. This underlines the competitiveness and growing demand for Indian steel products in global markets.

Performance of Major Steel Stocks

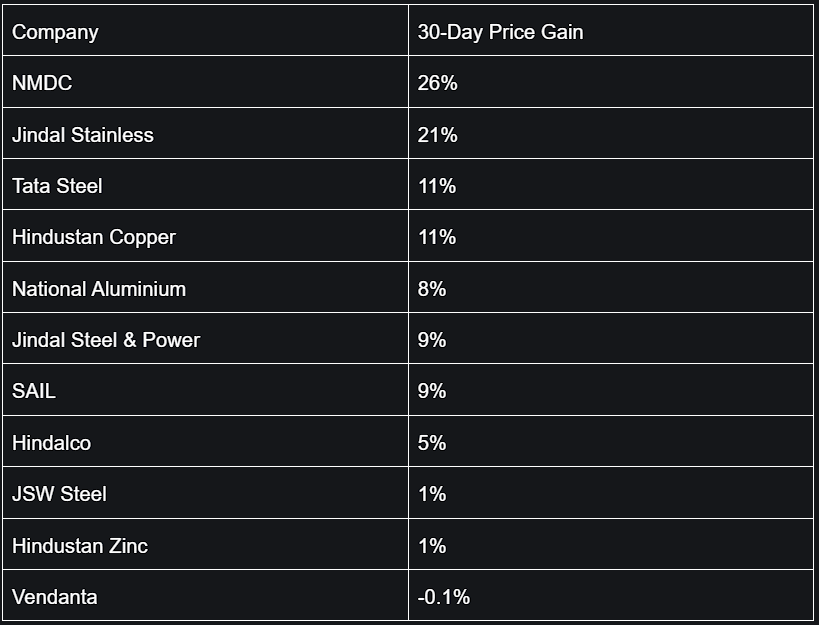

Indian Metal stocks have been on an upward trend over the past month, buoyed by encouraging macroeconomic indicators and expectations of a surge in steel prices.

Here's a closer look at the impressive 30-day price gains of some key players in the steel sector:

Outlook for Metal Stocks

Steel companies maintain optimism about long-term prospects, driven by confidence in the Indian infrastructure story, which accounts for 70% of steel consumption. These companies have ambitious capital expenditure plans, with top players allocating as much as Rs 55,000 crore per annum, twice the amount spent in the last five years.

The confidence in India's infrastructure growth further strengthens the sentiment surrounding metal stocks. Analysts anticipate metal sector stocks to yield returns of 30-40% over the next year.

Furthermore, developed nations are poised to contribute to metals demand in the coming years, further bolstering prices. This suggests a potential stabilisation of global steel prices and hints at a gradual recovery in demand.

Moreover, China's recent troubles, including production curtailments and the adoption of flat production policies, have contributed to the positive sentiment surrounding Indian metal stocks. Reduced imports from China may provide Indian producers with a competitive edge.

Conclusion

The surge in metal stocks can be attributed to a combination of factors, including China's policy initiatives, robust domestic demand, and optimism about India's growth prospects. While near-term challenges exist, long-term confidence in the metal sector remains strong, making it an attractive investment opportunity.

As you continue to monitor this dynamic sector, consider leveraging Liquide, your trusted trading companion. Discover expert-recommended trade set-ups and utilise LiMo, your AI-powered research assistant. Download the Liquide app today from the Google Play Store and Apple Appstore to enhance your investment journey.

Disclaimer: This blog is for informational purposes only and does not constitute financial advice. Please conduct thorough research and consult with a financial advisor before making investment decisions.