Market Recap: Volatility, Sector Analysis, and Economic Updates from Last Week

Dive into our weekly market analysis, sector performances and economic indicators, with insights into the upcoming Budget 2024-25.

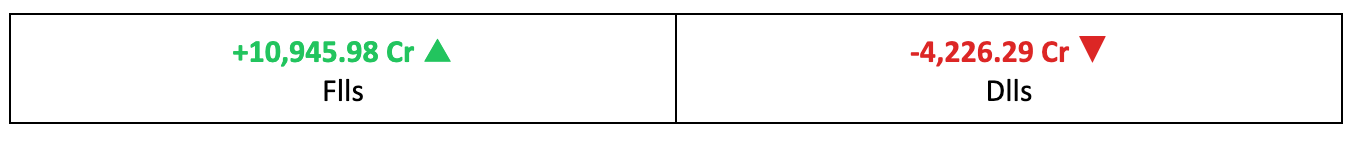

Markets were in for a rough ride in the closing stages of the week, ultimately closing essentially flat. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly report.

Weekly Recap

Volatile week!

- Markets started the week on an upward trajectory making fresh record highs, buoyed by positive global cues and key economic indicators, a promising beginning to the earnings season and progress in monsoon.

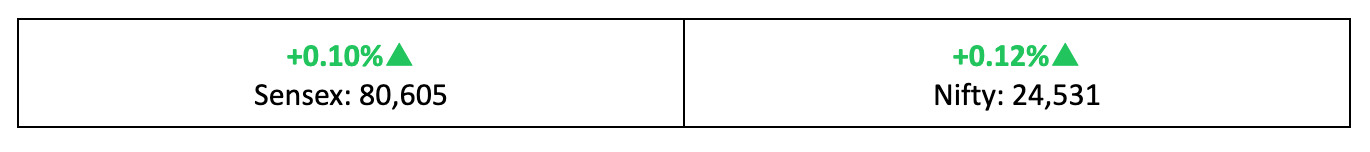

- However, key indices took a beating toward the end of the week due to profit-booking before the upcoming Budget announcement, closing with a marginal rise of 0.12% from last Friday’s levels.

- Volatility intensified throughout the week, with the India VIX advancing by 6% during the period.

- Regarding the Budget and potential opportunities for investors, we examined key factors likely to influence the market and aspects of the budget that could further stimulate interest: Union Budget 2024-25: Insights into Tax Reforms and Spending

What gives?

- Up until Thursday, markets were on an upward trend, reaching new record highs in anticipation of robust earnings from major IT heavyweights for the June quarter.

- However, market volatility shot up as the global mood turned sour. This, along with worries about valuations and the upcoming Budget, wiped out the earlier gains.

The winners!

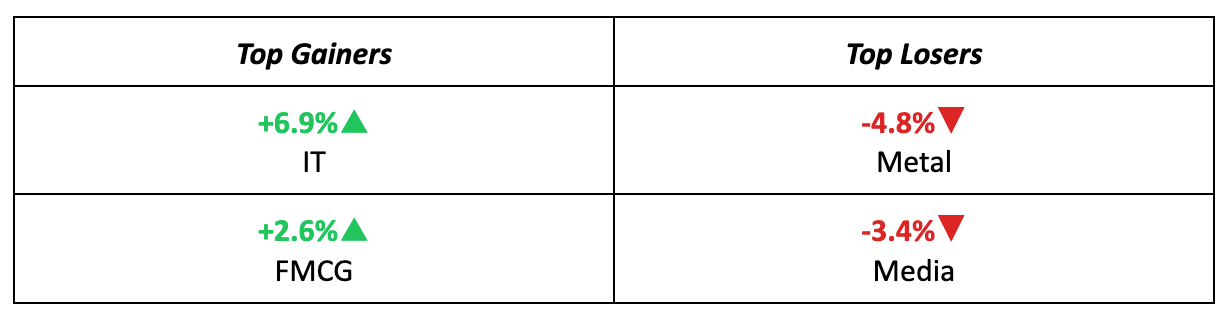

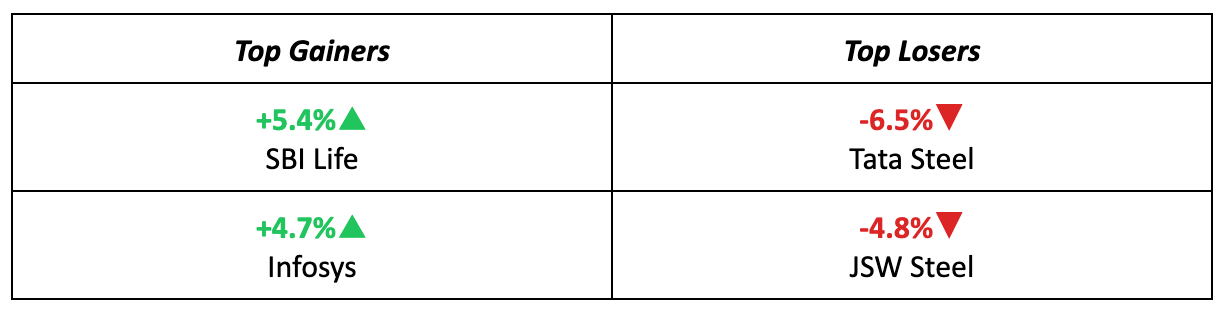

- The IT sector emerged as the week's top performer, buoyed by better-than-expected earnings from major companies like Infosys across various geographies.

- Additionally, significant momentum favoured major life insurance companies, with SBI Life notably achieving a 5.4% increase over the week.

The losers!

- The metals sector took a significant hit last week, with all major companies within the sector experiencing losses, driving the sectoral index down by 4.8%.

- The downturn was driven by numerous reports predicting a decline in net sales and earnings growth year-over-year for this quarter, leading to widespread profit-booking.

Meanwhile…

- A massive disruption in Microsoft systems on Friday impacted global businesses and governments, triggering substantial sell-offs in world indices, especially within the tech sector.

- Economic growth figures from China reported a lower-than-expected increase of 4.7% YoY for the second quarter, raising serious concerns about the economic future of the Asian powerhouse.

Market Brief

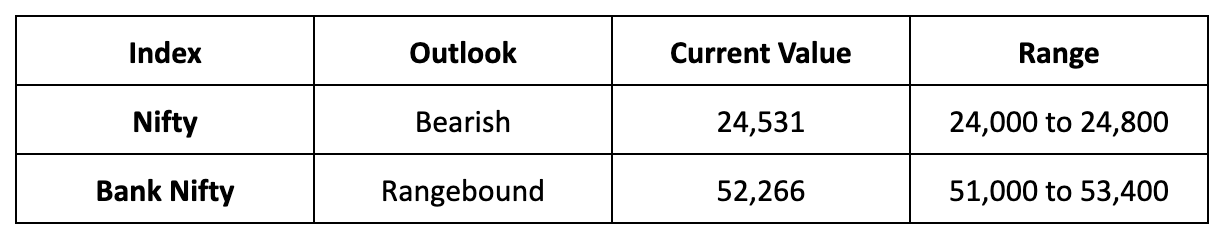

Market Outlook

Our take

- With the Budget drawing near and a sudden shift in global sentiment, we foresee the markets taking a pause next week.

- Market trends will hinge on the budget announcements. Consequently, we anticipate a volatile trend for the Nifty next week, with a slight downward bias, expecting it to oscillate between 24,000 and 24,800 levels.

- Regarding potential market responses to the Budget, we've explored strategies to safeguard your trading approach: Essential Trading Strategies for Budget 2024-25.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple App Store, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download today and enhance your financial journey with Liquide's cutting-edge features.