Weekly Market Recap | Sensex, Nifty Plunge Up to 2% Ahead of Election Results | Insights & Market Outlook

Review last week's market dip and upcoming election results in our latest analysis. Learn about key investment opportunities and market trends.

Weekly Recap

Markets fell up to 2% last week in a broad-based decline ahead of election results. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly report.

Slipping out of hand

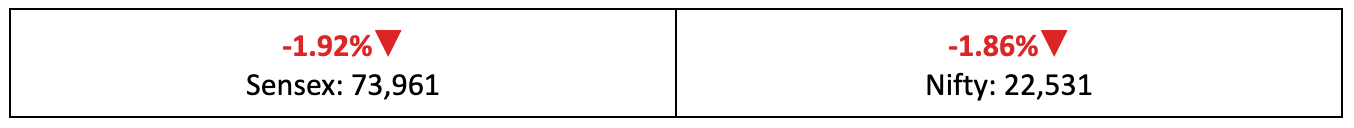

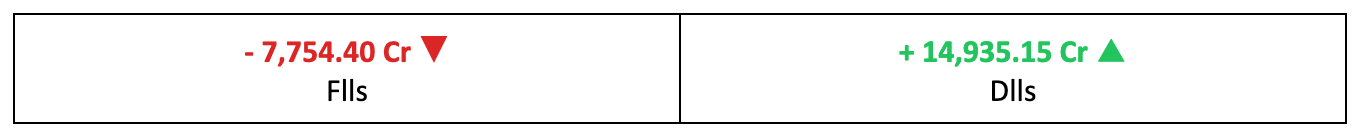

- Markets wiped out the previous week's gains, with the Nifty falling by 1.86% in a tumultuous week ahead of the exit poll results, GDP data release, and continued FII selling.

- Among the broader indices, the BSE Large-cap index shed 2% while the BSE Mid-cap and Small-cap indices fell 1.5% each.

- During the week, the India Vix (the measure of market volatility) surged by 15% amid uncertainties regarding the formation of the next government.

Reading the cues

- Global cues were weak during the week as investors weighed the Fed's possible moves post April's sticky inflation numbers.

- At home, with the pictures on voter turnout, the markets became jittery, concerned about the BJP's chances of returning with a strong majority.

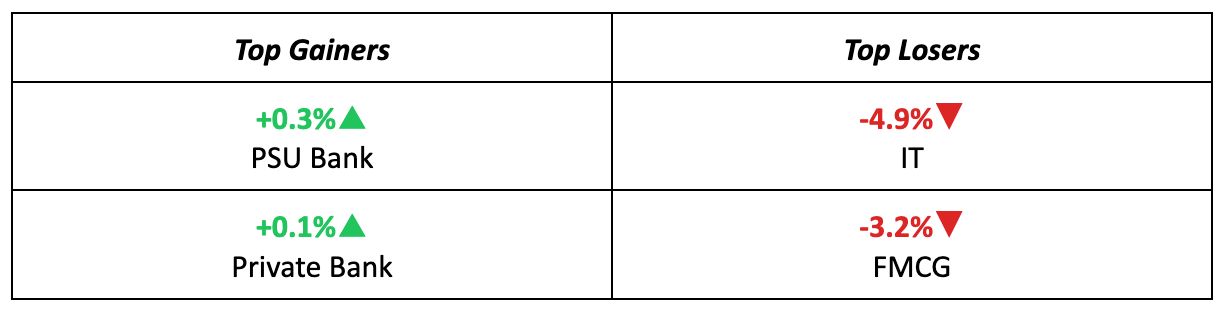

The winners

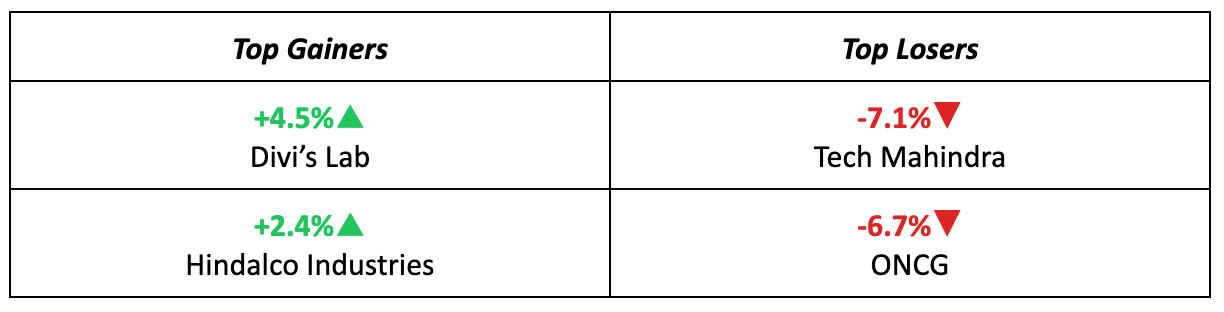

- Divi's Lab topped the list with a 4.5% weekly return, driven by robust Q4 results featuring a 67% surge in net profit for the quarter.

- Hindalco's U.S. subsidiary, Novelis, filed for an IPO on the NYSE, propelling Hindalco's stock price to record high levels.

The losers

- IT as a whole was a massive loser last week, at home and overseas, tanking due to uncertainties surrounding the Fed's rate decisions and persistent inflation challenges.

- ONGC also saw a 6.7% drop amid a tough week for crude oil prices, which declined due to increasing global inventories and ongoing concerns about demand.

Meanwhile…

- India's GDP growth exceeded expectations, reaching 7.8% in the January-March quarter, albeit slower than the 8.4% recorded in the previous quarter.

- Eurozone inflation rates came in higher than previously anticipated, with worries starting to grow on when the ECB will begin cutting rates.

Market Brief

Market Outlook

Our take

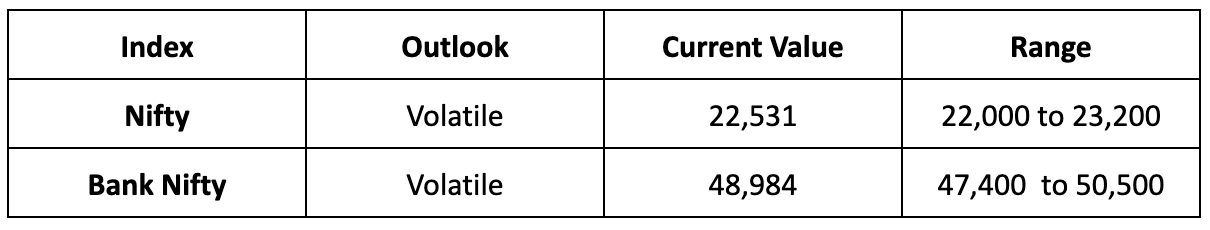

- We've seen a growing trend of volatility spikes and choppy trading the past few weeks as the election looms and global cues appear to provide investors with mixed signals.

- With exit polls favouring the BJP-led NDA, markets are likely to react positively on Monday. Yet, divergences in the final results might trigger adverse reactions.

- In light of this, we expect the Nifty to exhibit high volatility next week, with potential swings in either direction ranging between 22,000 and 23,200 levels.

For deeper insights into anticipated market behaviors and strategies for navigating increased volatility, read our article: Lok Sabha Exit Polls 2024 | Trading Strategies and Investment Opportunities for Maximum Gain

Stay ahead in the world of finance with the most relevant business news and market updates. With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey.