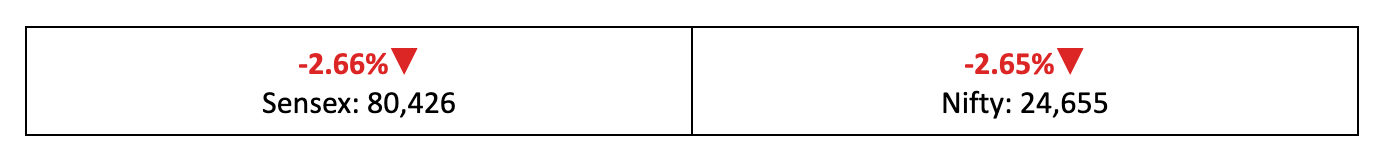

Weekly Market Recap: Nifty & Sensex Fall 2.65%, IT & Pharma Drag

Indian markets slipped 2.65% last week, marking the sharpest weekly decline in six months. IT & Pharma stocks tumbled while Maruti Suzuki and L&T emerged as bright spots. Here’s a full recap with outlook for the week ahead.

Markets broke their three-week winning streak, with benchmark indices slipping 2.65% – marking the steepest weekly decline in almost six months. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Bears Take Control

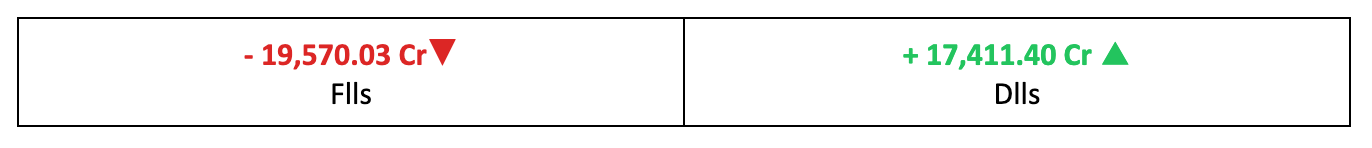

- Indices took a sharp hit last week, closing 2.65% lower due to weak global cues, continued foreign fund outflows, a depreciating rupee and pressure on IT and pharma stocks.

- Broader indices were hit harder, with the BSE Large-cap index falling 2.9%, the BSE Small-cap index losing 4.3% and the BSE Midcap index shedding 4.5%.

- The India VIX fear gauge also spiked nearly 15% over the week, signalling heightened investor anxiety on Dalal Street.

The Big Stories

- President Donald Trump announced aggressive new tariffs, including a 100% levy on imported pharmaceuticals (excluding generics), 25% on heavy-duty trucks and 50% on kitchen cabinets and other furniture, triggering uncertainty in global markets.

- Additionally, the US government's new $100,000 fee on H-1B visas prompted a sell-off in Indian IT stocks.

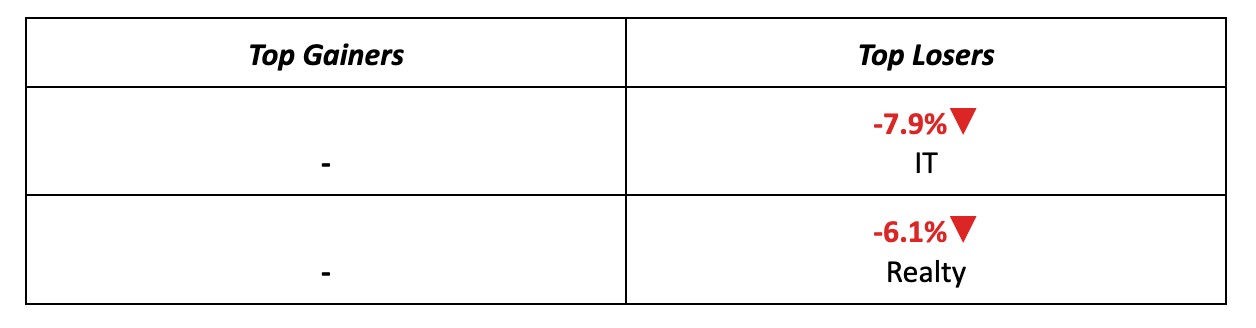

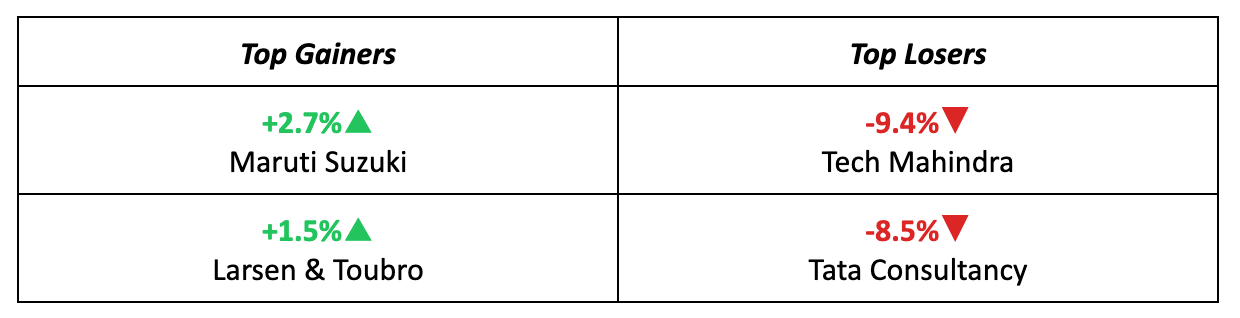

The Winners

- Maruti Suzuki was the top gainer of the week, rising 2.7% following a proposal to relax stringent fuel efficiency norms for small cars. As the dominant player in this segment, the company stands to benefit significantly.

- Larsen & Toubro also fared well, gaining 1.5% after Telangana took over Hyderabad Metro’s debt with a Rs 2,000 crore settlement, relieving L&T of a significant financial burden linked to the loss-making project.

The Losers

- Both the top losers of the week belonged to the IT pack, with Tech Mahindra down 9.4% and TCS down 8.5%.

- The sell-off in IT stocks was triggered by weak guidance from Accenture and concerns over changes to the H-1B visa policy.

Meanwhile…

- U.S. second-quarter economic growth was revised upwards to a 3.8% annualized rate, from 3.3% previously, causing a split among Federal Reserve officials on the pace of future interest rate cuts.

- The Indian Rupee reached an all-time low of 88.79 against the U.S. Dollar, while Gold hit a record high in international markets last week.

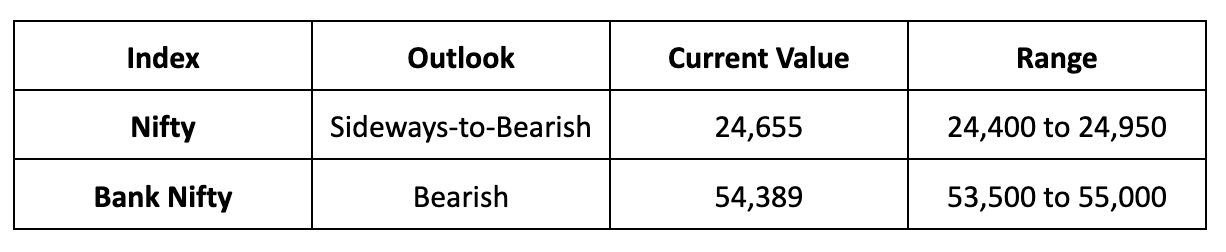

Market Brief

Market Outlook

Our Take

- The equity benchmarks closed sharply lower on Friday, marking the longest losing streak in the last 7 months. Technical indicators suggest more weakness in the near term.

- Looking ahead, we expect the Nifty to trade in a sideways-to-bearish range, between 24,400 and 24,950 levels.

- Investors should focus on fundamentally strong stocks and avoid aggressive directional bets until clearer signals emerge.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.