Weekly Stock Market Recap: Nifty Stays Flat Despite A RBI Rate Cut

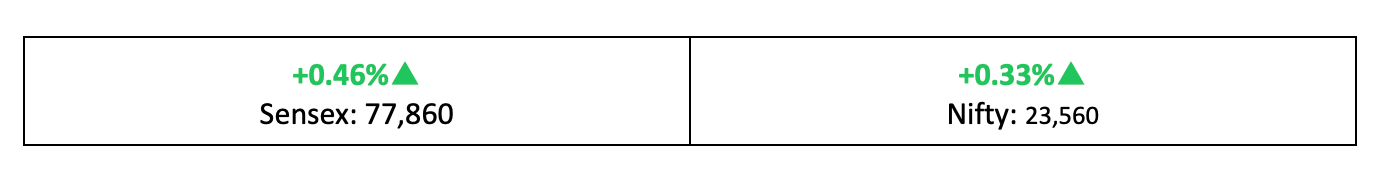

Markets gained for the second consecutive week, though with marginal upside. Nifty inched up 0.33% despite RBI’s first rate cut in five years. Here’s a quick recap of the key movers, trends, and outlook for the coming week.

Weekly Recap

Markets closed higher for the second consecutive week, though with modest gains this time. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Gains, But Nothing to Cheer

- Indices wrapped up another choppy week with marginal gains, as the Nifty edged up just 0.33% from last Friday.

- The India VIX trended downward, barring occasional spikes, signalling a slight easing of investor concerns post-Budget.

The Big Stories

- The RBI cut repo rates for the first time in almost five years, lowering it from 6.5% to 6.25% in line with economists' expectations, aiming to support slowing GDP growth.

- Movements in benchmark indices were driven by a combination of factors, including the ongoing reactions to the Budget, political developments in Delhi, and shifting US trade policies.

The Winners

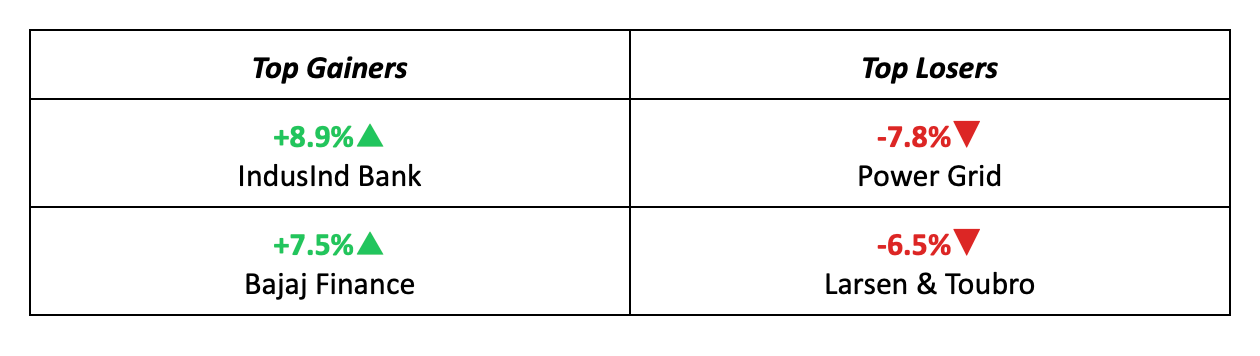

- IndusInd Bank led the gainers, climbing 8.9% last week, driven by optimism around its proposed Bharat Vikas Banking arm, which aims to tap into government support for rural growth.

- Bajaj Finance gained 7.5%, buoyed by strong quarterly results and post-Budget optimism, with expectations of increased credit demand boosting consumption.

The Losers

- Power Grid was the biggest laggard, dropping 7.8% to a nine-month low after reporting a year-on-year decline in Q3 profit along with lower revenue.

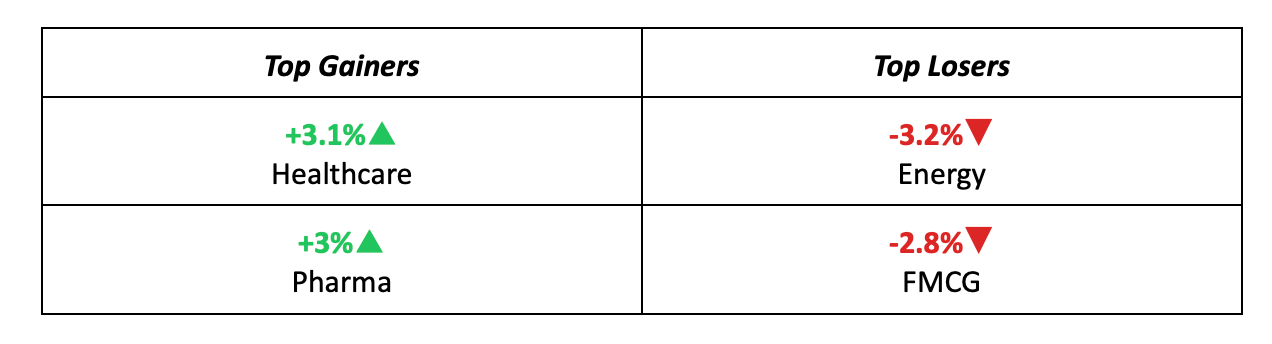

- The FMCG sector struggled, reversing the previous week’s post-Budget gains as investor sentiment turned cautious amid weak sector-wide Q3 results.

Meanwhile…

- The Bank of England cut interest rates to 4.5% from 4.75% on Thursday, the lowest since June 2023, while highlighting risks to global growth in 2025.

- US services sector activity unexpectedly slowed in January amid cooling demand, though inflation uncertainty persists due to the Trump administration’s policies.

Brief

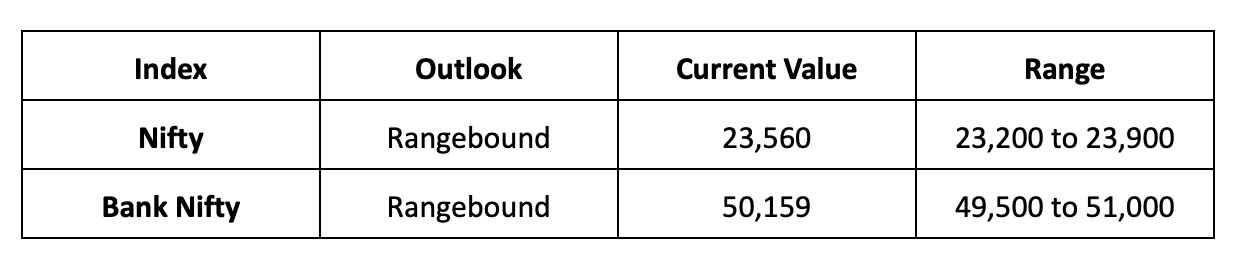

Key Indices

Sectors

Stocks

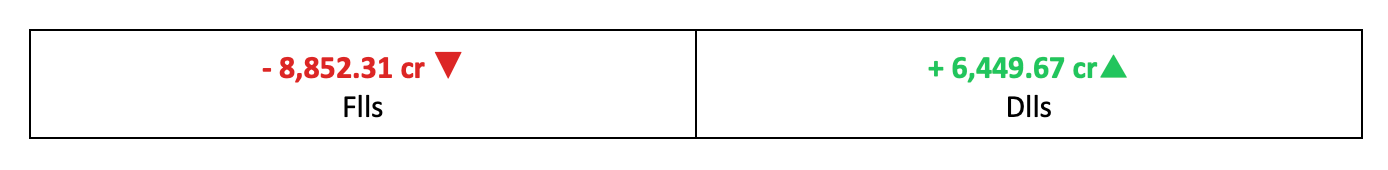

Other Key Data

Market Outlook

Sectors To Watch:

Our Take

- Despite the RBI’s rate cut and global developments, markets failed to gain meaningful momentum, keeping the Nifty largely flat last week.

- Caution is likely to persist in the coming week, with the index expected to trade within a range of 23,200 to 23,900.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.