Weekly Stock Market Review: 4.5% Correction and What's Next for Indices

Explore our detailed analysis of the significant 4.5% market correction last week, factors driving the decline, sectoral impacts, and our strategic advice for the upcoming trading week.

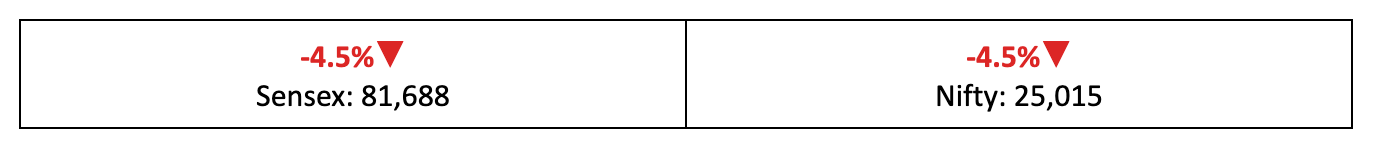

Markets recorded their biggest weekly fall since June 2022, as key benchmark indices dropped by over 4.5%. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly report.

Weekly Recap

Total turmoil

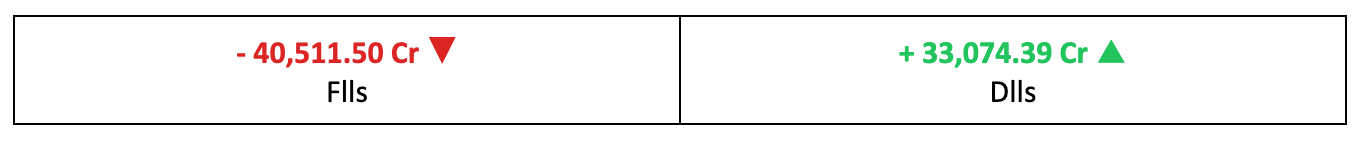

- Markets were sent spiralling downward last week, marking one of the worst trading weeks on D-Street in recent times, with both benchmark indices losing over 4.5%.

- In the broader market, the BSE Small-cap index slipped 2%, the BSE Mid-cap index declined 3.2%, and the BSE Large-cap index plummeted over 4%.

- The India VIX fear gauge also surged, jumping nearly 18% compared to last Friday's close.

What went so wrong?

- Though Thursday’s sharp decline made the headlines, markets were already struggling beforehand.

- A combination of factors, particularly the escalating geopolitical conflict in the Middle East and SEBI’s actions in the F&O segment, contributed to last week’s market downturn.

- Also read: Market Analysis & Outlook

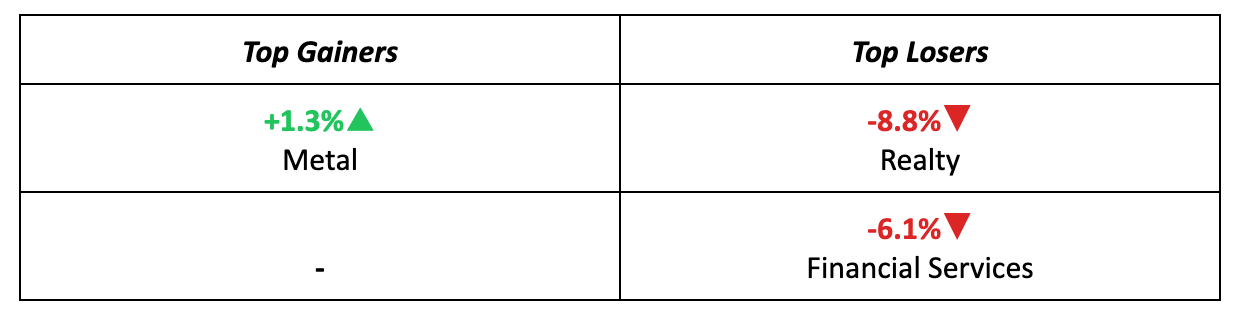

The winners

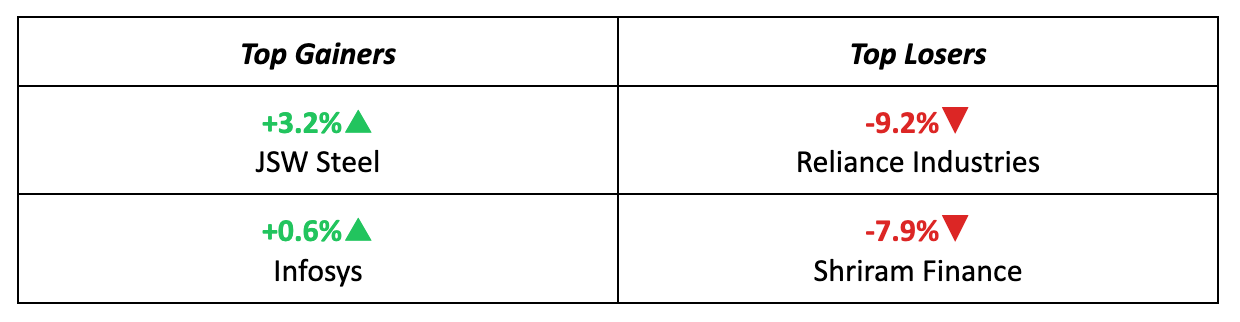

- JSW Steel had a good week, reaching lifetime highs after receiving positive coverage from Nomura, driven by improving demand growth and profit margins.

- Another standout, Infosys, managed a 0.6% gain ahead of its Q2 earnings, which are expected to reflect decent revenue growth.

The losers

- Reliance Industries tumbled 9.2% last week, as brokerages like Ambit maintained their sell ratings, especially amid the ongoing turmoil in oil markets.

- The real estate sector also faced a challenging week, with the sectoral index plunging 8.8% following housing sales data that revealed an 11% drop in Q3 of CY24.

Meanwhile…

- The S&P 500 remained largely flat last week, even as the US economy showed resilience with a stronger-than-expected October jobs report.

- Meanwhile, on the domestic front, services and manufacturing activity slowed in September, hitting 10 and 8-month lows, respectively, and GST collections reached a 40-month low.

Market Brief

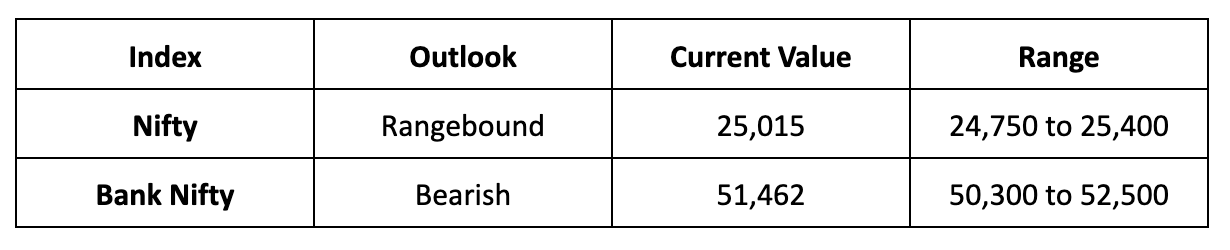

Market Outlook

Our take

- As investor concerns grow over the escalating Middle East conflict, we believe adopting a cautious wait-and-watch approach may be prudent for the upcoming week.

- We expect the markets to consolidate next week, likely trading between 24,750 and 25,400, with 25,000 being the critical level to monitor.

- Attention will soon shift towards the corporate earnings season for the September quarter. With earnings reports starting next week, stock-specific movements will continue. Additionally, interest-sensitive stocks will remain in focus ahead of the RBI policy meeting.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple App Store, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download today and enhance your financial journey with Liquide's cutting-edge features.