Nifty's Record Streak Extends into the Sixth Week | Market Analysis & Outlook

Dive into our weekly market analysis as the Nifty hits new records. Discover key trends, top gainers, and expert insights on what’s next in the markets.

Markets continued their record-breaking bull run for the sixth consecutive week. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly report.

Weekly Recap

From strength to strength

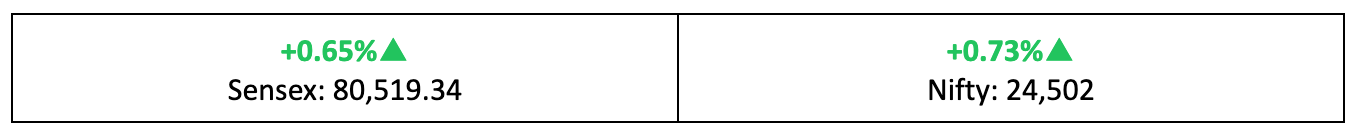

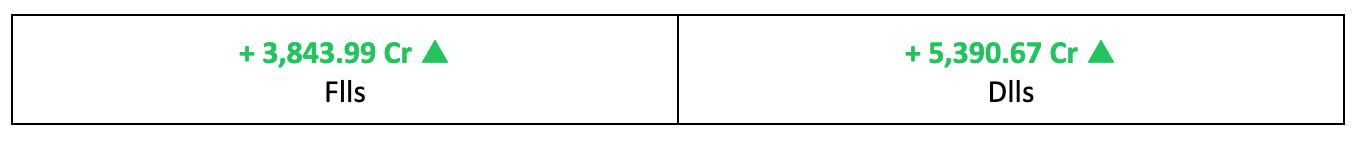

- Investors kept the party going on D-Street last week, pushing the Nifty up by 0.73% to fresh record highs. This rise was bolstered by robust buying from foreign investors, favourable monsoon progress, and a promising start to the earnings season.

- Although the markets experienced some volatility and consolidation during the first four days, they recorded significant gains in the final session of the week on July 12, primarily driven by IT stocks after TCS' Q1 earnings met expectations. For more details, read: TCS Q1 FY25 Earnings: Impressive Growth, Strong Margins But Soft TCV

- The broader indices underperformed the key benchmarks; the BSE Large-cap index advanced by 0.65%, the Mid-cap index saw a modest gain of 0.15%, and the Small-cap index shed 0.26%.

The big picture

- World markets had a good run last week, with the S&P and the DJIA also soaring on bets that the Fed would cut rates after recent consumer price reports showed easing inflation.

- At home, while the momentum was broadly upward, the hiccup came on Wednesday as investors booked profits ahead of inflation data and IT players’ Q1 earnings.

The winners

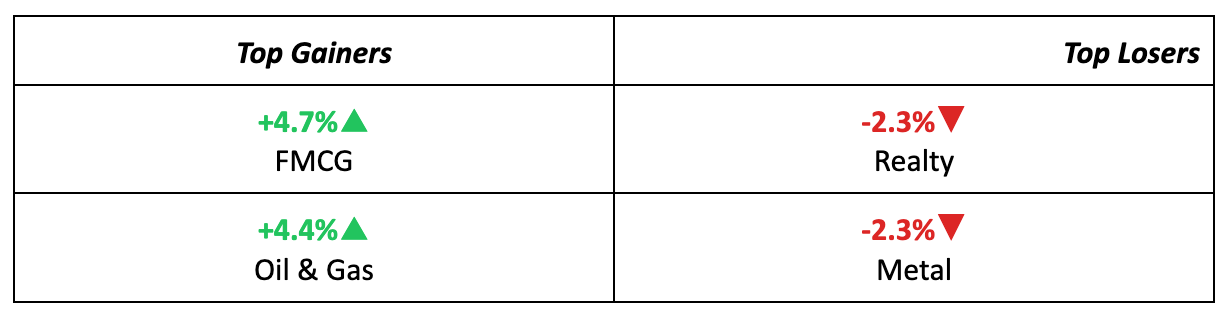

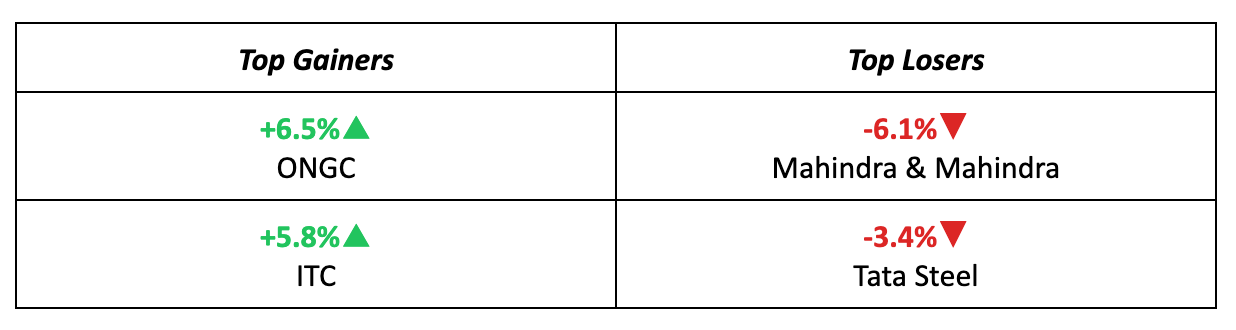

- ONGC was the week’s top performer, climbing 6.5% on positive remarks from the government about the oil & gas sector. This uplift occurred against the backdrop of the Prime Minister's recent trip to Russia, where he advocated for a long-term crude supply deal amid escalating Russian oil exports.

- ITC also posted strong weekly returns on solid volume recoveries in its cigarettes segment and government efforts to combat illegal cigarette sales.

The losers

- Mahindra and Mahindra raised investors’ nerves, posting a weekly loss of 6.1% after announcing a "temporary" price reduction for its premier XUV700 model.

- Tata Steel took the runner-up spot in the losers contest, with a 3.4% loss on weak domestic steel prices, which could stay flat for some time.

Meanwhile…

- India's industrial production data brought an unexpected delight, showing an annualized growth of 5.9% in May, up from 5% the previous month.

- European markets experienced a mixed week, influenced by political unrest in France, an encouraging uptick in the UK's GDP growth, and softer US inflation.

Market Brief

Market Outlook

Our take

- Rotational buying across heavyweights has helped the Nifty sustain its upward momentum. As Q1 results and the 2024 Budget start to come into sharper focus, we expect investors to start turning a little more cautious for the near term.

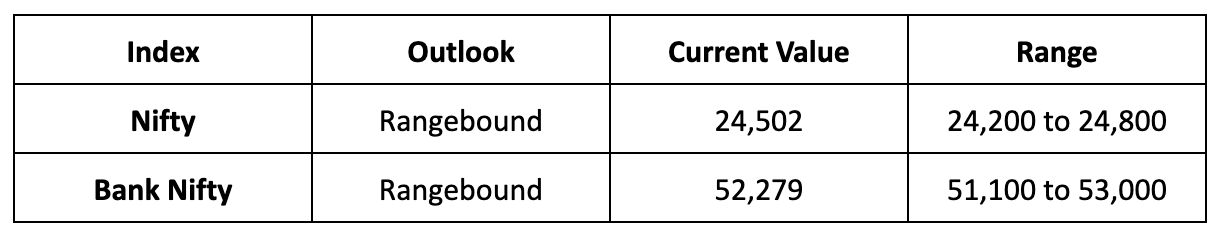

- Consequently, we expect the Nifty to exhibit a rangebound behaviour this week, anticipating a trading range of 24,200-24,800. Investors should maintain a “buy on dips” strategy, carefully selecting stocks and managing trades.

- Globally, market focus will shift to China's Q2 GDP figures, the U.S. Core Retail Sales data, and the European Central Bank’s decisions on interest rates for further cues.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple App Store, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download today and enhance your financial journey with Liquide's cutting-edge features.