Fear Gauge Surges: Why the Nifty Shed 600+ Points & What Happens Next

The Nifty plunged ~2.5% last week as geopolitical tensions and US tariff threats sent the India VIX soaring by 24.8%. From Adani’s 13% slide to Dr. Reddy’s gains, we break down the big stories, top movers and what to expect from the Nifty and the upcoming Union Budget.

Markets trended largely downward last week as geopolitical volatility spiked. Here’s a look at the past week, a few stories you might have missed, and our take on what’s next, in your weekly report.

Wipeout

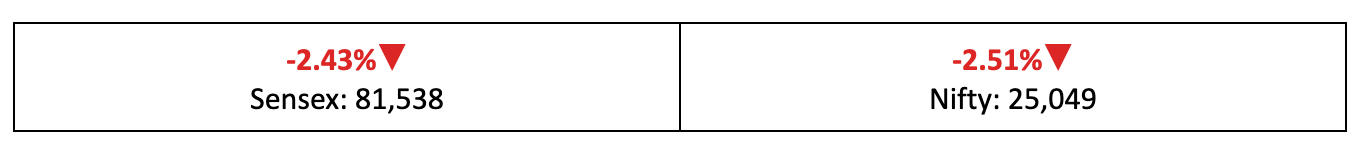

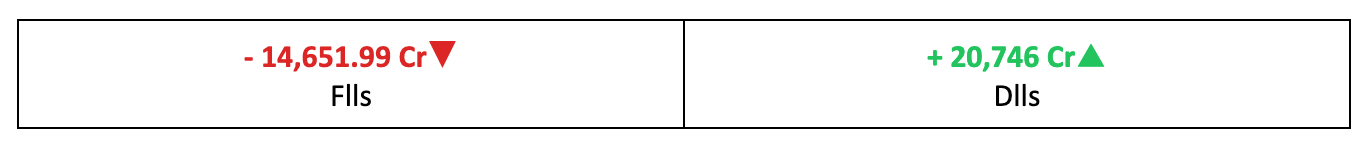

- Indices faced significant selling pressure last week as geopolitical tensions gripped global investors, sending the Nifty plunging over 2.5%.

- The broader markets took a harder hit, with the BSE Mid-Cap index dropping 4.2% and the Small-Cap index tumbling 5.8%.

- As volatility heated up across the US and Europe, the India VIX fear gauge surged 24.8%, suggesting that choppy sessions and sharp swings are likely to persist in the near term.

The Big Stories

- Last week’s dominant narrative was fuelled by the Trump administration’s tariff threats against the EU and other allies. The friction stemmed from a renewed push for the US to acquire Greenland, a move that sent global nerves soaring and reignited fears of a transatlantic trade war.

- While tensions eased toward the end of the week—after the military option was ruled out—Indian equities failed to recover.

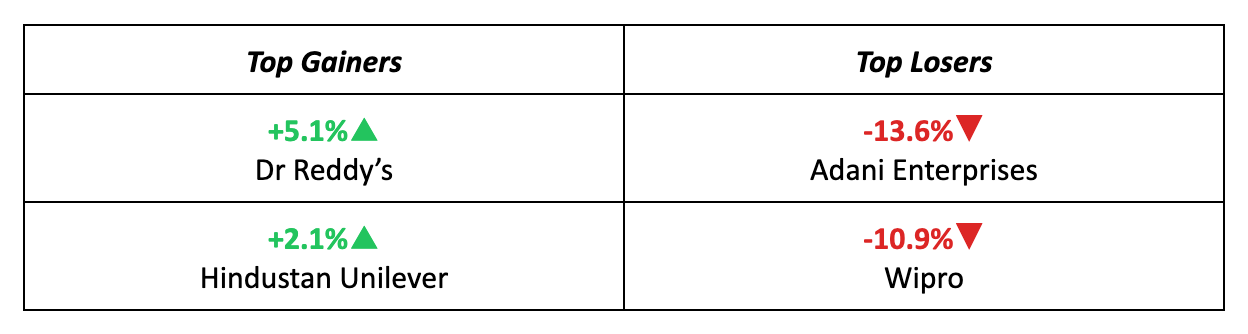

The Winners

- Dr. Reddy’s Laboratories emerged as the top performer last week, rising by 5.1%. The firm’s Q3 profit decline was less than anticipated, thanks to its strong domestic portfolio.

- Hindustan Unilever followed closely, securing a 2.1% gain, driven by brokerage upgrades. These were fuelled by expectations of increased buying volumes due to the anticipated impact of GST.

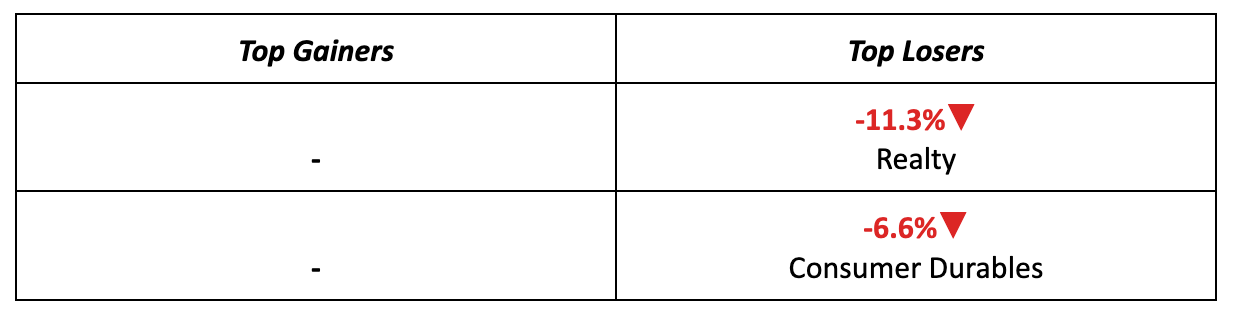

The Losers

- Adani Enterprises was the biggest loser of the week, with the stock plunging 13.6%. This was triggered by the US SEC's request to a US court for permission to question the Adanis regarding bribery allegations.

- Wipro also faced a significant setback, with its stock dropping nearly 11% following weaker-than-expected Q3 results and subsequent brokerage downgrades.

Meanwhile…

- January marked the first increase in PMI activity in five months, with the HSBC Composite Flash PMI rising to 59.5, up from 57.8 in December.

- As the US Supreme Court reviews the legality of the president's tariffs, both New Delhi and Brussels have signalled that India-EU trade talks are nearing completion, with a deal on the horizon.

Market Brief

Our Take

- Tariff and geopolitical events-driven volatility made a return last week, highlighting that broader market risks are never fully behind us.

- On that basis, we expect the Nifty to continue trending volatile next week, with a forecasted trading range between 24,700 and 25,400.

- Volatility will also be influenced by anticipations surrounding the Union Budget. For more insights on what to expect from the Budget, check out: Budget 2026 Predictions: Top Sectors & Stocks

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.