Utkarsh SFB IPO Opens Today: Should You Subscribe?

Explore an in-depth analysis of Utkarsh SFB’s IPO, weighing its potential growth, valuation, risks and investment opportunities.

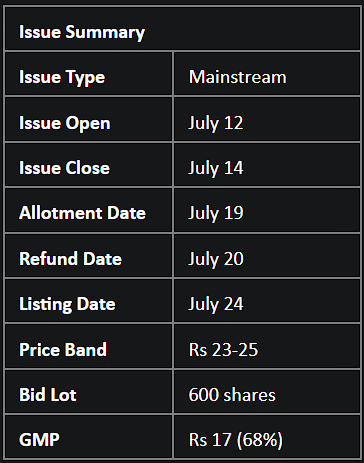

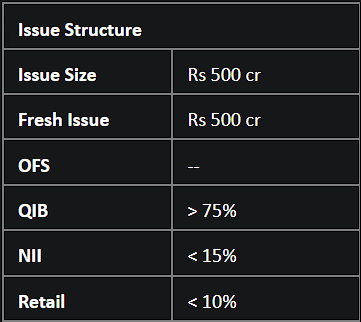

Varanasi-based Utkarsh Small Finance Bank seeks to raise Rs 500 crore through its initial public offering (IPO), which opens for subscription today. The price band is fixed between Rs 23-25 per share, with a minimum bidding size of 600 shares. Retail investors can make applications in multiples of 600 shares after the initial minimum bid. Thus, the minimum investment checks in at Rs 15,000 for one lot, with a cap at Rs 1.95 lakh for 13 lots.

Preceding the IPO, the company successfully attracted Rs 222.75 crore from a pool of 20 anchor investors. These investments were made at the higher end of the price band, set at Rs 25 per share.

Market insiders have noted that Utkarsh SFB shares have begun trading in the unlisted stock market, with shares currently enjoying a premium of Rs 17 (i.e. 68% premium) in the grey market.

ABOUT UTKARSH SFB

Promoted by Utkarsh CoreInvest Ltd, the bank provides a comprehensive product lineup, ranging from micro-banking loans, retail and wholesale lending, housing, commercial vehicle/equipment, and gold loans, newly introduced in FY2022. On the liability side, offerings include diverse term and recurring deposits, along with non-credit services like ATM-debit cards, bill payment systems, and third-party product distribution.

Utkarsh SFB has recorded impressive Gross Loan Portfolio (GLP) growth, ranking third among SFBs over Rs 6000 crore from FY2019-2023. From FY21 to FY23, the bank's Gross Loan Portfolio (GLP) surged annually by 28.8%, reaching a total of Rs 13,957.1 crore. This growth was matched by a significant rise in deposits, which climbed by 35.1% to stand at Rs 13,710.1 crore. In the same period, Utkarsh SFB also witnessed a significant improvement in its net interest income (NII), which grew 35% annually to hit Rs 1,529 crore. Consequently, the bank's net interest margin (NIM) increased from 8.2% to 9.6%. Additionally, its liquidity position is robust, as evidenced by its Liquidity Coverage Ratio of 375.82% as of March 2023, which far exceeds the regulatory requirement of 90%.

This financial growth was paralleled by an expansion in the bank's customer base. The total number of deposit-only customers more than doubled from 0.38 million in March 2021 to 0.86 million by March 2023. Furthermore, the bank's total clientele, encompassing both deposit and credit customers, increased from 2.9 million to 3.59 million over the same period.

Utkarsh SFB also boasts a broad and robust distribution network. As of March 2023, the bank operated 830 outlets spread across 26 states and union territories in India, covering 253 districts.

RISK FACTORS

Despite its impressive performance, potential investors should be aware of several risk factors associated with Utkarsh SFB. Although the bank saw steady growth in revenue, it encountered a significant setback in its bottom line in FY22. This was primarily due to an increase in provisions for delinquencies, which saw the net profit dropping from Rs 111.8 crore in FY21 to Rs 61.5 crore in FY22, before bouncing again to Rs 404.5 crore in FY23.

Moreover, a major portion of the bank's lending is concentrated in Bihar and Uttar Pradesh, which have demonstrated poor asset quality during downturns, leading to heightened risk exposure for the bank in such circumstances. Utkarsh SFB is also grappling with regulatory issues as it has received a show cause notice from SEBI for alleged violations of the Companies Act 2013 and SEBI regulations on public security offerings, which could result in punitive actions.

Additionally, a large part of the bank's loan portfolio, including micro-banking loans, is unsecured, meaning they lack collateral. This could potentially impact the bank's financial health if the recovery of these loans is delayed or becomes unattainable. The bank has also dealt with negative cash flow from operations in the past, posing a risk to its profitability and growth if it is unable to convert this into positive cash flow.

VERDICT: NEUTRAL

From a valuation standpoint, the IPO appears to be reasonably priced at a PE multiple of 6.8x, which is lower than the industry average. Additionally, the grey market premium (GMP) for the issue indicates a premium listing, making it appealing for investors seeking listing gains.

The strong deposit growth, a 31% uptick in loan book, steady secured loans growth, and declining trend in non-performing assets position the IPO as a potentially attractive short-term investment opportunity. However, Utkarsh SFB lags in some aspects, as highlighted in the 'Risk Factors' section above. Therefore, investors eyeing long-term capital growth should assess the company's performance over the next two quarters before making any investment commitments.

In conclusion, while Utkarsh Small Finance Bank's IPO presents an intriguing investment opportunity, it's essential to consider all factors and conduct thorough research before making any investment decisions. If you're looking for a comprehensive platform that can help you navigate the world of investments and grow your wealth over time, consider exploring Liquide. With features like LiMo, an AI-powered bot at your service, expert-recommended trade setups, and real-time tracking, Liquide offers a transparent and user-friendly experience. Download the Liquide app from the Google Play Store or Apple App Store to take advantage of its powerful tools and make informed investment choices. Start your journey towards financial growth and take control of your investments with Liquide today.