Beyond the F&O Shock: 3 Multi-Bagger Themes from Budget 2026

The Union Budget 2026 sent shockwaves through the trading community with a steep hike in STT on F&O. But for long-term investors, the real story lies in the ₹12.2 lakh crore Capex outlay.

The Union Budget 2026 has been unveiled and the message is loud and clear: India is doubling down on its "Manufacturing-First" strategy. While the headline-grabbing hike in Securities Transaction Tax (STT) on derivatives caused a tremor in the markets, a deeper look at the sectoral allocations reveals a structurally bullish roadmap for long-term investors.

⚖️ With a massive Rs 12.2 lakh crore Capex outlay (up from Rs 11.21 lakh crore last year) and a narrowing Fiscal Deficit (4.3% Vs 4.4% last year), the government is successfully balancing aggressive growth with fiscal discipline.

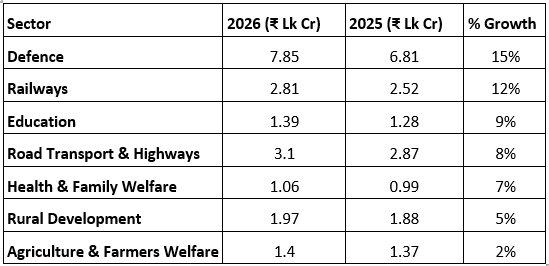

2026 vs. 2025: The Sectoral Growth Story

To understand the scale of this year's ambitions, look at the steady increase in funding across the board. Most critical sectors have received a significant "top-up," signalling continuity in policy.

Comparative Analysis: Budget 2026 vs. 2025

🏗️ Investor Insight: The double-digit growth in Defence and Railways signals a continued focus on modernization and indigenization—creating a "gold mine" for companies in the manufacturing and industrial engineering space.

Three "Game-Changer" Themes for 2026

1. The High-Tech Pivot: Biopharma SHAKTI & ISM 2.0

The government is pivoting India from a "low-cost assembly shop" to a "high-value Intellectual Property hub."

- Biopharma SHAKTI: A Rs 10,000-crore warchest to turn India into a global hub for biologics (advanced medicines for cancer and diabetes).

- Semiconductors (ISM 2.0): Moving beyond semiconductor "fabs" to own the entire value chain, including equipment and specialized materials.

- Electronics: The outlay for component manufacturing was hiked from Rs 22,919 crore to Rs 40,000 crore.

2. Rare Earth Corridors: Securing the Green Future

- To insulate the EV and Renewable Energy sectors from global supply shocks, the Budget introduced dedicated Rare Earth Corridors in Odisha, Kerala, Andhra Pradesh and Tamil Nadu.

- By integrating mining and processing, India aims to break its import dependence on critical minerals.

3. Tax Incentives for "Toll Manufacturing"

- In a strategic win for "Make in India," non-resident suppliers of capital goods to bonded manufacturing zones will enjoy an Income Tax exemption for 5 years.

- Coupled with slashed customs duties on lithium-ion cell components and aircraft parts, India is positioning itself as an irresistibly efficient global export hub.

The F&O Tax Hike: Why the Market is Worried

The one "bitter pill" for traders was the increase in Securities Transaction Tax (STT):

- STT on Futures: Raised from 0.02% to 0.05%.

- STT on Options: Raised from 0.1% to 0.15%.

While this is a direct hit to high-frequency trading (HFT) and brokerages, the intent is clear: the government wants to move retail capital away from high-risk speculation and toward long-term "productive" investments in the equity market.

Conclusion: A Blueprint for a Productive India

The 2026 Union Budget is a masterclass in economic re-engineering. By decisively cutting input costs for manufacturers and simultaneously increasing the "cost of speculation" via the STT hike, the Finance Minister has cleared the tracks for a manufacturing-led supercycle.

The government is no longer just subsidizing growth; it is architecting a high-tech, self-reliant ecosystem. For the visionary investor, today’s market volatility is not a warning—it is a strategic entry point. While the indices react to the short-term sting of transaction costs, the underlying roadmap for India’s industrial backbone remains more robust than ever.

💡 The Strategy: Use this dip to build positions in quality stocks positioned at the heart of these structural changes. In the long run, the productive capacity of the nation will always outweigh the temporary noise of the trading floor.

We’ve identified the specific companies set to be the biggest beneficiaries of the Budget 2026 announcements.

📲 Download the Liquide App today to get full access to our research-backed stock picks.