TVS Supply Chain IPO: A Golden Opportunity or a Risky Bet?

Explore an in-depth analysis of TVS Supply Chain’s IPO, weighing its potential growth, valuation, risks and investment opportunities.

After 32 years, the prestigious TVS group is once again venturing into the primary market. But is it worth the investment? Dive deep into our comprehensive analysis of this IPO, highlighting its growth potential, valuation, associated risks, and unique investment opportunities.

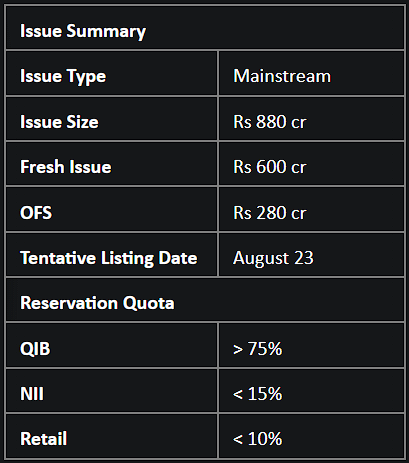

IPO Details

The TVS Group company aims to raise Rs 880 crore via its initial public offering (IPO), which comprises fresh equity shares of up to Rs 600 crore and an offer for sale of 14,213,198 shares. The book build issue will remain open for subscribers till Monday, 14 August 2023.

The shares, commanding a grey market premium (GMP) of Rs 22, are being offered in the price band of Rs 187-197. Potential investors can subscribe to lots of 76 shares or multiples thereof.

Prior to the IPO, TVS Supply Chain Solutions (TVS SCS) raised Rs 396 crore from 18 anchor investors. The anchor book was fully subscribed as the company allotted 2,01,01522 equity shares at Rs 197 per share.

Glimpse into the Financial Performance

Promoted by the renowned TVS Group, TVS SCS stands as one of India's leading and most rapidly expanding integrated supply chain logistics providers based on revenue growth. The company boasts an extensive global network and capabilities throughout the value chain, along with cross-deployment abilities. They cater to a diverse range of sectors including automotive, industrial, consumer products, technology and tech infrastructure, rail and utilities, and healthcare.

The financial graph of TVS SCS shows a commendable 21.5% CAGR revenue growth, soaring from Rs 6,934 crore in FY21 to Rs 10,235 crore in FY23. EBITDA experienced a surge from Rs 387 crore to Rs 684 crore within this timeframe. FY23 saw them with a net profit of Rs 41.8 crore.

Strategic acquisitions are one of their strengths. Over the past 16 years, they've integrated 20 acquisitions spanning Europe, the UK, the USA, and the Asia Pacific, ensuring a diversified revenue stream.

Risk Factors To Consider

While the IPO paints a promising picture, caution is advised. The IPO is pegged at a P/E multiple of 210x based on FY23 earnings, which indicates elevated valuations.

Additionally, the company's track record has been marked by consistent losses in the past, with only FY23 showing a profit. The EBITDA and PAT margins, standing at 6.7% and 0.4% respectively, fall short of industry benchmarks.

Further, given that 73% of the company's revenue is internationally sourced, it is susceptible to risks from currency variations and regional regulations.

Verdict: Avoid

Although the company has showcased impressive growth with a sharp turnaround in financials in FY23, its track record is not convincing enough for long-term investment. Hence, we recommend assessing the company's performance over the next couple of quarters before making any investment commitments.

Looking for a way to stay informed about the latest market trends and investment opportunities? Explore Liquide, a powerful financial app designed to provide you with real-time insights and data-driven analysis. With features like LiMo, our cutting-edge AI-powered assistant, Liquide offers you a comprehensive platform to make informed investment choices. Don't miss out – download Liquide from the Apple Appstore or Google Play Store today and take control of your financial future.