Mutual Fund Stock Investments in May 2023: Analysis and Market Insights

Let's have a look at the list of stocks that are bought heavily by the mutual fund house in May 2023

Market Overview

May 2023 proved to be an eventful month for the Indian equity markets. The benchmark Nifty50 saw a notable 2.6% rise, driven by several positive factors. These included consistent inflows of foreign capital, encouraging March quarter results by India Inc., and improving economic indicators.

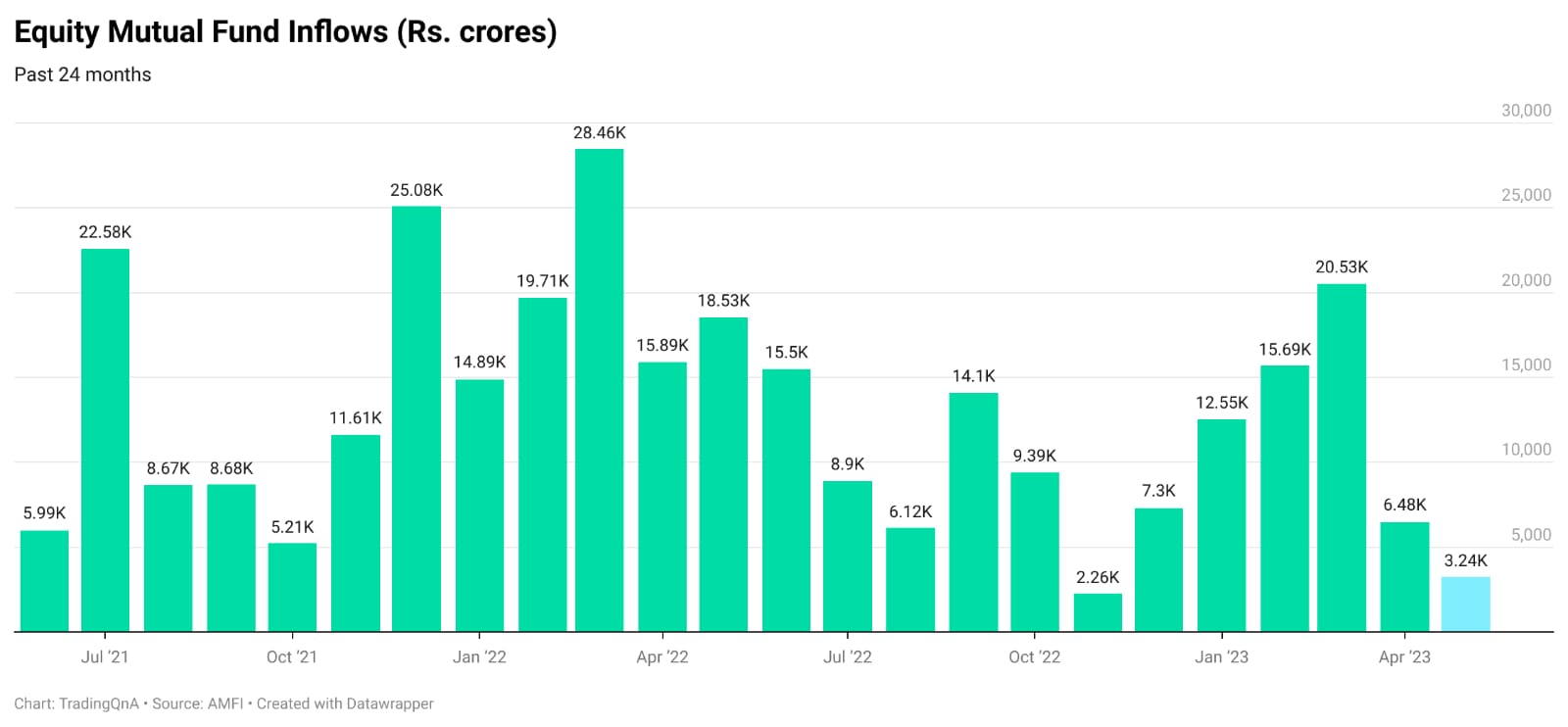

Equity mutual funds, on the other hand, experienced a sharp decline in inflow, amounting to Rs 3,240 crore in May, hitting a five-month low, largely attributed to investors capitalizing on their profits in the backdrop of a surging stock market. Despite this, the equity asset class continued to see positive net flows for an impressive 27th consecutive month. However, compared to the preceding month of April, this inflow was slashed by half, according to the data made public by the Association of Mutual Funds in India (Amfi). Let’s take a look at what these mutual funds bought and sold.

Stock Investments by Leading Mutual Funds

With billions of rupees flowing into mutual funds each month, it is important to gain insights into the stock buying and selling activities of these funds. In May 2023, top mutual funds in India actively participated in stock churn, with strategic reallocation of assets. The analysis presented here delves into the stocks that the top 5 mutual funds purchased and divested last month.

SBI Mutual Fund

A prominent player in the industry, SBI Mutual Fund increased positions in

It also acquired smaller quantities of

indicating its interest in diverse sectors.

Notably, the fund house reduced its stake in

In the mid-cap segment, SBI MF demonstrated interest in stocks such as

suggesting a strategic focus on emerging opportunities within this segment.

ICICI Prudential Mutual Fund

As the second-largest fund by AUM, ICICI Prudential MF's investment decisions carry significant weight in the market. In May 2023, the fund house increased its holdings in

Additionally, it acquired smaller positions in

On the selling side, the fund house reduced its exposure in

In the mid-cap segment, ICICI Prudential MF picked up stakes in

signalling their strategic focus on specific companies within this space.

HDFC Mutual Fund

With the third-largest AUM in the industry, HDFC Mutual Fund actively churned its portfolio in May 2023.

The fund house significantly increased positions in

a move that reflects their strong conviction in the company's growth trajectory.

It also added smaller quantities of

showcasing their diversified investment approach.

In the healthcare sector, the fund house picked up stakes in

Noteworthy is HDFC MF's reduction of holdings in

indicating a reassessment of their investment theses for these companies.

Nippon India Mutual Fund

Nippon India MF, formerly known as Reliance Mutual Fund, has maintained its reputation as a respected player in the industry.

In May 2023, the fund house added

to its portfolio.

Remaining neutral on

suggests a cautious stance or a balanced view of the oil and gas sector.

In the mid-cap segment, Nippon India MF picked up stakes in

On the selling side, the fund house aggressively reduced its exposure in

UTI Mutual Fund

One of the oldest mutual funds in India, UTI MF made strategic moves in May 2023.

The fund house increased its holdings in

indicating their positive outlook on these companies and their confidence in their ability to deliver strong returns.

In the mid-cap space, the fund's preferred picks included

Notably, UTI MF reduced its positions in

Conclusion

The stock buying and selling activities of mutual funds provided valuable insights into their investment strategies. Along with the analysis of their holdings, it is important to consider the overall market scenario, including Nifty movements and mutual fund inflows/outflows. Understanding these trends and data can help investors align their portfolios with the broader market sentiment and make informed investment decisions.

Disclaimer: The information presented in this article may not reflect the current or real-time positions of these mutual funds. Investors are advised to conduct their own research or consult financial advisors before making any investment decisions.

In the dynamic world of mutual fund investments, gaining insights into the stock buying and selling activities of leading funds is crucial. Liquide, a revolutionary investment platform, offers features like LiMo, an AI-powered bot that provides expert recommendations and portfolio health checkups. With Liquide, investors can align their portfolios with market sentiment and make informed decisions. To take advantage of these powerful tools and enhance your investment experience, download the Liquide app from Google Play Store or Google Play Store today.