Equity Fund Inflows Reach Record High of Rs 41,887 Cr; SIPs at All-Time High

October 2024 saw record-breaking equity fund inflows of Rs 41,887 crore, marking the 44th consecutive month of positive inflows. Discover the top mutual fund picks and key investment trends.

The Indian equity mutual fund sector has seen a remarkable surge in investments, with the Association of Mutual Funds in India (AMFI) reporting a record high of Rs 41,887 crore in inflows for October 2024.

Despite weak market conditions, the equity fund segment saw a 21.69% rise in month-on-month (MoM) inflows, marking the 44th consecutive month of positive inflows.

A Closer Look at SIP Inflows in October 2024: An All-Time High

One of the standout numbers for October 2024 was the rise in Systematic Investment Plan (SIP) inflows, which reached Rs 25,322 crore. This is an all-time high, surpassing the Rs 24,509 crore invested through SIPs in September.

Fund Flow Breakdown

The inflow distribution across different fund categories also offers some interesting insights:

- Large-Cap Funds saw a nearly two-fold increase, with inflows surging to Rs 3,452 crore.

- Mid-Cap Funds witnessed a 50% jump in net investments, totalling Rs 4,683 crore.

- Small-Cap Funds also saw a 23% rise in inflows, attracting Rs 3,772 crore.

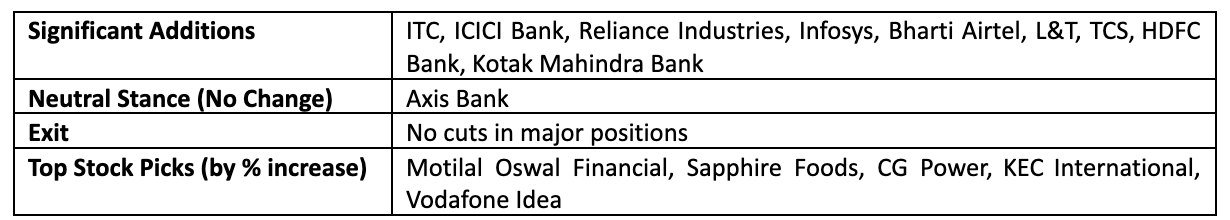

What Were the Big 5 Mutual Funds Buying and Selling in October 2024?

The five largest mutual fund houses by assets under management (AUM) have been active in managing their equity portfolios. Here's a quick look at the key movements across these funds:

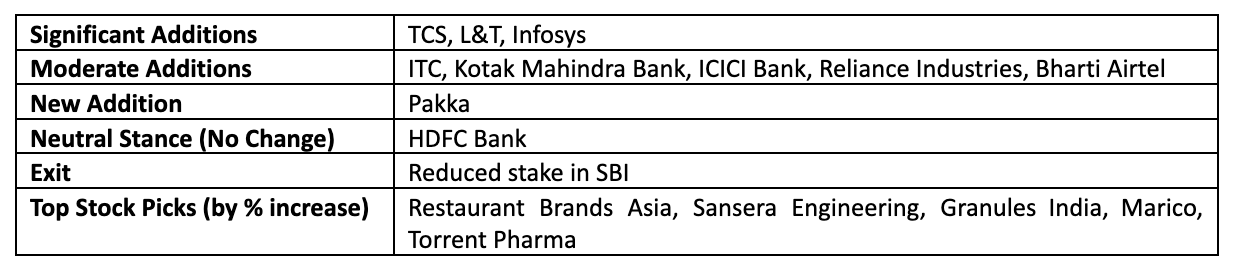

SBI Mutual Fund

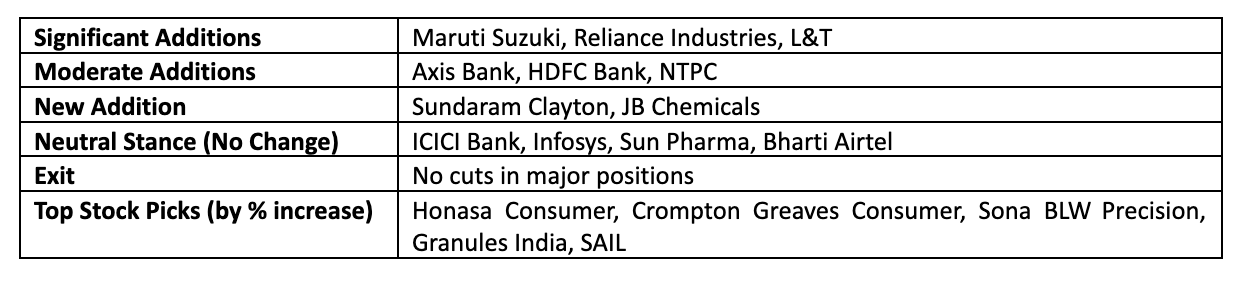

ICICI Prudential Mutual Fund

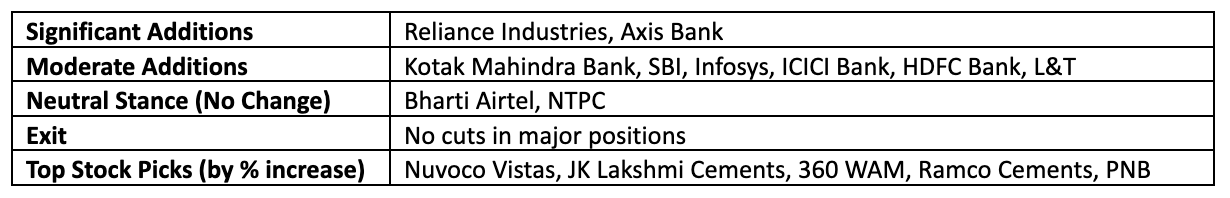

HDFC Mutual Fund

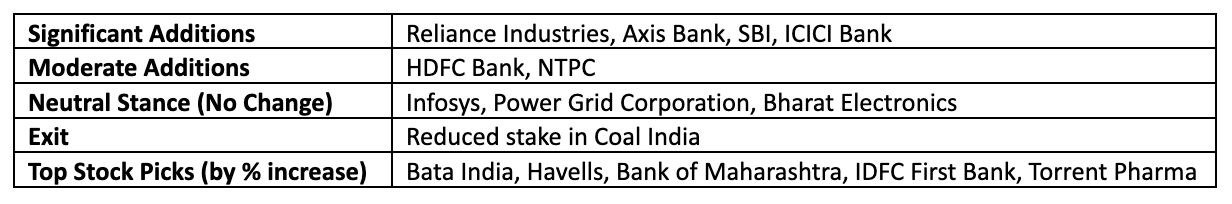

Nippon India Mutual Fund

UTI Mutual Fund

Key Takeaways for Investors

Despite market volatility, the strong inflows into equity funds and SIPs suggest a continued bullish sentiment among Indian investors. Large, mid, and small-cap funds are all seeing increased interest, reflecting growing diversification in portfolios.

The big five mutual fund houses are making strategic moves, increasing their stakes in key sectors such as technology and financials. This could indicate where the market is heading in the medium term.

Stay Ahead of the Curve: Leverage Expert Insights with Liquide

As of today, over Rs 70 lakh crore is invested in mutual funds in India. Yet, many investors are unaware of potential issues like underperformance and hidden fees that can impact their returns.

Liquide’s AI-powered Mutual Funds Portfolio Analytics Tool is designed to expose these inefficiencies, enabling smarter investment decisions.

Key Features

- 360-Degree Portfolio Analysis: Identify underperforming segments and high-risk areas within your portfolio.

- Discover Hidden Costs: Say goodbye to hidden fees that silently chip away at your returns. Our tool scrutinizes every aspect of your investment, revealing costs you may never have known existed.

- Enhanced Decision-Making: Gain clear, actionable insights that help optimize your portfolio for better returns.

Take Control of Your Financial Future with Liquide

Don’t let your hard-earned money be mismanaged. Utilize the Liquide app to streamline your investing journey, monitor your Mutual Funds' performance, and make informed adjustments. Moreover, the app equips you with all the essential resources and tools for savvy investments in equities too. Don't miss out – download the Liquide App today from the Apple Appstore or Google Play Store today and take control of your financial future.