Stock Market Weekly Recap: Nifty Falls, Midcaps & Smallcaps Struggle

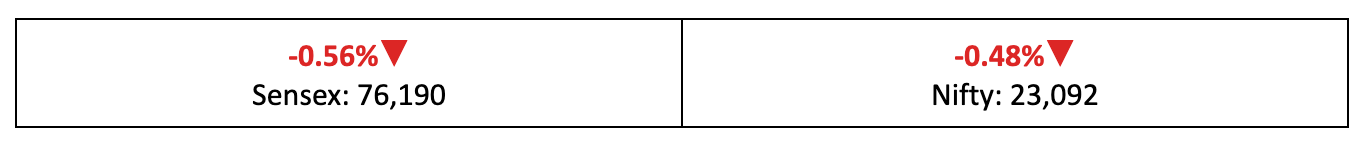

The markets ended lower for the third straight week, with Nifty slipping 0.48% and broader indices taking a sharper hit. Discover the key winners, losers, and what lies ahead as global and domestic factors keep investors on edge.

Markets wrapped up their third straight week in the red—the first time that's happened in three months—with mid-caps and small-caps taking the biggest hit. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Weekly Recap

Still feeling low

- Last week marked a third straight week of volatility, with the Nifty dipping another 0.48% from the previous close. The broader markets took an even harder hit, with Mid-Cap and Small-Cap indices dropping by more than 2% and 4%, respectively.

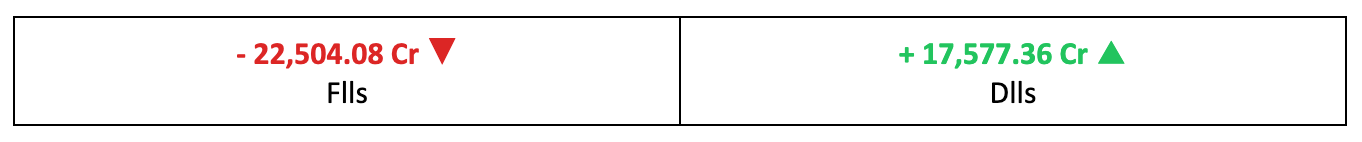

- Trading remained choppy throughout the week, and any signs of a rebound were quickly wiped out as investors remained cautious due to uncertainty over Trump’s policies, persistent FII outflows and mixed Q3 earnings.

What’s going on?

- Global markets, particularly in Asia, were in flux as the second Trump administration began, with the president signalling a more hawkish stance on trade policy.

- Meanwhile, domestic investors grappled with disappointing Q3 earnings from several major companies, prompting a reassessment of valuations across the board.

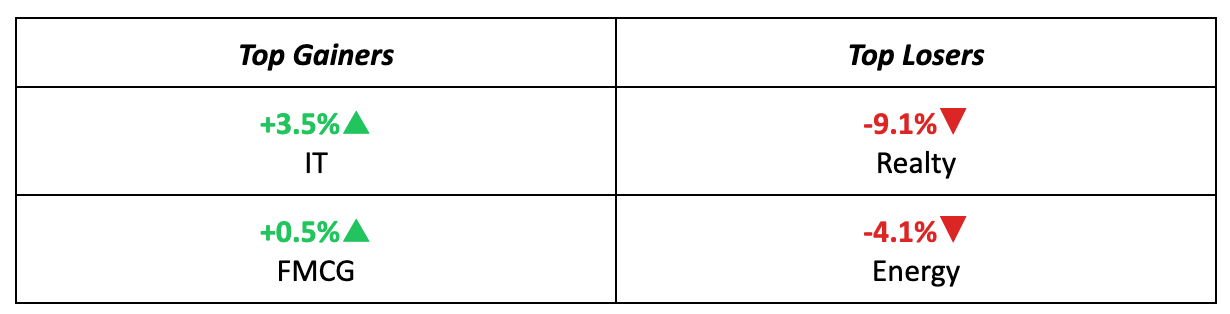

The winners

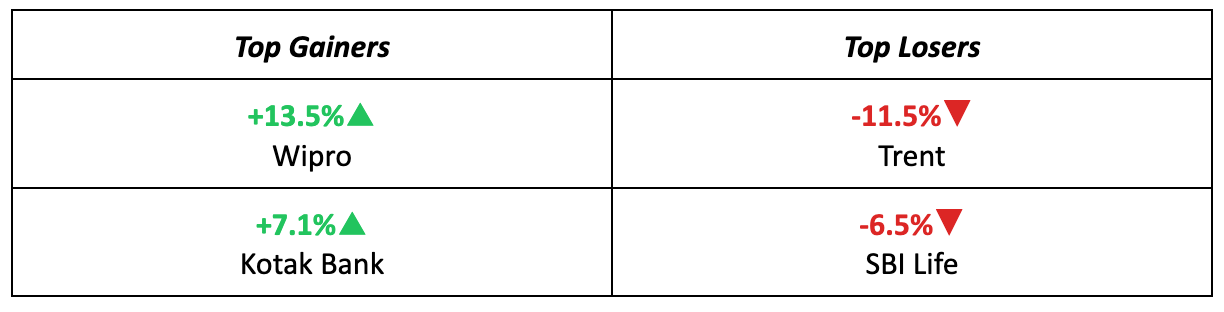

- Wipro stole the spotlight last week, climbing 13.5% to approach a 52-week high. The surge was fuelled by strong large deal bookings, an interim dividend announcement, and solid Q3 profit growth.

- Kotak Mahindra Bank followed closely, gaining 7.1% as brokerages upgraded their ratings on the stock, citing impressive Q3 results.

The losers

- Tata Group’s Trent, one of 2024’s best performers, stumbled last week, dropping 11.5% amid concerns over slowing revenue growth and potential cannibalization.

- SBI Life also struggled, falling 6.5% as brokerages flagged concerns about business growth prospects and heightened regulatory scrutiny.

Meanwhile…

- The International Monetary Fund (IMF) raised its 2025 global growth forecast to 3.3%, citing stronger-than-expected US demand and easing inflation, which could pave the way for further interest rate cuts by central banks.

- On the domestic macro front, the HSBC Flash India Composite Output Index dropped from 59.2 in December to 57.9 in January, marking the slowest pace of expansion in 14 months.

Market Brief

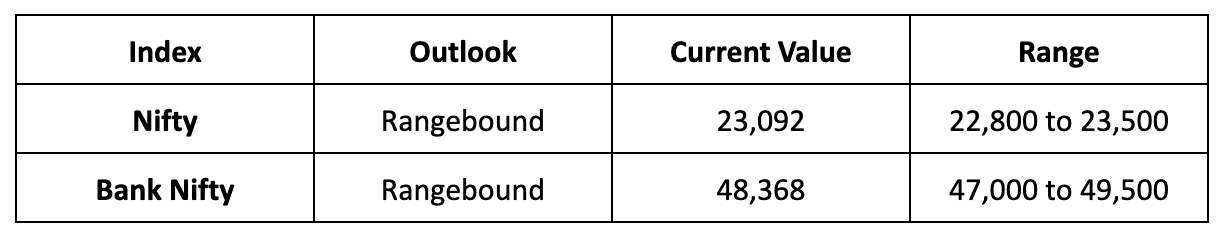

Market Outlook

Our Take

- Investors are still grappling with global uncertainties and weaker-than-expected earnings results domestically, which is likely to keep buying activity in the markets muted.

- Consequently, we expect the Nifty to remain rangebound next week, trading between 22,800 and 23,500 levels.

- Volatility is expected to spike as FM Sitharaman presents the Union Budget 2025-26 on February 1. From tax tweaks to sectoral reforms, expectations are sky-high as taxpayers, investors, and industries wait to see what’s in store. From railways to agriculture, here are some sectors and stocks likely to see major action: Union Budget 2025: Halwa Ceremony Secrets & Big Predictions Revealed!

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.