Weekly Market Recap: Sensex, Nifty surge up to 2%: Check Top Gainers, Key Losers, Sectoral Insights | Liquide

Unpack a tumultuous week on Dalal Street with our insights on market sell-offs, sector performances, and future outlook.

Markets saw a strong return to the green this past week. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly report.

Resilient

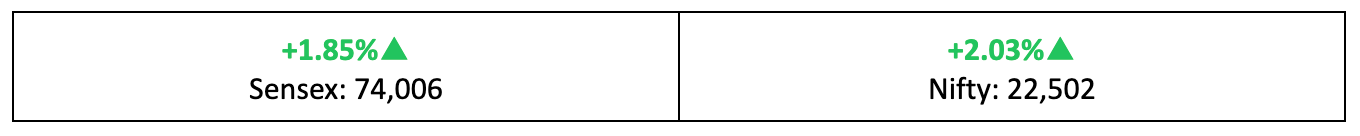

- After a couple of weeks of languishing around in pessimism, investors in Indian markets had reason to cheer again as the Nifty delivered a 2% return this week.

- Indices trended upward on almost all days of the extended trading week, though the India VIX still remains significantly elevated relative to early May levels.

- This week around, the broader markets outperformed benchmark indices, with the Nifty Midcap 100 and Smallcap 100 indices gaining 4.7% and 5.6%, respectively.

What gives?

- This past week was exceptionally positive for global markets as well, with the Dow Jones reaching a historic milestone of 40,000 for the first time.

- This surge was mainly fuelled by softer-than-expected U.S. inflation figures, which have bolstered expectations of potential interest rate cuts by the Federal Reserve later in the year.

- Furthermore, strong earnings from index heavyweights and optimism about a favourable economic outlook following general elections also fuelled buying interest.

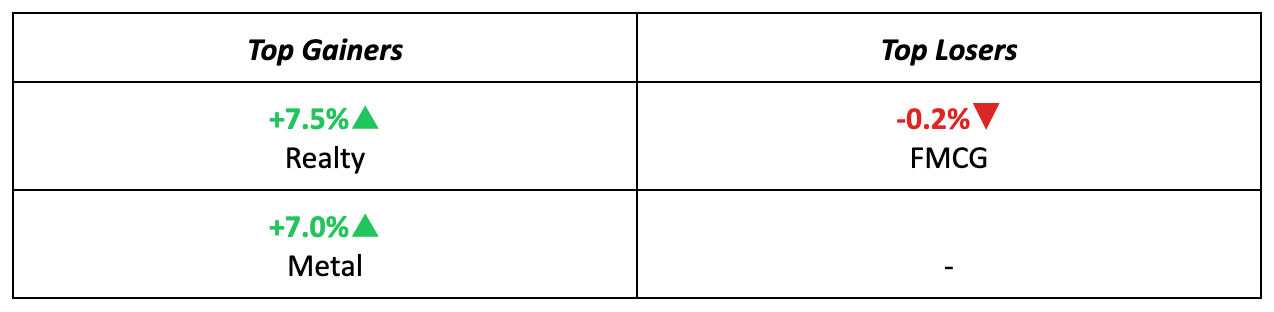

The winners

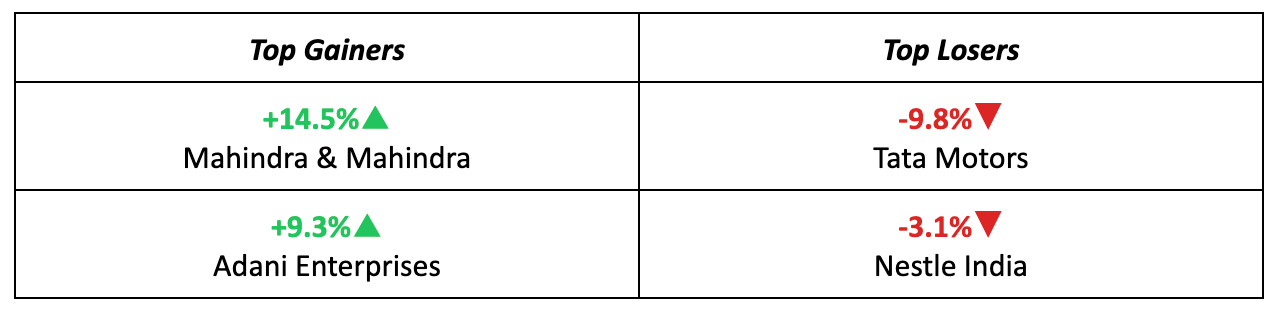

- Mahindra and Mahindra stole the show with a 14.5% return over the week, led by a stellar increase in Q4 net profits, revenue, and volumes.

- The realty sector as a whole also had a great week, with giants like Oberoi Realty posting solid gains on record quarterly and annual profit numbers.

The losers

- Tata Motors sank noticeably this week, as the auto major missed earnings estimates and gave a weak guidance for Jaguar Land Rover’s earnings.

Also Read: Tata Motors Q4 Earnings: Analysis & Outlook

- Nestle India also slid this week, which was negated somewhat by the late-in-the-week surge on its shareholders rejecting an increase in royalties to its Swiss parent.

Meanwhile…

- This week saw a rise in oil prices, driven by optimistic market sentiment following positive economic updates from the US and China.

- The US announced a raft of new tariffs (reaching as high as 100% on electric vehicles) on Chinese goods, in an escalation of the two countries’ years-long trade conflict.

Market Brief

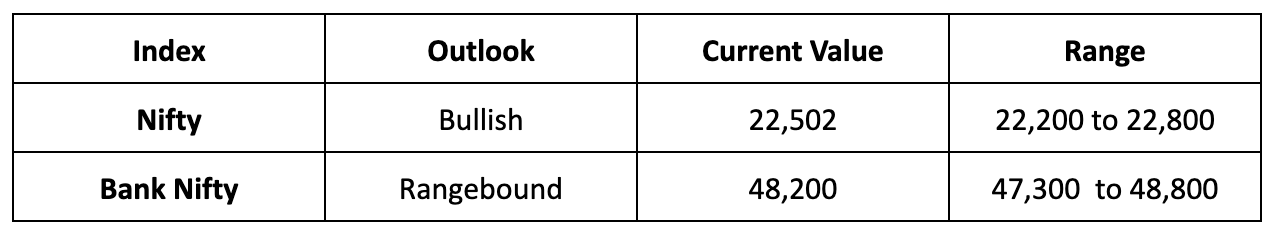

Market Outlook

Our take

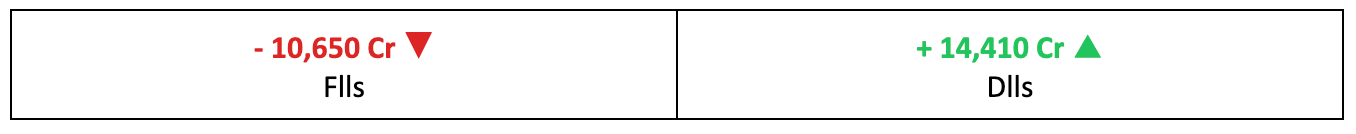

- The market showed a significant rebound from recent lows during the extended trading week.

- We predict a bullish outlook for the Nifty, with potential profit-booking at higher levels as the election results date nears.

- Consequently, we expect the Nifty to oscillate between 22,200-22,800 levels in the upcoming truncated trading week.

- Equity markets will be closed on May 20 due to general elections. Market participants will focus on the FOMC minutes and the Fed chair's speech, as well as the ongoing Lok Sabha election phases and upcoming corporate earnings, which are expected to provide further guidance for the indices.

Stay ahead in the world of finance with the most relevant business news and market updates. With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey