Special Live Trading Session on NSE, BSE, on Saturday, March 02, 2024

Special live trading session on NSE & BSE, March 2, 2024. Key insights on DR site transition in Equity & Derivatives.

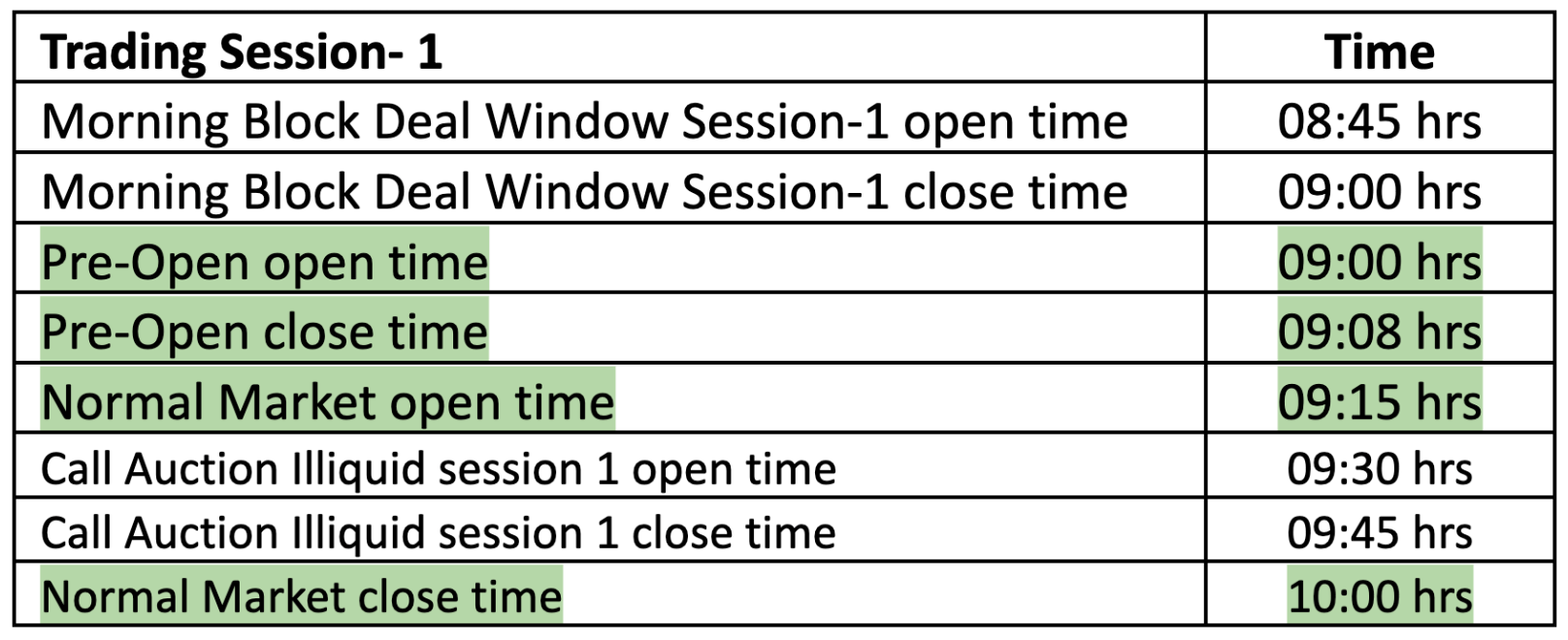

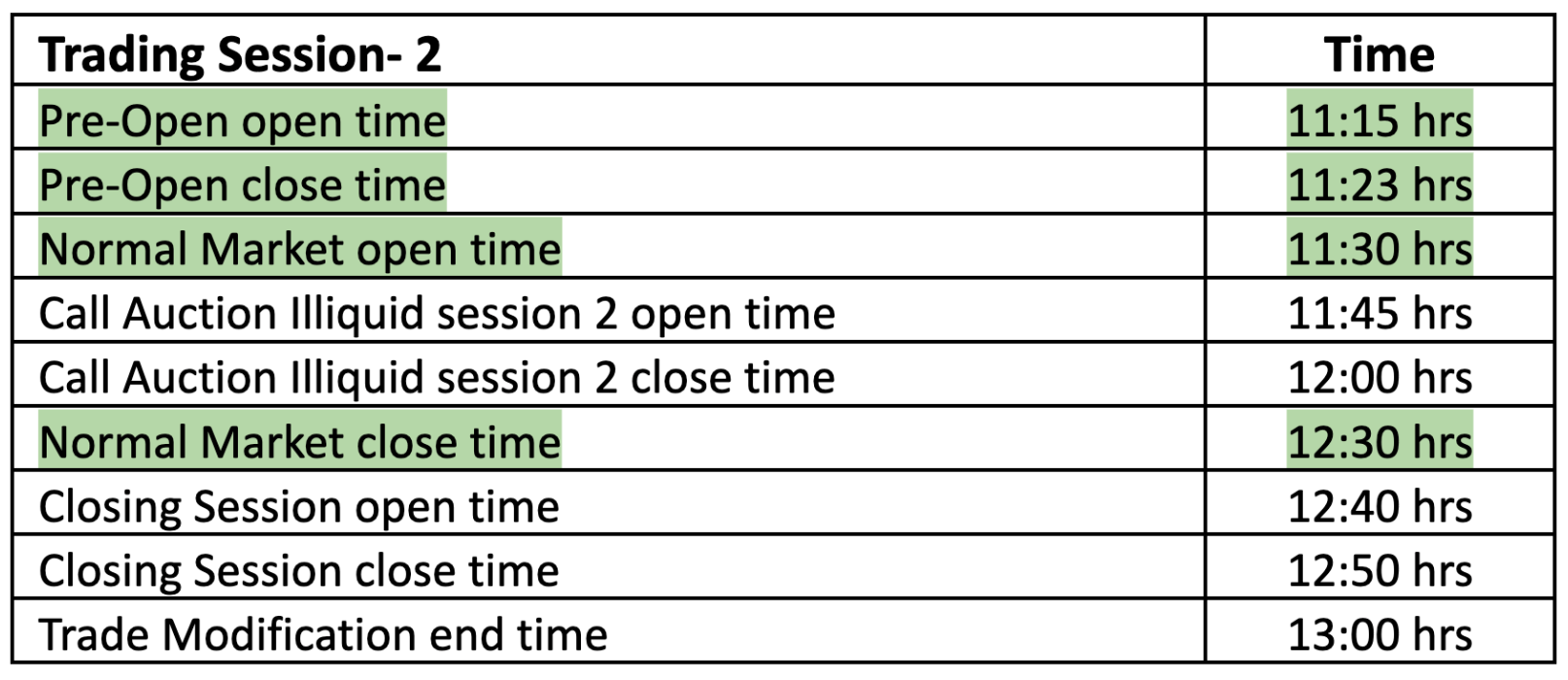

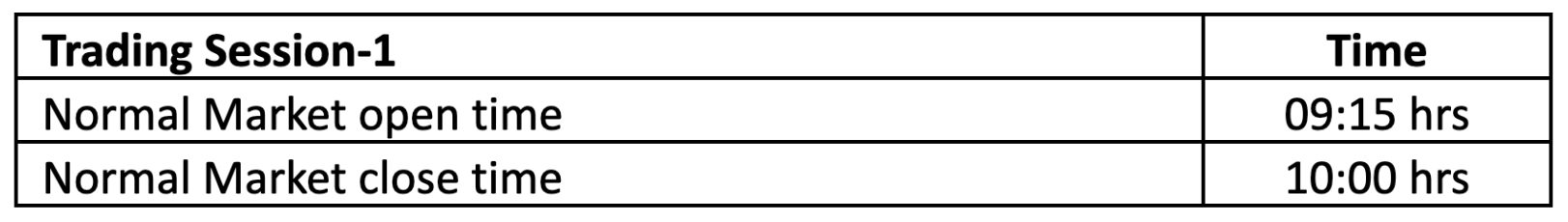

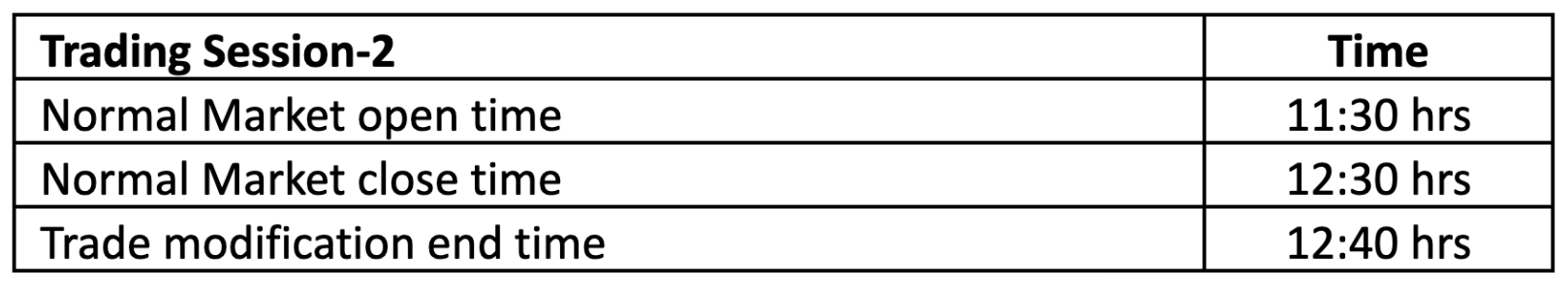

Please be informed that on Saturday, March 02, 2024, the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE) will hold a special live trading session featuring an intraday transition from the Primary Site (PR) to the Disaster Recovery Site (DR) in both the Equity and Equity Derivatives Segments. The trading session timings are as follows:

CAPITAL MARKET SEGMENT

Live trading from Primary Site:

Live trading from DR Site:

FUTURES & OPTIONS (F&O) SEGMENT

Live trading from Primary Site:

Live trading from DR Site:

Changes in Trading activities due to Operations at the DR site

- Securities purchased on March 1 will not be eligible for sale on the following trading day, March 2, due to both settlements' pay-in occurring on March 4, 2024.

- All securities will have a maximum price band of 5%. Securities that are currently within a 2% or lower price band will remain in their respective bands.

- After Market Orders (AMO) will be normally placed during the first session only.

- Good Till Date (GTD) orders will also be accepted in the first session only. Any GTD orders not executed in the first session will be cancelled by the Exchange in the second session. However, the same will be activated on the next regular trading day.

- The credit or profits from Friday's trading activities will not be accessible as margin for the Saturday session.

Frequently Asked Questions (FAQs)

- Why is the DR site transition happening during live trading?

The live DR site transition is part of a disaster recovery strategy to test system robustness in real-time, ensuring seamless operation shifts during actual emergencies. This enhances market stability and reliability.

- How does the special session affect the settlement cycle?

The special Saturday session temporarily alters the settlement cycle, with March 1 purchases not sellable on March 2 and settling on March 4, to accommodate this unique event. Traders must adjust their strategies accordingly.

- What ensures trading platform stability during the DR transition?

Preparations for a stable DR transition include comprehensive DR site testing, operational readiness of all systems, robust technical support, and clear communication with market participants to minimize trading disruptions and maintain market integrity.

Stay ahead in the world of finance with the most relevant business news and market updates. Access in-depth market analysis, expert advice, and real-time updates through the Liquide App. Download it today from the Google Play Store or Apple App Store and begin your journey towards informed and successful investing.