SBFC Finance IPO Opens Today: To Subscribe or Not? Your Ultimate Guide

Explore an in-depth analysis of SBFC’s IPO, weighing its potential growth, valuation, risks and investment opportunities.

After a stellar run of new listings, the financial landscape is abuzz with the news of the SBFC Finance Ltd IPO, which has commenced for subscription. Spanning three days from Thursday, August 3, to Monday, August 7, this IPO has garnered considerable interest.

SBFC Finance is a systemically important, non-deposit-taking NBFC that provides loans. These include secured loans to Micro, Small, and Medium Enterprises (MSMEs) and loans against gold, concentrating on amounts ranging from Rs 5 lakh to Rs 30 lakhs. As of March 31, 2023, the company has extended its reach to 120 cities across 16 states and 2 Union Territories in India, operating through a network of 152 branches. Here's a detailed analysis of the IPO and insights into SBFC Finance's performance.

IPO Details

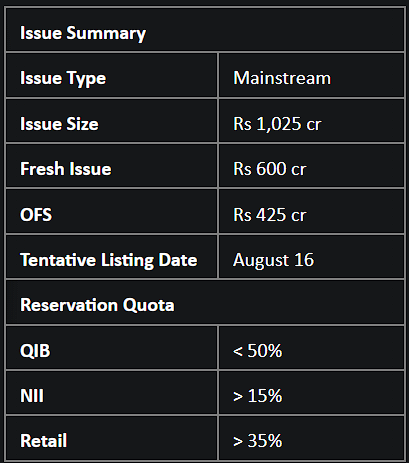

The initial public offering (IPO) of SBFC Finance, a non-banking finance company, is valued at Rs 1,025 crore. The shares, commanding a grey market premium (GMP) of Rs 39, are being offered in the price band of Rs 54-57. Potential investors can subscribe to lots of 260 shares or multiples thereof.

Prior to the IPO, SBFC Finance raised Rs 304.43 crore from 37 anchor investors, including prominent names like Abu Dhabi Investment Authority, Carmignac Portfolio, Axis Mutual Fund, Birla Mutual Fund, and more.

SBFC Finance Shows Impressive Growth

SBFC Finance has demonstrated impressive growth over the past two years. Its operating revenue has seen a CAGR of 20%, reaching Rs 732.8 crore in FY23. Net profit grew at a CAGR of 33%, reaching Rs 149.7 crore in FY23. Another notable highlight is its impressive growth in Assets Under Management (AUM). The company stands out among MSME-centric NBFCs in India with one of the highest AUM growth rates, boasting a Compound Annual Growth Rate (CAGR) of 44% from Fiscal 2019 to Fiscal 2023. This is complemented by solid disbursement growth, with the company recording a robust 40% CAGR in the same period.

Additionally, SBFC Finance has successfully managed a decreasing trend in Net Non-Performing Assets (NPAs), consistently reducing them from 1.95% in FY21 to 1.63% in FY22, and further down to 1.41% in FY23. These factors collectively illustrate the strong financial performance and prudent risk management at SBFC Finance.

Risk Factors To Consider

While SBFC Finance has shown strengths in various areas, there are risk factors that potential investors need to consider. The company's Net Interest Margin (NIM) has experienced a substantial decrease, falling from 11.73% in FY21 to 9.39% in FY22, and further dropping to 9.32% in FY23. This declining trend in NIM may indicate a reduction in the company's profitability from its lending operations.

Moreover, SBFC's return ratios, such as the average Return on Equity (6.6%) and Return on Assets (1.9%) over the past three fiscal years, are significantly below the industry standards of 13.5% and 3.8%, respectively. These low return ratios could be reflective of operational inefficiencies or underlying issues in the company's asset management, raising concerns for long-term investors.

What Should Investors Do?

SBFC Finance stands out as a rapidly growing NBFC with robust earnings growth and stable asset quality. Moreover, the bullish sentiment surrounding the banking and NBFC sectors provides a strong backdrop, and SBFC is well-placed to leverage the prevailing macroeconomic tailwinds.

From a valuation standpoint, the IPO is priced at a PE multiple of 40.4x, with the price-to-book value ratio at ~3.5x, which is slightly below the industry average of 4x, thus suggesting potential upside for new investors participating in the IPO. Additionally, the grey market premium (GMP) for the issue, often used as a gauge for investor sentiment, indicates a solid listing.

Considering these factors, we recommend a ‘Subscribe’ rating to this IPO for healthy listing gains. For those with a longer-term perspective, however, it may be prudent to consider higher-tier NBFCs that carry 'AA' and 'AAA' ratings as opposed to SBFC Finance, which holds an A+ long-term rating. Despite its rapid growth phase, the company's Return on Equity has lingered in the single digits over the past three financial years, and there has been a concerning decrease in the Net Interest Margin. These trends do warrant caution.

Are you ready to make well-informed investment decisions like a seasoned pro? Enhance your financial journey with Liquide's powerful tools. From LiMo, our AI-powered assistant, to comprehensive stock insights, Liquide equips you with the knowledge you need. Download the Liquide app from the Google Play Store or Apple App Store now, and embark on your path to informed investing. Don't miss out on the opportunity to elevate your investment strategy – get Liquide today and unlock your financial potential.