Are Retail Investors in India Truly Getting a Fair Deal in the IPO Market?

Are retail investors being misled by the IPO boom in India? Discover the truth behind the performance of Mainboard and SME IPOs, uncovering risks, rewards and the reality behind the IPO frenzy.

The Indian IPO market has been on fire, with 80 mainboard IPOs raising Rs 1,630 billion in FY25 alone, up from just Rs 619 billion the year before. But amidst this surge, here’s one burning question: Are retail investors truly getting a fair shot in the IPO frenzy or are they unknowingly walking into a minefield of risks?

2024-2025 IPO Performance: A Reality Check

The hype surrounding IPOs is hard to ignore, but the reality is far from glamorous. You’d be surprised to know that, from the 2024 listings, 43% of Mainboard IPOs and 41% of SME IPOs are still trading BELOW their issue price, leaving retail investors nursing heavy losses.

And if you thought 2024 was rough, 2025 might be even worse. Over HALF of 2025’s SME IPOs are already trading BELOW their issue price, with an average loss of approximately -31%. That’s a major blow for retail investors!

SME IPOs have definitely had some big winners, but they come with much higher risks when they miss the mark. To put it in perspective, while 41% of 2025’s Mainboard IPOs are trading below their issue price, they’ve only seen an average loss of around -10%.

With these numbers in mind, let's dig deeper into the true story behind the IPO frenzy and explore what it really means for retail investors.

SME Vs Mainboard: A Tale of Contrasting Risk Profiles

When comparing SME IPOs and Mainboard IPOs, an interesting trend emerges. SME IPOs have consistently outpaced Mainboard IPOs from 2022 to 2024, with 91% of SME IPOs in 2024 showing a positive listing.

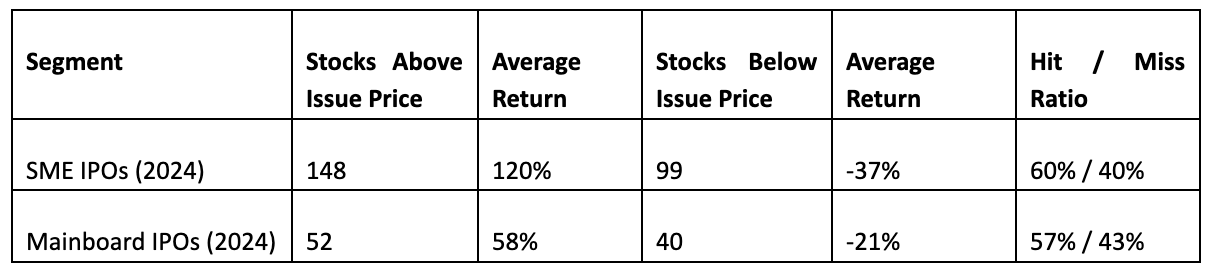

However, the post-listing reality paints a different picture. Despite the initial success, over 40% of these SME IPOs have since fallen below their issue price, with an average negative return of approximately -37% (see the table below).

This highlights that strong listing gains don’t always speak about the quality of the IPO or translate into long-term wealth.

Diverging Paths: Mainboard IPOs vs SME IPOs in 2025

Looking at the broader trends, there’s a notable divergence in the performance of IPOs. In the period from 2021 to 2023, roughly 60–65% of IPOs, both Mainboard and SME, were trading above their issue price.

Fast forward to 2025, SME IPOs have seen a substantial dip, with only 47% currently trading above their IPO price. In contrast, Mainboard IPOs have shown a recovery, with 59% trading above their issue price.

Moreover, in terms of listings, 76% of Mainboard IPOs had positive listings in 2025, compared to just 68% for SME IPOs.

💡 Food for Thought: Does this mean SME IPOs perform better in bullish markets but struggle during periods of volatility?

💡 Deeper Dive: Even with 59% of Mainboard IPOs trading above their issue price, it's important to note that only HALF of these have seen returns of 10% or more, with the rest showing either marginal gains or no returns at all.

Conclusion: A Fair Deal or a Risky Bet?

These statistics leave us with a compelling question: Is the IPO market really living up to the expectations set by the hype or is it merely a means for institutional investors and large players to profit at the expense of retail investors?

While some IPOs have delivered solid returns, the reality is that many are falling short, leaving investors with losses. The IPO market, especially in the SME segment, is a tricky and risky space, with minimum application sizes exceeding Rs 1 lakh for retail investors. Perhaps the most important takeaway is the need for caution and thorough research, especially if you’re investing from a long-term view.

In the end, the question remains: Can retail investors truly win in the IPO market or are they taking on more risk than they realise?

Expert IPO Analysis with Liquide

Looking to invest in IPOs? Liquide offers expert analysis and detailed reviews of Mainboard IPOs, evaluating each company’s fundamentals, market outlook and growth potential. Our comprehensive IPO reports help you make informed decisions. For an in-depth look, visit the IPO Corner on Liquide.