POST-MARKET SUMMARY 7th November 2024

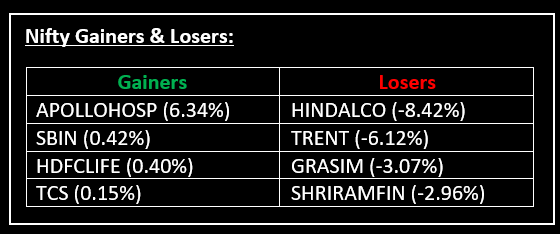

On November 7th, Indian benchmark indices erased gains from previous sessions, ending a two-day winning streak due to broad-based selling across sectors as investors stayed cautious ahead of the Federal Open Market Committee (FOMC) outcome later tonight. Top Gainer: APOLLOHOSP | Top Loser: HINDALCO

On November 7th, Indian benchmark indices erased gains from previous sessions, ending a two-day winning streak due to broad-based selling across sectors as investors stayed cautious ahead of the Federal Open Market Committee (FOMC) outcome later tonight.

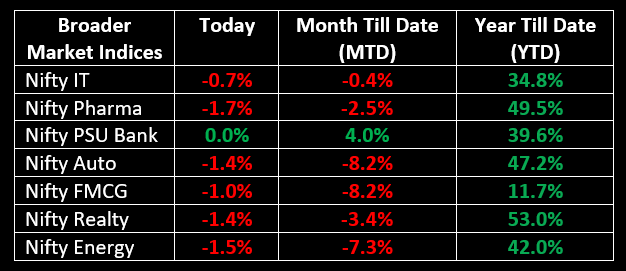

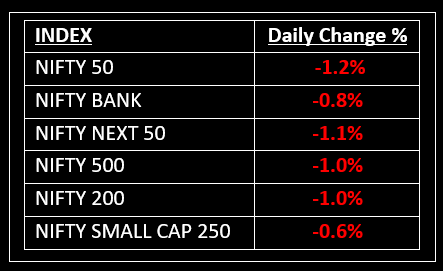

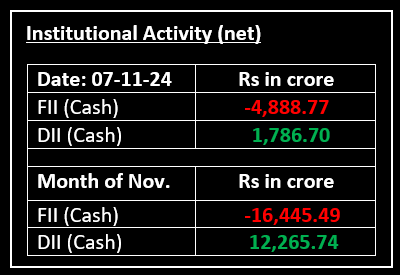

At close, the Sensex was down 836.34 points or 1.04% to 79,541.79, while the Nifty dropped 284.70 points or 1.16% to 24,199.30. All sectoral indices finished in the red, with auto, metal, power, telecom, pharma, and realty sectors declining between 1-2%.

NIFTY: The index opened flat at 24,489 and made a high of 24,503 before closing at 24,199. Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,260 while immediate support is at 24,160.

BANK NIFTY: The index opened 59 points lower at 52,258 and closed at 51,916. Bank Nifty has formed a bearish candlestick pattern on the daily chart. Its major resistance level is now placed at 52,100 while major support is at 51,650.

Stocks in Spotlight

▪ Wockhardt: Shares tanked as much as 5% as investors dumped the stock after the company launched a Qualified Institutional Placement (QIP) at a floor price that offers a steep discount from the previous closing level.

▪ Trent: Stock sank almost 8% after it reported September quarter results, which were below expectations. Net profit for the company stood at Rs 335 crore, marking an on-year rise of around 47%.

▪ Avalon Technologies: Stock rallied 20% after the firm posted a 140% year-on-year increase in net profits.

Global News

▪ Gold prices rose on Thursday but remained near a three-week low, as market participants awaited the U.S. Federal Reserve's rate-cut decision later in the day.

▪ Mainland China's CSI 300 led Asian markets, closing up 3.02% at 4,145.7, while Hong Kong's Hang Seng index rose 2% in its final trading hour.

▪ The dollar remained near four-month highs after its biggest rally in two years post-Trump’s election win. Meanwhile, sterling rose following a Bank of England rate cut, with the bank forecasting quicker inflation and growth for the UK.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.