POST-MARKET SUMMARY 7th February 2024

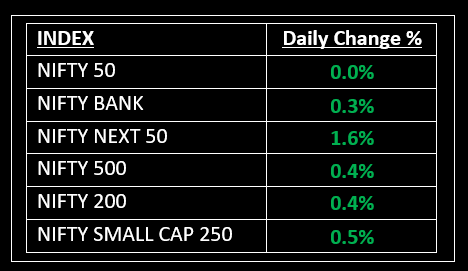

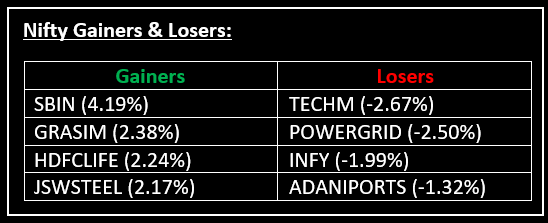

On February 7, the benchmark indices closed unchanged following a volatile session, with the Nifty unable to maintain its position above the 22,000 level despite starting above it. Top Gainer: SBIN | Top Loser: TECHM

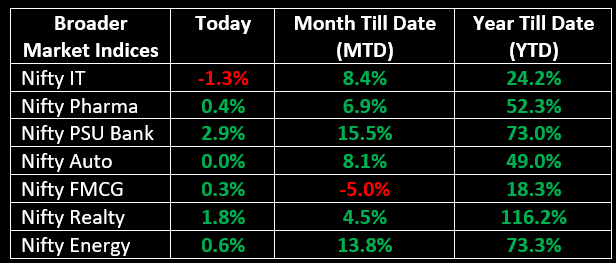

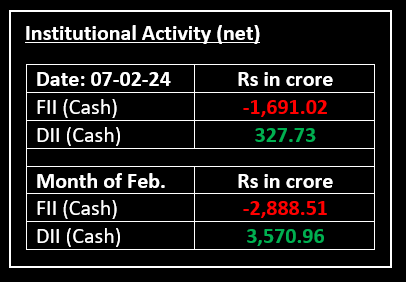

On February 7, the benchmark indices closed unchanged following a volatile session, with the Nifty unable to maintain its position above the 22,000 level despite starting above it. Early gains were eroded as investors turned their attention to the Reserve Bank of India's forthcoming monetary policy announcement scheduled for February 8. Notable sectoral movers included Nifty PSU Bank and realty, which saw increases of 2.86% and 1.84% respectively. Conversely, profit-booking was observed in the IT and auto sectors.

NIFTY: The index opened 116 points higher at 22,045 and made a high of 22,053 before closing at 21,930. Nifty has formed a bearish candlestick with lower shadow on the daily chart. Its immediate resistance level is now placed at 22,000 while immediate support is at 21,860.

BANK NIFTY: The index opened 254 points higher at 45,944 and closed at 45,818. Bank Nifty has formed an indecisive candlestick on the daily chart. Its immediate resistance level is now placed at 46,050 while support is at 45,600.

Stocks in Spotlight

▪ Trent Ltd: Stock surged 19% after the retail player reported a consolidated net profit of Rs 370.6 crore for the December quarter, rising 39% from Rs 154.81 crore in the year-ago quarter.

▪ Delta Corp Ltd: Stock surged 11% on reports that the government could soften its stance on the retro goods and services tax (GST) demand notices issued to online gaming companies.

▪ IEX Ltd: Stock slumped 5% after the Central Electricity Regulatory Commission (CERC) ordered a shadow pilot on the market coupling of India's power exchanges.

Global News

▪ The pan-European Stoxx 600 was down 0.3% in early morning deals, with most sectors trading in negative territory. Oil and gas stocks were down 0.8%, while autos were up 1.3%.

▪ The dollar fell on Wednesday, further retreating from a nearly three-month high against the euro hit a day earlier, with a decline in U.S. bond yields adding to the pressure.

▪ Oil prices ticked higher on Wednesday, as growth in U.S. oil production is expected to remain largely steady through 2025, easing worries of excess supply.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.