POST-MARKET SUMMARY 5th February 2024

On February 5, the Indian equity benchmarks were unable to sustain their initial gains and concluded lower in a volatile session. Investors anxiously awaited the outcome of the RBI meeting for insights into potential rate cuts and the inflation trajectory. Top Gainer: TATAMOTORS | Top Loser: UPL

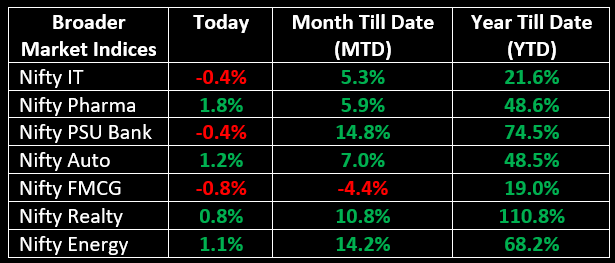

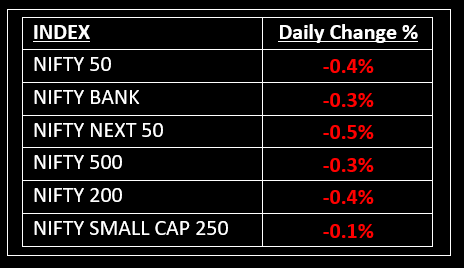

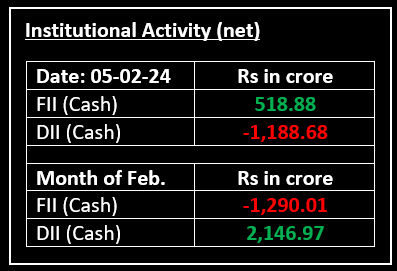

On February 5, the Indian equity benchmarks were unable to sustain their initial gains and concluded lower in a volatile session. Investors anxiously awaited the outcome of the RBI meeting for insights into potential rate cuts and the inflation trajectory. Despite a positive global backdrop, the market opened on a positive note but remained range-bound with a favorable bias in early trade. However, last-hour selling pressure wiped out all the gains, leading to the Sensex and the Nifty closing near the day's lowest levels. On the sectoral front, bank, capital goods, information technology, and FMCG were down by 0.3-0.9%, while auto, pharma, metal, oil & gas, and realty posted gains of 1% each.

NIFTY: The index opened 68 points higher at 21,921 and made a high of 21,964 before closing at 21,771. Nifty has formed a bearish candlestick pattern, which resembles a Bearish Engulfing kind of pattern on the daily chart. Its immediate resistance level is now placed at 21,815 while immediate support is at 21,700.

BANK NIFTY: The index opened flat at 45,962 and closed at 45,825. Bank Nifty has formed a bearish candlestick pattern with upper and lower shadows on the daily timeframe. Its immediate resistance level is now placed at 46,250 while support is at 45,500.

Stocks in Spotlight

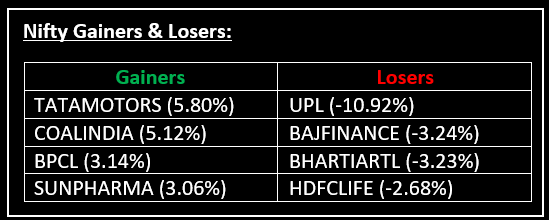

▪ Tata Motors: Stock gained 5.8% after the company’s Q3 results beat the Street estimates.

▪ KPI Green Energy: Stock zoomed 5% and hit the upper circuit after the company received a 15 MW order for solar power project from Aether Industries.

▪ UPL: Stock fell 10.92% after the company reported a quarterly loss in the October-December period as it struggled with weak demand, inventory destocking and falling prices.

Global News

▪ Gold dropped 1% to more than a one-week low on Monday, weighed down by a higher dollar and bond yields after a solid U.S. jobs report and remarks from Federal Reserve officials poured dashed expectations of early interest rate cuts.

▪ The dollar rose to its highest in almost three months against other major currencies on Monday as traders clawed back bets for aggressive rate cuts by the Federal Reserve this year.

▪ Oil prices stabilized in early Asian trading on Monday after sharp falls last week, amid continued attempts to reach a ceasefire in the Israel-Palestinian conflict even as the U.S. planned new strikes on Iran-backed groups.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.