POST-MARKET SUMMARY 5th December 2024

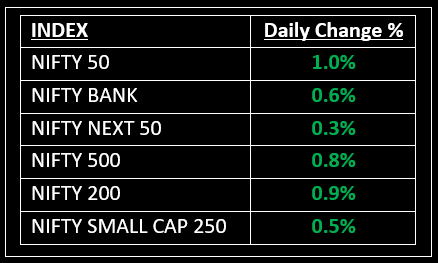

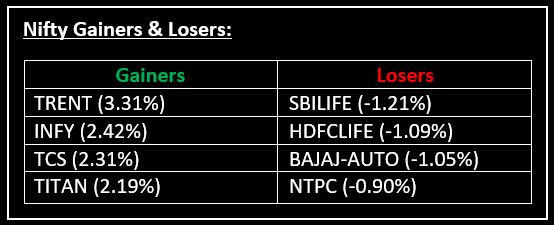

On December 5, the Indian equity market managed to close higher in yet another highly volatile session, marking a fifth consecutive day of gains. Top Gainer: TRENT | Top Loser: SBILIFE

On December 5, the Indian equity market managed to close higher in yet another highly volatile session, marking a fifth consecutive day of gains. Buying momentum in the second half drove the market upward, though most intraday gains were pared as investors stayed cautious ahead of the Reserve Bank of India's policy announcement tomorrow.

Among sectors, Information Technology emerged as the top gainer, rising nearly 2%, while all other indices, except realty and PSU Bank, also closed in the green. Also read: Nifty IT Index Hits All-Time High: Here’s Why Indian IT Stocks Are Soaring

NIFTY: The index opened 72 points higher at 24,539 and made a high of 24,857 before closing at 24,708. Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,800 while immediate support is at 24,580.

BANK NIFTY: The index opened 88 points higher at 53,354 and closed at 53,603. Bank Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed around 53,800 while immediate support is around 53,300.

Stocks in Spotlight

▪ Indraprastha Gas: Stock ended 6.5% higher after the gas distributor announced that the board will consider the proposal of bonus share issue on December 10.

▪ Divi's Laboratories: Stock fell 3% as Novartis lost a US court appeal to block MSN Pharmaceuticals' generic version of Entresto, impacting the firm’s CDMO contract with Novartis for the drug.

▪ BSE Ltd: Stock surged over 14% amid heavy trading volumes. BSE shares have also entered the F&O segment from the December series.

Global News

▪ European stocks edged higher on Thursday, with French markets in focus after Prime Minister Michel Barnier’s government was toppled in a vote of no-confidence Wednesday.

▪ The British pound rose for a third consecutive session on Thursday as it continued to recover from a six-month trough hit in late November.

▪ Gold prices steadied on Thursday as investors held back from placing big bets ahead of U.S. non-farm payrolls data that could influence the Federal Reserve’s interest rate trajectory as markets awaited this year’s final policy-setting meeting.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.