POST-MARKET SUMMARY 3rd May 2024

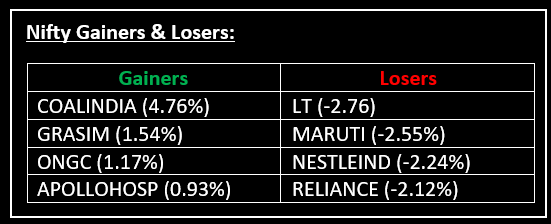

On May 3rd, the Indian markets failed to maintain their opening gains amidst a volatile session, closing lower with the Nifty below 22,500 due to selling pressure in heavyweight stocks and across various sectors, except for metal. Top Gainer: COALINDIA | Top Loser: LT

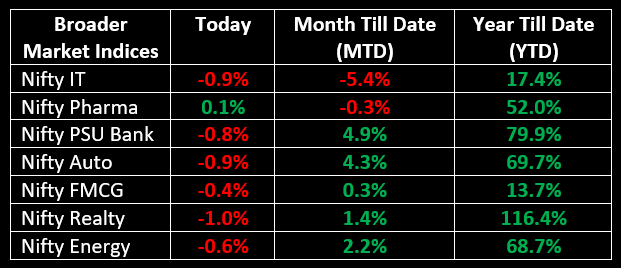

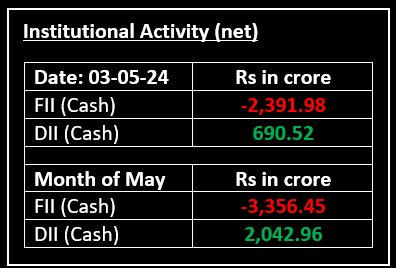

On May 3rd, the Indian markets failed to maintain their opening gains amidst a volatile session, closing lower with the Nifty below 22,500 due to selling pressure in heavyweight stocks and across various sectors, except for metal. Initially opening on a positive note, the market traded in an upward direction for the first couple of hours. However, a sudden downturn wiped out the early gains, pushing the market into negative territory for the remainder of the session. Barring the metal sector, all other sectoral indices ended in the red, with capital goods, realty, telecom, and PSU Bank declining by 1% each, while oil & gas, auto, Information Technology, and Media witnessed a decline of 0.5% each.

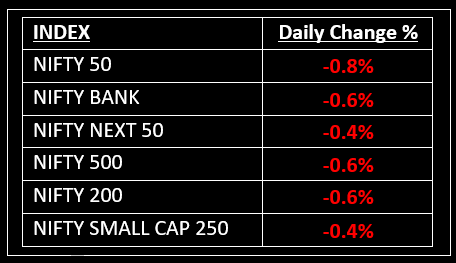

NIFTY: The index opened 118 points higher at 22,766 and made a high of 22,794 before closing at 22,475. Nifty has formed a long bearish candlestick pattern with a small lower shadow on the daily chart. Its immediate resistance level is now placed at 22,540 while immediate support is at 22,350.

BANK NIFTY: The index opened 144 points higher at 49,375 and closed at 48,923. Bank Nifty has formed a long bearish candlestick with both upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 49,130 while support is at 48,650.

Stocks in Spotlight

▪ Ajanta Pharma: Stock surged over 6% after the company reported stellar earnings in the Mach quarter and announced buyback plans.

▪ MRF: Stock fell 4% after the company’s consolidated net profit fell in the March quarter.

▪ Bharat Forge: Stock slipped nearly 2% after class 8 truck orders in the North American regions plunged to a nine-month low in April.

Global News

▪ Gold prices were poised for a second straight weekly decline, although bullion held steady on Friday as investors digested the latest U.S. non-farm payrolls data.

▪ The dollar fell in today’s session after data showed that U.S. employers added fewer jobs than expected in April, while wage inflation was also slightly cooler than expected.

▪ Oil prices edged higher on Friday, but headed for their steepest weekly loss in three months as uncertainty about demand and high interest rates drove a sell-off limited by the prospect OPEC+ will continue to curb output.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.