POST-MARKET SUMMARY 30th October 2024

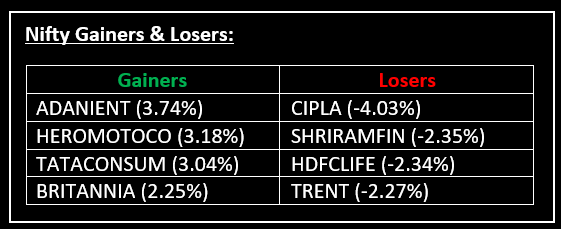

On October 30, the Indian benchmark indices snapped two-day gains and ended lower in a volatile session, with the Nifty closing below 24,350 amid selling pressure in banking, metal, and IT stocks. Top Gainer: ADANIENT | Top Loser: CIPLA

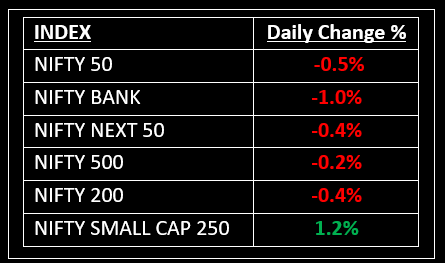

On October 30, the Indian benchmark indices snapped two-day gains and ended lower in a volatile session, with the Nifty closing below 24,350 amid selling pressure in banking, metal, and IT stocks. At close, the Sensex was down 426.85 points or 0.53% at 79,942.18, and the Nifty was down 126 points or 0.51% at 24,340.85.

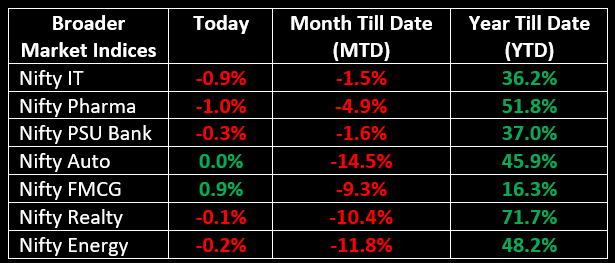

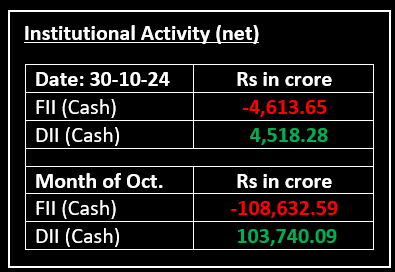

Following mixed global cues, the indices opened on a negative note and traded within a tight range with a negative bias for most of the session. Sectorally, FMCG, capital goods, and media rose by 0.5-2%, while banking, pharma, and IT declined by 1% each.

NIFTY: The index opened 95 points lower at 24,371 and made a high of 24,498 before closing at 24,340. Nifty has formed a small bearish candlestick pattern with a long upper shadow on the daily chart. Its immediate resistance level is now placed at 24,430 while immediate support is at 24,300.

BANK NIFTY: The index opened 332 points lower at 51,988 and closed at 51,807. Bank Nifty has formed a bearish candlestick pattern with an upper shadow on the daily chart. Its major resistance level is now placed at 52,100 while major support is at 51,600.

Stocks in Spotlight

▪ Garden Reach Shipbuilders: Stock rose close to 4% after the company secured an order worth Rs 491 crore to design an Acoustic Research Ship for the Defence Research & Development Organisation.

▪ Adani Enterprises: Stock advanced 4% after the company announced solid Q2 earnings, with an eightfold jump in its net profit to Rs 1,742 crore.

▪ Force Motors: Stock was locked at 20% upper circuit after the company posted a strong set of earnings for the September quarter.

Global News

▪ Gold prices rose to a record high on Wednesday as uncertainty over the U.S. presidential election boosted safe-haven demand, with traders also awaiting economic data for cues on the Federal Reserve’s policy path.

▪ The dollar ticked up on Wednesday after stronger-than-expected private sector jobs data, though it remained off a three-month peak, while bitcoin sat close to a record high as traders raised their bets on a Donald Trump victory in next week’s election.

▪ Oil prices rose more than 2% on Wednesday, after Reuters reported OPEC+ could delay a planned oil production increase scheduled to take effect in December by a month or more, due to concerns about soft oil demand and rising supply.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.