POST-MARKET SUMMARY 29th February 2024

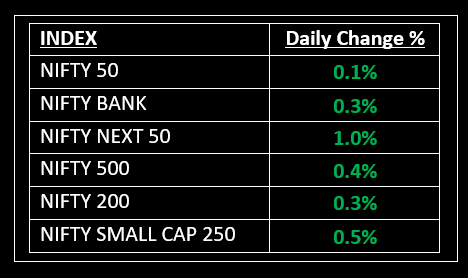

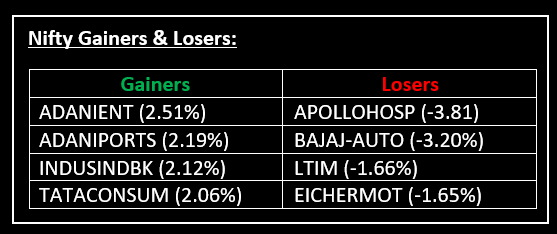

On February 29, amid a highly volatile session on the F&O expiry day, the Indian benchmarks ended with minor gains, with the Nifty finishing around the 22,000 level. Top Gainer: ADANIENT | Top Loser: APOLLOHOSP

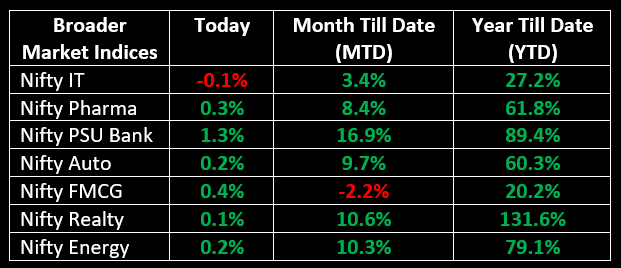

On February 29, amid a highly volatile session on the F&O expiry day, the Indian benchmarks ended with minor gains, with the Nifty finishing around the 22,000 level. Across sectors, except for healthcare, all other indices closed in the green, with bank, capital goods, metal, and power sectors up by 0.5-1%.

NIFTY: The index opened flat at 21,935 and made a high of 22,060 before closing at 21,982. Nifty has formed a bullish candlestick pattern with long upper and lower shadows, which resembles a High Wave kind of pattern on the daily chart. Its immediate resistance level is now placed at 22,050 while immediate support is at 21,900.

BANK NIFTY: The index opened 82 points lower at 45,881 and closed at 46,120. Bank Nifty has formed a bullish candlestick pattern with upper and lower shadows on the daily scale. Its immediate resistance level is now placed at 46,500 while support is at 45,900.

Stocks in Spotlight

▪ Suzlon Energy: Stock surged nearly 5% after the company won a 30-MW wind power project for EDF Renewables in Gujarat.

▪ NBCC: Stock jumped 2.8% after the company executed the e-auction of approximately 61,000 sq.ft. commercial built-up area at Ayurvigyan Nagar in New Delhi.

▪ BEML: Stock fell 3.7% even after the company won an order worth Rs 72.71 crore from Eastern Coalfields Limited for BH100 Rear dumper.

Global News

▪ Gold turned positive after inflation data released on Thursday rose in line with expectations in January.

▪ The Stoxx 600 index was up 0.27% at 1:40 p.m. in London, slightly extending earlier gains after the U.S. personal consumption expenditures price index, excluding food and energy costs (the Federal Reserve’s preferred measure of inflation) rose in line with expectations by 0.4% monthly and 2.8% annually in January.

▪ Consequently, the dollar fell for a brief period on Thursday but quickly pared losses in a choppy trading session.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.