POST-MARKET SUMMARY 29th April 2024

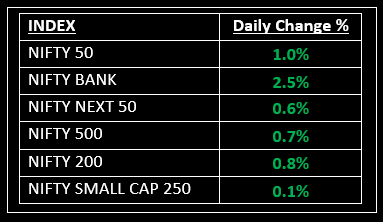

On April 29, the market saw a sharp rebound, nullifying all losses from the previous session, as Nifty concluded above 22,600 amidst widespread buying across sectors, excluding realty. Top Gainer: ICICIBANK | Top Loser: HCLTECH

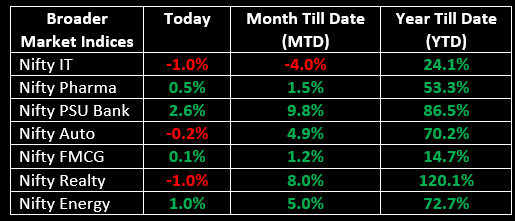

On April 29, the market saw a sharp rebound, nullifying all losses from the previous session, as Nifty concluded above 22,600 amidst widespread buying across sectors, excluding realty. Benefitting from positive global cues, the market initiated the day on a positive trajectory and continued to move higher as the day progressed, primarily driven by financials, resulting in benchmarks closing near their intraday highs. Barring realty, all other sectoral indices closed in positive territory, witnessing gains ranging from 0.4% to 2% in healthcare, metal, power, bank, and oil & gas.

NIFTY: The index opened 56 points higher at 22,475 and made a high of 22,655 before closing at 22,643. Nifty has formed a long bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 22,700 while immediate support is at 22,600.

BANK NIFTY: The index opened 158 points higher at 48,359 and closed at 49,424. Bank Nifty has formed a big bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 49,500 while support is at 49,050.

Stocks in Spotlight

▪ ICICI Bank: Stock jumped 4% after the company posted a strong set of earnings for the March quarter.

▪ BSE: Stock plunged 13% after Sebi asked the exchange to pay the regulatory fee based on the notional value of its options contracts and not based on the premium value.

▪ IREDA: Stock jumped 6% after the company achieved the 'Navratna' status from the Department of Public Enterprises.

Global News

▪ Gold prices rose on Monday helped by a softer U.S. dollar, while investors waited for the Federal Reserve policy meeting and U.S. non-farm payrolls data due this week for policy clues.

▪ European markets were higher on Monday as investors look ahead to more central bank decisions, earnings and data this week.

▪ The U.S. dollar was a shade softer in early deals on Monday, thinned by a holiday in Japan, though the yen, euro and sterling stayed near the bottom of the ranges hit during Friday’s volatile session.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.