POST-MARKET SUMMARY 29 November 2023

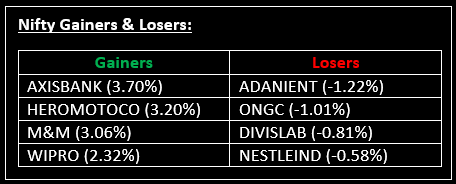

On November 29, Indian equity benchmarks continued their upward momentum for the second consecutive day, as the Nifty crossed the 20,000 mark after a span of over two months. Top Gainer: Axis Bank | Top Loser: Adani Enterprise

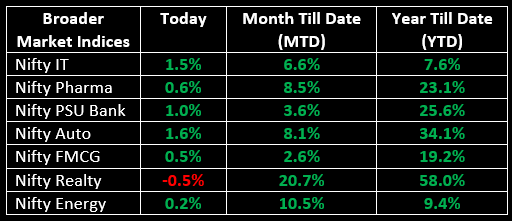

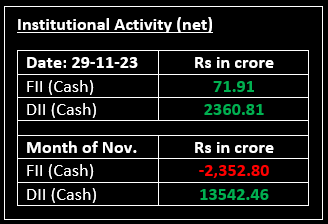

On November 29, Indian equity benchmarks continued their upward momentum for the second consecutive day, as the Nifty crossed the 20,000 mark after a span of over two months. This surge was fuelled by positive global cues and substantial buying in heavyweight stocks. Barring realty, all other sectoral indices closed in the positive territory, with auto, bank, information technology, and oil & gas each gaining 1%.

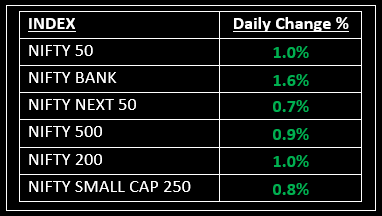

NIFTY: The index opened 87 points higher at 19,976 and made a high of 20,104 before closing at 20,096. Nifty has formed a long-bodied bullish candlestick pattern. Its immediate resistance level is now placed at 20,135 while immediate support is at 20,000.

BANK NIFTY: The index opened 201 points higher at 44,081 and closed at 44,566. Bank Nifty has formed a strong bullish candlestick pattern on the daily scale. Its immediate resistance level is now placed at 44,700 while support is at 44,400.

Stocks in Spotlight

▪ Tata Motors: Stock rose 2% as the market expects strong listing for Tata Technologies, which will be listed on November 30.

▪ BHEL: Stock surged over 5% rallying for the fifth consecutive session after the Defence Ministry sealed a deal with the company to procure 16 upgraded super rapid gun mount (SRGM) and accessories for the Indian Navy.

▪ R R Kabel: Stock slipped 1.22% on reports of income-tax searches at its offices across the country emerged.

Global News

▪ Gold prices touched a nearly seven-month high on Wednesday propelled by an extended decline in the US dollar and bond yields as investors grew confident that the Federal Reserve would likely cut rates by the first half of next year.

▪ Asia-Pacific markets were trading lower on Wednesday, led by Hong Kong markets, while China’s benchmark index closed at its lowest level in over a month.

▪ European stocks moved higher after a negative start to the week, with Autos up 2%.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.