POST-MARKET SUMMARY 28th February 2024

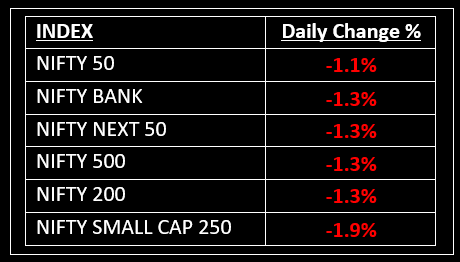

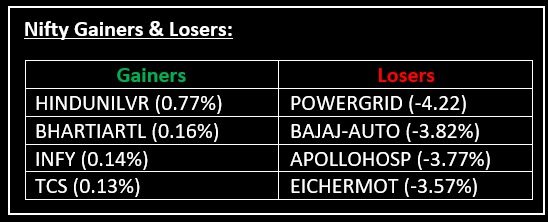

On February 28, the Indian equity benchmarks concluded with a decline of over 1%, marked by widespread selling across sectors. Top Gainer: HINDUNILVR | Top Loser: POWERGRID

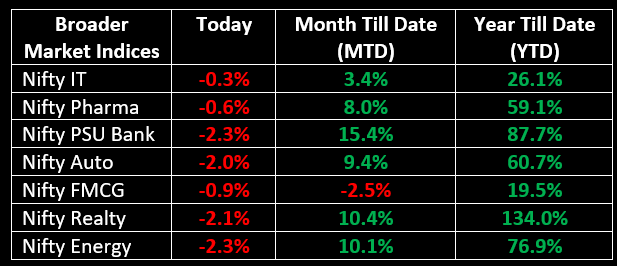

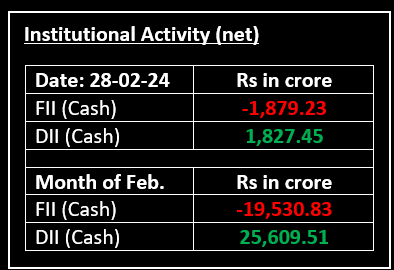

On February 28, the Indian equity benchmarks concluded with a decline of over 1%, marked by widespread selling across sectors. Small and midcaps bore the brunt of the downturn, particularly ahead of the monthly expiry and the impending release of GDP data. Every sectoral index closed in negative territory, witnessing a 2% drop in auto, oil & gas, power, and realty sectors.

NIFTY: The index opened flat at 22,214 and made a high of 22,229 before closing at 21,951. Nifty has formed a long bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 22,000 while immediate support is at 21,875.

BANK NIFTY: The index opened 52 points higher at 46,640 and closed at 45,963. Bank Nifty has formed a long bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 46,200 while support is at 45,700.

Stocks in Spotlight

▪ Torrent Power: Stock fell 2.3% even after the company announced that it bagged a project in Solapur, Maharashtra, marking its foray into the transmission segment.

▪ Gensol Engineering: Stock soared 7% intraday after the company's subsidiary Gensol Electric Vehicles received certification and approval for an electric vehicle from the Automotive Research Association of India (ARAI).

▪ Zee: Stock fell 6.4% a day after the media company said it had set up a panel to examine the allegations levelled against the company, its promoters and key managerial personnel by regulatory bodies.

Global News

▪ European stocks dipped 0.2% to hover just shy of recent highs, as lacklustre corporate earnings also weighed on sentiment. German stocks bucked the trend to add 0.2%.

▪ Asia-Pacific stock markets mostly fell Wednesday as New Zealand’s central bank kept its interest rate steady, while Hong Kong scrapped rules to tighten its property market at its budget announcement.

▪ Bitcoin hit $60,000 on Wednesday for the first time in more than two years, as a flurry of capital into new U.S. spot bitcoin exchange traded products fuelled a 42% price rally in February, which would mark its largest monthly gain since December 2020.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.