POST-MARKET SUMMARY 28 November 2023

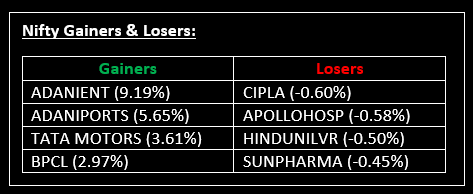

On November 28, the Indian benchmark indices wrapped up another volatile session with a strong finish. The Nifty crossed 19,900, driven by buying activities in the oil & gas, power, auto, and metal sectors. Top Gainer: Adani Enterprise | Top Loser: Cipla

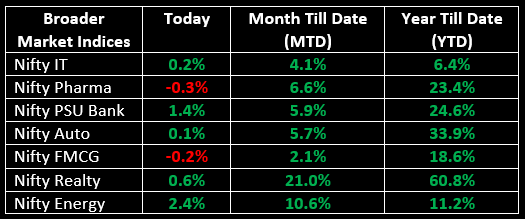

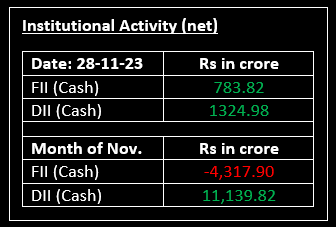

On November 28, the Indian benchmark indices wrapped up another volatile session with a strong finish, breaking the two-day streak of mildly negative closes. The Nifty crossed 19,900, driven by buying activities in the oil & gas, power, auto, and metal sectors. Despite a mildly positive start influenced by mixed global cues, early gains were nullified, leading to a rangebound movement. Nevertheless, on the sectoral front, the power and oil & gas indices recorded a 3% increase each, while the metal, auto, and PSU Bank indices saw a rise of 1% each. Conversely, some selling pressure was observed in the capital goods, FMCG, and pharmaceutical sectors, as the market dynamics continued to shift.

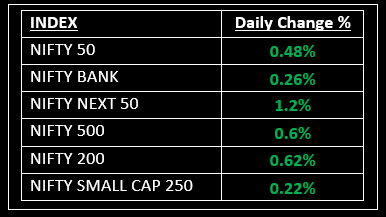

NIFTY: The index opened 50 points higher at 19,844 and made a high of 19,916 before closing at 19,889. Nifty has formed a bullish candlestick pattern with upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 19,950 while immediate support is at 19,800.

BANK NIFTY: The index opened 82 points higher at 43,851 and closed at 43,880. Bank Nifty has formed a small-bodied bullish candlestick pattern with long upper and lower shadows on the daily chart and continued higher highs and higher lows for three days in a row. Its immediate resistance level is now placed at 44,050 while support is at 43,700.

Stocks in Spotlight

▪ MCX: Stock gained 7% to hit a new 52-week high as it was removed from the NSE F&O ban list.

▪ ATGL: Stock surged 20% to hit the upper circuit after the Supreme Court reserved its judgement on the Adani-Hindenburg case.

▪ IRB Infrastructure: Stock slipped 2% after the firm’s special purpose vehicle, IRB Lalitpur Toll way, signed a concession agreement with the National Highways Authority of India and will pay an upfront amount of Rs 4,428 crore.

Global News

▪ Gold held its ground on Tuesday after touching a six-month peak, buoyed by expectations that the US Federal Reserve has concluded its interest rate hikes, ahead of the release of key economic data.

▪ Asia-Pacific markets were mixed on Tuesday, a day after the region saw all its major indexes end the day in negative territory. Oil prices eased somewhat lower after Qatar said the truce between Israel and Hamas has been extended by a further two days.

▪ The US dollar hit a three-month low against a basket of peers on Tuesday before steadying, as traders continued to unwind long dollar positions before this week’s US and Euro zone inflation data.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.