POST-MARKET SUMMARY 26th March 2024

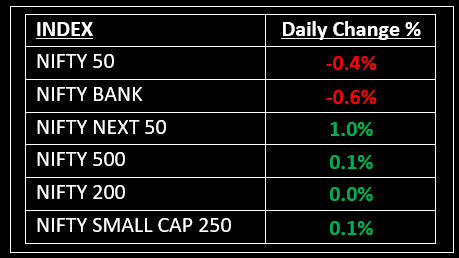

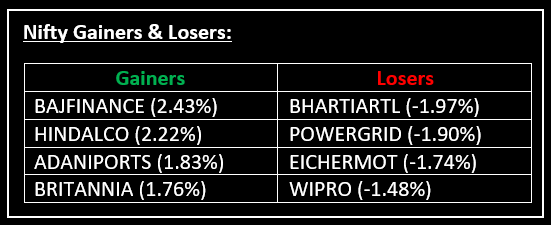

On March 26, the markets snapped their three-day winning streak, closing lower in a volatile session with the Nifty hovering around the 22,000 mark, driven by selling pressure in the Information Technology, Banking, and Media sectors. Top Gainer: BAJFINANCE | Top Loser: BHARTIARTL

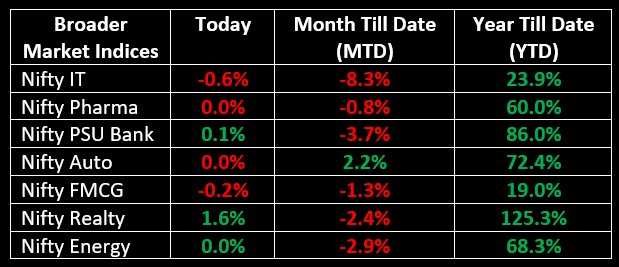

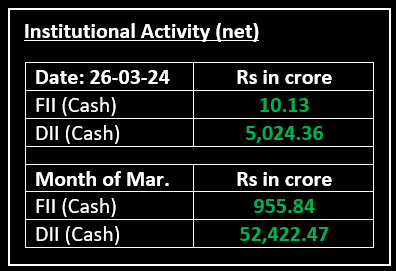

On March 26, the markets snapped their three-day winning streak, closing lower in a volatile session with the Nifty hovering around the 22,000 mark, driven by selling pressure in the Information Technology, Banking, and Media sectors. Despite an initial dip, the market experienced an intraday rebound fueled by buying interest in Oil & Gas, Metal, Capital Goods, and Realty stocks. However, it ultimately concluded near the day's low due to significant selling pressure in prominent Media, IT, and Banking entities. On the sectoral front, the Bank and Information Technology indices were down 0.5%, while the Capital Goods, Realty, Oil & Gas, and Metal indices registered gains of 0.5% to 1%.

NIFTY: The index opened 149 points lower at 21,947 and made a high of 22,073 before closing at 22,004. Nifty has formed a bullish candlestick pattern with an upper shadow, which resembles an inside body candle on the daily chart. Its immediate resistance level is now placed at 22,080 while immediate support is at 21,950.

BANK NIFTY: The index opened 311 points lower at 46,552 and closed at 46,600. Bank Nifty has formed a small bullish candlestick pattern with a long upper shadow on the daily chart. Its immediate resistance level is now placed at 46,800 while support is at 46,400.

Stocks in Spotlight

▪ IIFL: Stock slumped 4% after the Reserve Bank of India announced a special audit for the company.

▪ Rategain: Stock ended 1% higher after the company announced a strategic partnership with Madrid-based Summerwind GSA for airline representation.

▪ RVNL: Stock soared 4% after the state-run railway company signed an MoU with Airports Authority of India (AAI).

Global News

▪ European markets were mixed on Tuesday as investors continue to ponder last week’s central bank policy decisions in Europe and the U.S.

▪ Gold prices rose on Tuesday supported by a weaker dollar as investor focus turns to U.S. inflation data due later this week, which could shed more light on the timing of the Federal Reserve’s first interest rate cut this year.

▪ The dollar dipped on Tuesday as traders waited on a fresh catalyst to give clues on the Federal Reserve policy, while the yen was steady after Japan’s finance minister said that he would not rule out any measures to cope with the weakening currency.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.