POST-MARKET SUMMARY 25th July 2024

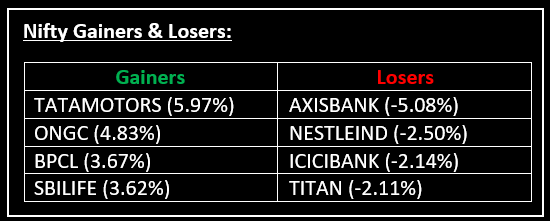

On July 25, profit-booking continued for the fifth straight session, with Nifty managing to close around 24,400 amid F&O expiry day volatility. Top Gainer: TATAMOTORS | Top Loser: AXISBANK

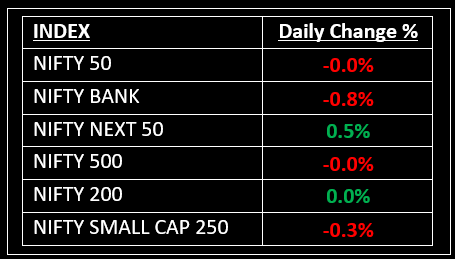

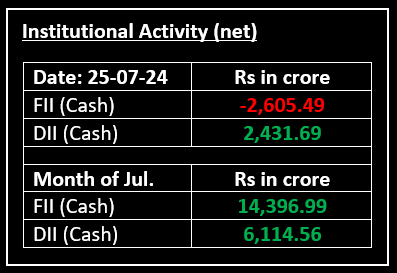

On July 25, profit-booking continued for the fifth straight session, with Nifty managing to close around 24,400 amid F&O expiry day volatility. At close, the Sensex was down 109.08 points or 0.14% at 80,039.80, and the Nifty was down 7.40 points or 0.03% at 24,406.10. The Nifty index recovered 195 points from the day's low, while the Sensex saw a recovery of 560 points from the day's low.

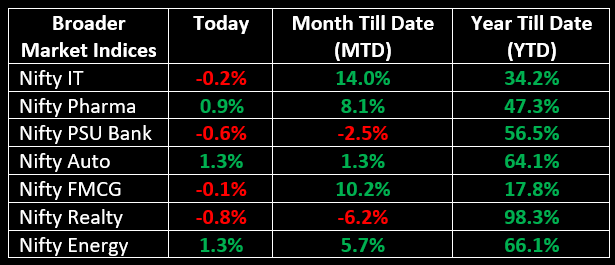

On the sectoral front, auto, capital goods, power, oil & gas, healthcare, and media rose 0.5-3%, while bank, IT, metal, realty, and telecom shed 0.5-1%.

NIFTY: The index opened 183 points lower at 24,230 and made a high of 24,426 before closing at 24,406. Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,455 while immediate support is at 24,350.

BANK NIFTY: The index opened 555 points lower at 50,762 and closed at 50,888. Bank Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 51,000 while immediate support is at 50,600.

Stocks in Spotlight

▪ RBL Bank: Stock fell 3% after a 7.95% stake was sold through a block deal on the stock exchanges.

▪ Axis Bank: Stock plunged 5% after the lender reported its June quarter earnings, which highlighted its worsening asset quality. Dive into the details here

▪ RVNL: Stock fell 3% amid profit-booking despite the company receiving a Letter of Acceptance (LoA) for a project worth Rs 191.53 crore from South Eastern Railway.

Global News

▪ Gold slid over 1% on Thursday, falling to its lowest level in two weeks, as investors squared positions to focus on U.S. economic data that could offer additional insights into the timing of the Federal Reserve’s potential interest rate cuts.

▪ The U.S. dollar trimmed losses on Thursday after data showed the world’s largest economy expanded faster than expected and inflation slowed in the second quarter.

▪ China’s central bank cut the medium-term facility lending rate to 2.3% from 2.5%, in its latest move to stimulate the economy after lowering its loan prime rates on Monday.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.