POST-MARKET SUMMARY 25 July 2023

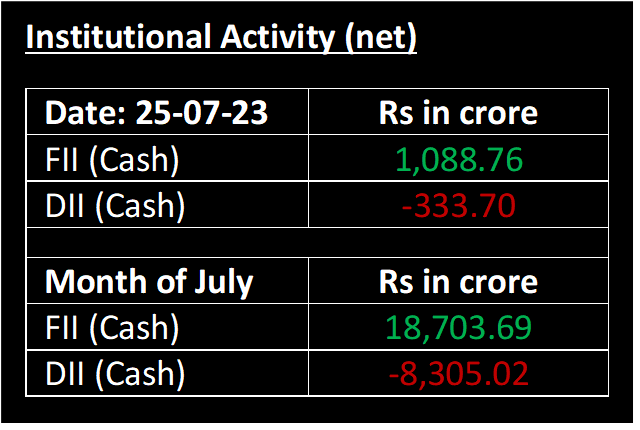

On July 25, after experiencing a two-day fall, the Nifty was seen consolidating with minimal changes. Investors were cautious ahead of the US Federal Open Market Committee (FOMC) meeting outcome scheduled for Wednesday. The focus of the market is now on the Fed's decision regarding interest rates, which is expected to be announced by midnight on July 26. According to data from the CME FedWatch Tool, market expectations strongly suggest a 98% probability of a quarter-point rate increase.

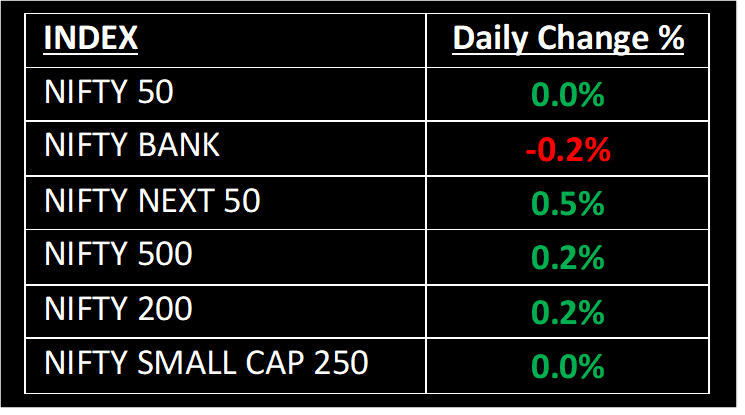

NIFTY: The index opened 57 points higher at 19,729 and made a high of 19,729 before closing at 19,680. Nifty has formed a near hammer-like pattern after a two-day fall, suggesting the possibility of a short-term upward reversal. Its immediate resistance level is now placed at 19,800 while immediate support is at 19,600.

BANK NIFTY: The index opened 231 points higher at 46,154 and closed at 45,845. Bank Nifty witnessed selling pressure after opening on a positive note, which indicates it was unable to sustain at the higher levels. Its immediate resistance level is now placed at 46,200 while support is at 45,500.

Stocks in Spotlight

▪ TVS Motor Company Ltd: Stock jumped nearly 6% after the company reported a 46% rise in net profit to Rs 468 crore for the June quarter.

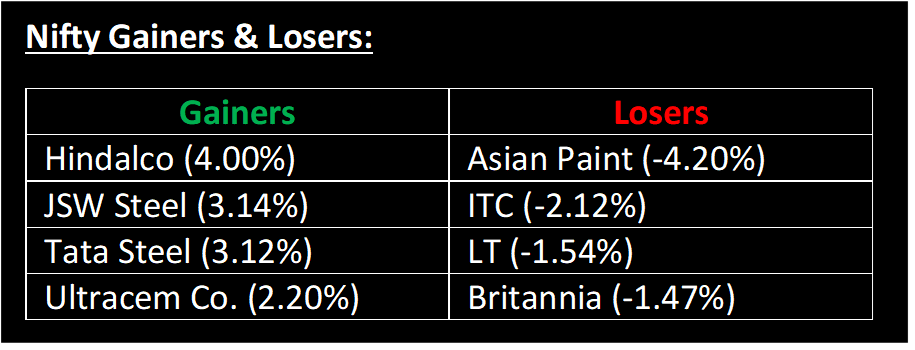

▪ Tata Steel Ltd: Stock gained over 3% after the company posted better-than-expected earnings for the June quarter.

▪ Chennai Petroleum Corporation Ltd: Stock tanked 9.5% after the company put up a poor earnings show. Consolidated revenue fell 34% to Rs 17,985.67 crore in the June quarter.

Global News

▪ Pan-European Stoxx 600 index was up 0.3% by mid-afternoon, with mining stocks jumping 3.9% on the back of new Chinese stimulus measures, while travel and leisure stocks fell 0.9%.

▪ Oil prices edged higher, extending gains from the previous session, as signs of tighter supplies and pledges by Chinese authorities to shore up the country's economy lifted sentiment.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.