POST-MARKET SUMMARY 25 August 2023

Post-market report and news around trending stocks.

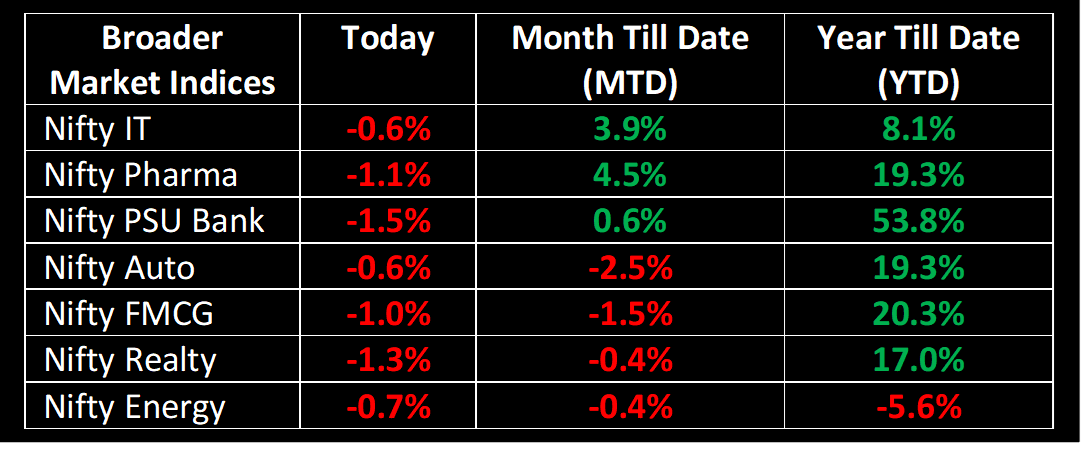

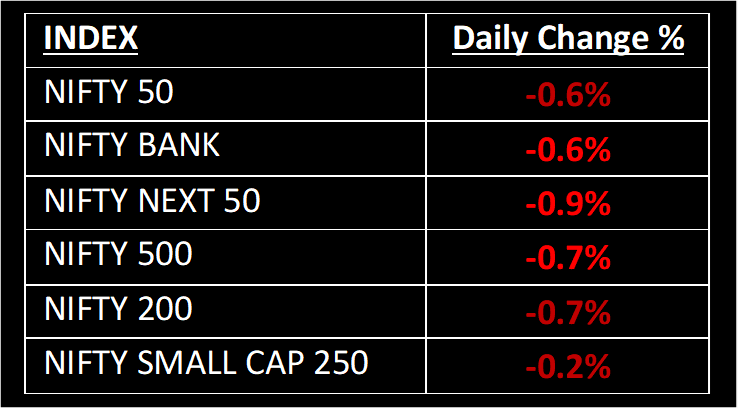

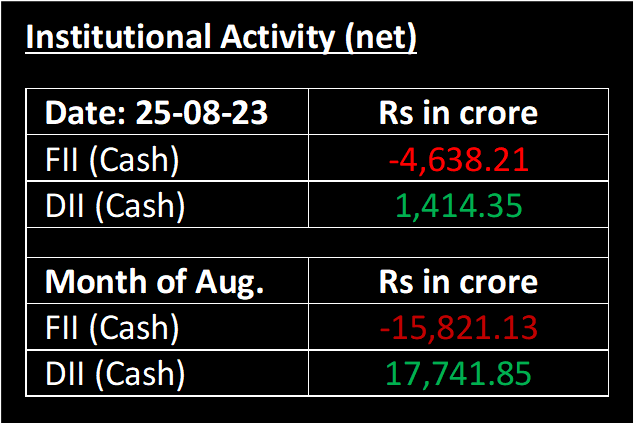

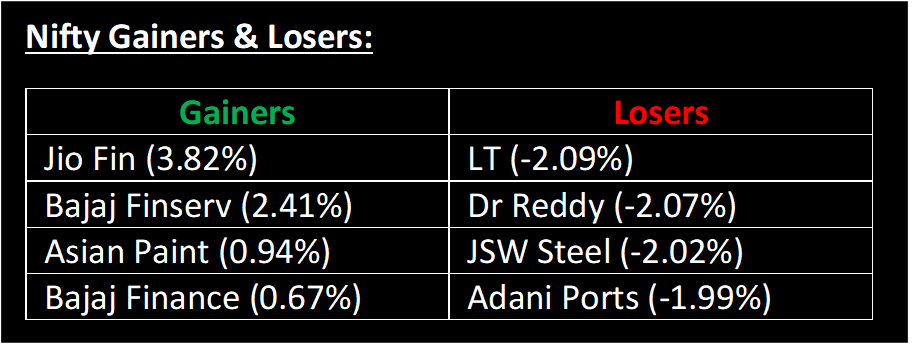

On August 25, the Nifty moved lower, marking an eight-week low as it closed at 19,266. The bearish sentiment was influenced by subdued global indicators, as investors held back in anticipation of the US Federal Reserve chief’s address during the annual Jackson Hole meeting scheduled for later in the day. Correspondingly, all sectors moved in tandem with the benchmark index, with realty, metal, and pharma segments emerging as the biggest decliners.

NIFTY: The index opened 89 points lower at 19,297 and made a high of 19,339 before closing at 19,265. Nifty has formed a bearish candlestick with minor upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 19,400 while immediate support is at 19,000.

BANK NIFTY: The index opened 220 points lower at 44,276 and closed at 44,231. Bank Nifty has formed a Doji pattern on the daily scale, as the closing was near opening levels, indicating indecisiveness among the bulls and the bears. Its immediate resistance level is now placed at 44,550 while support is at 44,000.

Stocks in Spotlight

▪ Coforge Ltd: Stock closed 2.5% lower after a host of funds picked up a 10.3% stake, worth Rs 2,976 crore in the mid-sized IT company.

▪ Engineers India Ltd: Stock fell over 2%, a day after the company’s board of directors approved the acquisition of a 4.37% equity stake in Numaligarh Refinery.

▪ Shoppers Stop Ltd: Stock tanked 12.7% after the retail major announced that Venugopal Nair had quit as the managing director.

Global News

▪ Pan-European Stoxx 600 inched 0.4% higher by early afternoon after a tepid open, with retail stocks adding 1.1% to lead gains as most sectors nudged into positive territory.

▪ Oil prices jumped more than 1% on Friday as the dollar firmed ahead of an eagerly awaited speech by the head of the US Federal Reserve for hints on the outlook for interest rates.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.