POST-MARKET SUMMARY 23rd May 2024

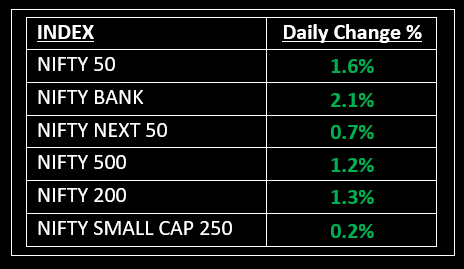

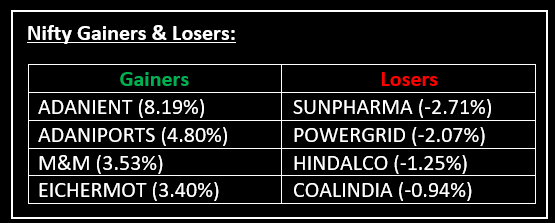

On May 23, bulls were back in action on Dalal Street as benchmark indices, Nifty and the Sensex, hit fresh record highs of 22,993.60 and 75,499.91 intraday, respectively. Top Gainer: ADANIENT | Top Loser: SUNPHARMA

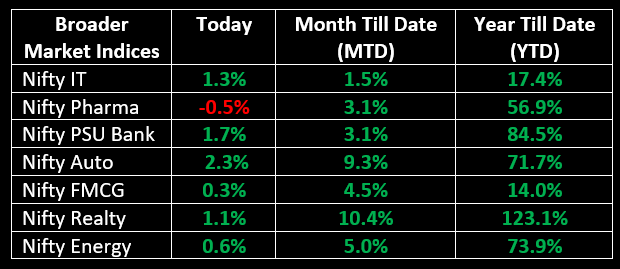

On May 23, bulls were back in action on Dalal Street as benchmark indices, Nifty and the Sensex, hit fresh record highs of 22,993.60 and 75,499.91 intraday, respectively. The Nifty closed just shy of the coveted 23,000 mark, with buying seen across most sectors, despite hawkish Fed minutes. All sectoral indices, except metal and pharma, ended in the green, with auto, bank, and capital goods sectors each up 2%.

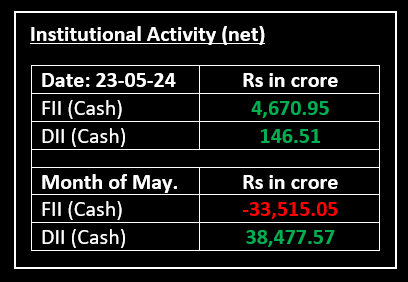

The Reserve Bank of India’s (RBI’s) announcement of a substantial dividend payout of Rs 2.1 lakh crore for FY24 also boosted sentiment. Read more at: RBI Approves Highest-Ever Dividend Payout To Govt

NIFTY: The index opened flat at 22,614 and made a high of 22,993 before closing at 22,967. Nifty has formed a long bullish candle on daily chart. Its immediate resistance level is now placed at 23,000 while immediate support is at 22,850.

BANK NIFTY: The index opened 118 points higher at 47,899 and closed at 48,768. Bank Nifty has formed a bullish candlestick pattern with a long bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 48,900 while support is at 48,600.

Stocks in Spotlight

▪ Jio Financial Services: Stock gained 3% after the company stated that it is seeking shareholder approval to attract foreign investments, including foreign portfolio investments, up to 49% through equity.

▪ Taj GVK Hotels: Stock soared 6% after the company reported a 81% on-year spike in net profit to Rs 26 crore for Q4 FY24.

▪ Garden Reach Shipbuilders: Stock surged 19% as investors cheered the company's robust March quarter results.

Global News

▪ Gold prices declined to a one-week low on Thursday, extending their fall for a third consecutive session on profit-booking after minutes from the U.S. Federal Reserve’s latest meeting indicated that interest rates would stay higher for longer.

▪ European markets were slightly higher on Thursday as traders digested the minutes of the last U.S. Federal Reserve meeting.

▪ The pound held broadly steady on Thursday near multi-month highs a day after British Prime Minister Rishi Sunak called a national election and data showed inflation did not slow as much as expected in April.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.