POST-MARKET SUMMARY 23 January 2024

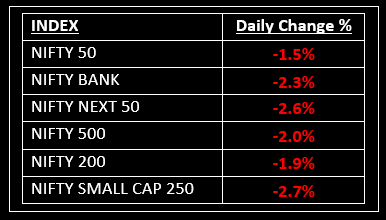

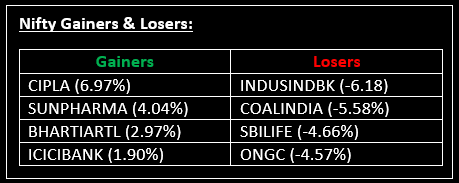

On January 23, the Indian equity market extended the losses from the previous session, witnessing a 1.5% decline in both Sensex and Nifty50. This decline was attributed to selling across various sectors, except for Pharma. Top Gainer: CIPLA | Top Loser: INDUSINDBK

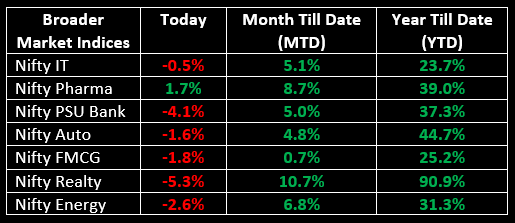

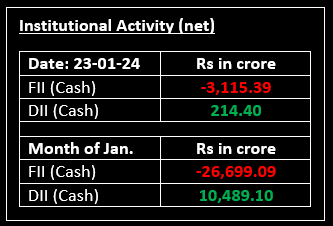

On January 23, the Indian equity market extended the losses from the previous session, witnessing a 1.5% decline in both Sensex and Nifty50. This decline was attributed to selling across various sectors, except for Pharma. Despite a robust start influenced by positive global markets, the benchmark indices faced selling pressure in most sectors. The market's losses were exacerbated as Zee Entertainment shares fell following the termination of the merger plan with the Sony Group, resulting in the market closing near the day's low. On the sectoral front, all indices, except pharma, concluded the day in the red.

NIFTY: The index opened 145 points higher at 21,716 and made a high of 21,750 before closing at 21,238. Nifty has formed a long bearish candlestick on the daily chart, which indicates a sharp downward reversal. Its immediate resistance level is now placed at 21,315 while immediate support is at 21,190.

BANK NIFTY: The index opened 437 points higher at 46,495 and closed at 45,015. Bank Nifty has formed a bearish candlestick on the daily chart. Its immediate resistance level is now placed at 45,360 while support is at 44,750.

Stocks in Spotlight

▪ Zee Entertainment: Stock fell over 32% as it hit a series of lower circuits after Japan’s Sony Pictures’ Indian arm scrapped its $10-billion merger with the Indian media giant. Several brokerages also downgraded the stock.

▪ Finolex Industries: Stock fell 3.9% after the company’s Q3 results disappointed the markets. Its net profit grew 24% YoY to Rs 89.21 crore (below estimates) and sales revenue fell 9.3% to Rs 1,019.69 crore in the quarter.

▪ Cipla: Stock jumped nearly 7% after the company reported strong performance in Q3. Net profit grew 32.7% to Rs 1049 crore. Revenue also went up by 14.2% to Rs 6,544 crore.

Global News

▪ European markets turned lower Tuesday, losing an air of positivity seen in the previous trading session.

▪ Hong Kong stocks rebounded to lead gains in Asia markets, while Japan’s Nikkei 225 index was marginally lower after the Bank of Japan kept its monetary policy unchanged in its first policy meeting of the year.

▪ The benchmark 10-year Treasury note was around 1.7 basis points higher at 4.11% Tuesday morning, ahead of Q4 GDP data in the US due for release on Thursday.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.