POST-MARKET SUMMARY 22nd March 2024

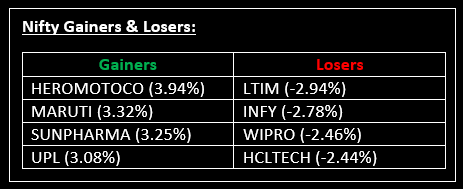

On March 22, the equity benchmarks concluded the day with gains, marking a third consecutive session of positive momentum driven by buying across sectors, except for information technology. Top Gainer: HEROMOTOCO | Top Loser: LTIM

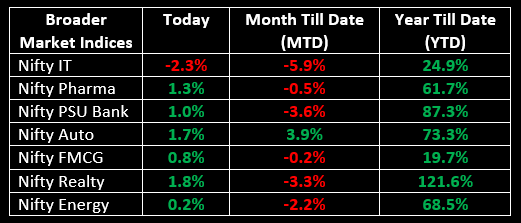

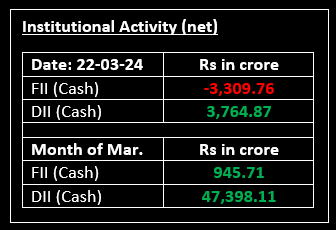

On March 22, the equity benchmarks concluded the day with gains, marking a third consecutive session of positive momentum driven by buying across sectors, except for information technology. The market commenced on a lower note, influenced by weakness in information technology stocks following a downward revision in full-year revenue growth projection by tech giant Accenture. However, purchasing activity in other sectoral indices managed to offset these initial losses. Sectors such as metal, auto, realty, FMCG, capital goods, healthcare, and power witnessed gains ranging from 0.5% to 1%, while the information technology index experienced a decline of 2%.

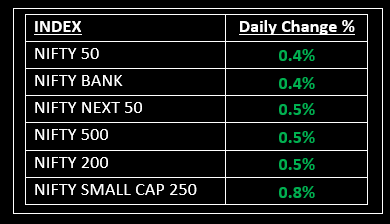

NIFTY: The index opened 79 points lower at 21,932 and made a high of 22,180 before closing at 22,096. Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 22,150 while immediate support is at 22,000.

BANK NIFTY: The index opened 50 points lower at 46,634 and closed at 46,863. Bank Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 47,000 while support is at 46,650.

Stocks in Spotlight

▪ Prestige Estates: Stock surged 4.9% after the company acquired 62.5 acres of land in Indirapuram Extension, NCR.

▪ Bharat Dynamics: Stock gained 1.4% after the company's board approved a split of its shares and also declared an interim dividend for FY23-24.

▪ TCS: Stock saw selling pressure after tech giant Accenture cut revenue guidance as uncertain economy makes clients slash spending on consulting services.

Global News

▪ Gold prices slipped on Friday due to a stronger dollar, although they were set for a fourth weekly gain in five as the U.S Federal Reserve’s decision to retain its interest rate-cut projections for 2024 bolstered bullion’s appeal.

▪ The U.S. dollar was set for a second week of broad gains on Friday, with even a rate hike in Japan unable to halt its march, and a surprise cut in Switzerland highlighting the gap between the Federal Reserve and global peers in interest rate settings.

▪ Oil prices were little changed on Friday, with global benchmark Brent hovering above $85 per barrel, as the possibility of a ceasefire in Gaza gained traction.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.