POST-MARKET SUMMARY 21st May 2024

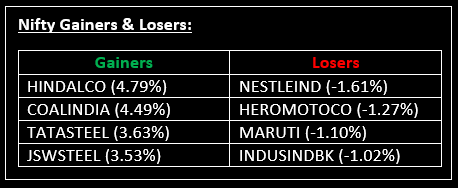

On May 21, the Indian markets ended almost flat in a volatile session, with Nifty managing to hold above 22,500. Top Gainer: HINDALCO | Top Loser: NESTLEIND

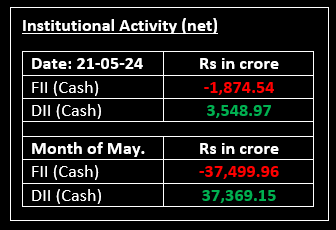

On May 21, the Indian markets ended almost flat in a volatile session, with Nifty managing to hold above 22,500. The Indian indices opened marginally lower amid mixed global cues, with Nifty slipping below 22,500 to extend the losses in the first half. However, it recovered the losses in the second half amid buying seen in the metal, power, oil & gas, and PSU Banks.

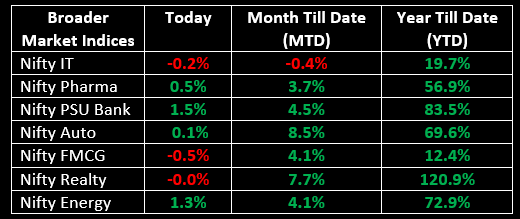

Among sectors, the metal index was up 4%, the power index gained 2%, the PSU Bank index rose 1.5%, while FMCG was down 0.5%.

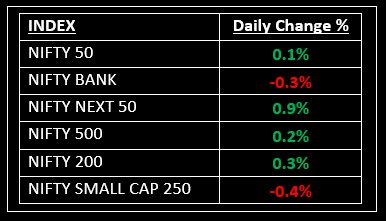

NIFTY: The index opened 98 points lower at 22,404 and made a high of 22,591 before closing at 22,529. Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 22,600 while immediate support is at 22,440.

BANK NIFTY: The index opened 272 points lower at 47,927 and closed at 48,048. Bank Nifty has formed a bullish candlestick pattern with a long upper shadow on the daily chart. Its immediate resistance level is now placed at 48,250 while support is at 47,900.

Stocks in Spotlight

▪ Delhivery: Stock slumped over 10% after the company slipped back into losses in the March quarter.

▪ Aptus Value Housing Finance: Stock tanked 5% after a large deal worth Rs 1,075 crore took place on the stock exchanges.

▪ Rail Vikas Nigam: Stock surged 15% after the company bagged an order worth Rs 148 crore from the South Eastern Railway.

Global News

▪ The Stoxx 600 index was down 0.44% at 1 p.m. London time. Most sectors were in the red as banks fell 1%, while mining stocks rose 0.3%.

▪ The dollar struggled for direction on Tuesday as investors stuck to their views of the expected timing of Federal Reserve monetary easing this year.

▪ Hong Kong’s Hang Seng index led losses in Asia-Pacific markets on Tuesday, falling about 2% as basic material and industrials stocks fell.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.