POST-MARKET SUMMARY 20th March 2024

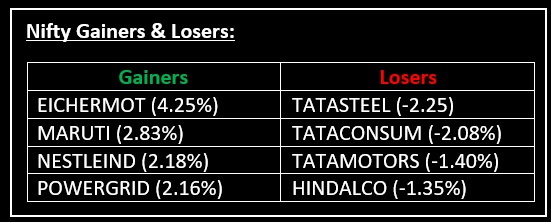

On March 20, the market concluded with moderate gains following a volatile session, with investors maintaining caution in anticipation of the Federal Open Market Committee (FOMC) meeting outcome. Top Gainer: EICHERMOT | Top Loser: TATASTEEL

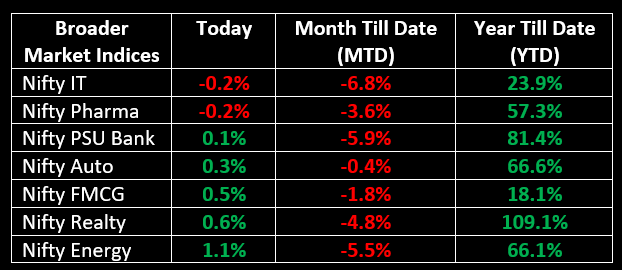

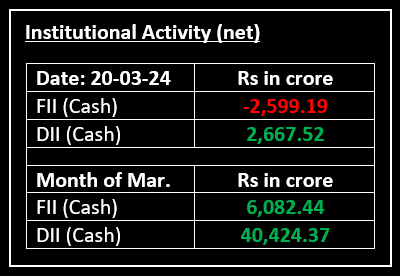

On March 20, the market concluded with moderate gains following a volatile session, with investors maintaining caution in anticipation of the Federal Open Market Committee (FOMC) meeting outcome. Throughout the day, the market fluctuated between gains and losses, but a surge in auto and energy stocks aided the benchmark indices in closing higher. Notably, sectors such as auto, FMCG, realty, oil & gas, and power saw gains ranging from 0.5% to 1%, while the metal index experienced a decline of nearly 1%.

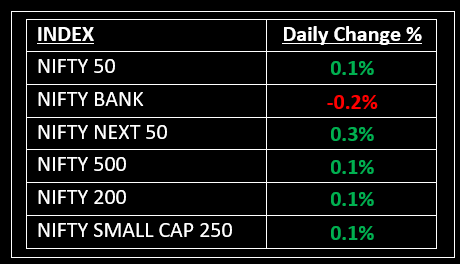

NIFTY: The index opened 26 points higher at 21,843 and made a high of 21,930 before closing at 21,839. Nifty has formed a Doji candlestick pattern on the daily chart. Its immediate resistance level is now placed at 21,930 while immediate support is at 21,760.

BANK NIFTY: The index opened flat at 46,392 and closed at 46,310. Bank Nifty has formed a High Wave kind of candlestick pattern on the daily timeframe ahead of the US FOMC meet outcome. Its immediate resistance level is now placed at 46,750 while support is at 46,200.

Stocks in Spotlight

▪ Aurobindo Pharma: Stock gained 2.7% after the company received US Food & Drug Administration (USFDA) approval for a nasal spray.

▪ IREDA: Stock fell 2.6% after NSE revoked its inclusion in several key indices due to the firm’s non-compliance with SEBI portfolio concentration norms.

▪ Shakti Pumps: Stock fell nearly 4% after the water pump company launched a qualified institutional placement (QIP) to raise up to Rs 200 crore.

Global News

▪ Asian shares were hesitant on Wednesday on concerns the Federal Reserve could signal a slower path of rate cuts this year, while the yen plunged to a fresh four-month low on expectations that policy in Japan will remain accommodative for a while longer.

▪ U.S. Treasury yields were little changed on Wednesday as investors awaited the Federal Reserve’s latest interest rate decision and guidance about monetary policy and the economy.

▪ Gold prices, too, were little changed while the dollar rose for a fifth straight session on Wednesday, as traders awaited the U.S. Federal Reserve’s monetary policy decision and Fed Chair Jerome Powell’s remarks for more clues on prospects of rate cuts.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.