POST-MARKET SUMMARY 20th February 2024

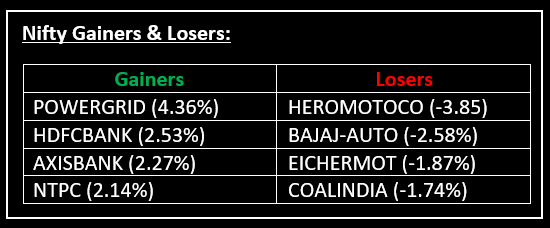

On February 20, benchmark indices extended their winning streak to the sixth consecutive day, with the Nifty hitting new all-time highs. Top Gainer: POWERGRID | Top Loser: HEROMOTOCO

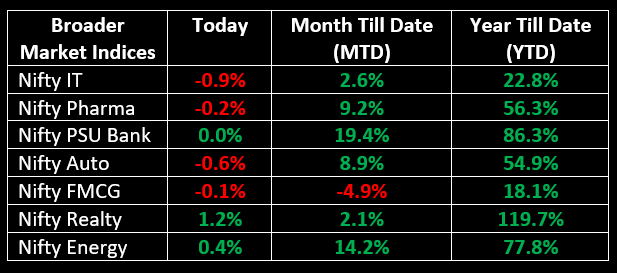

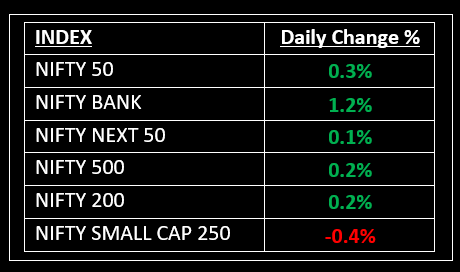

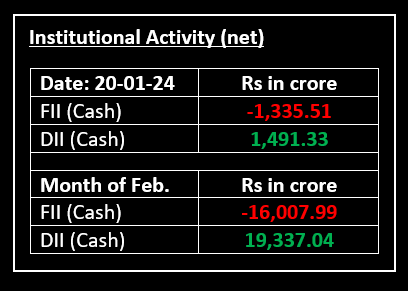

On February 20, benchmark indices extended their winning streak to the sixth consecutive day, with the Nifty hitting new all-time highs. The banking and financial services sectors witnessed significant buying activity, driving up both the Sensex and Nifty indices. The sectoral breakdown on the NSE showed a mixed performance. Nifty Media emerged as the top performer, rising by 2.27%. Following closely were Nifty Realty, Nifty Bank, and Nifty Financial Services, each gaining over 1%. However, Nifty IT and Nifty Auto experienced declines of approximately 1% each.

NIFTY: The index opened 23 points lower at 22,099 and made a high of 22,215 before closing at 22,196. Nifty has formed a bullish candlestick with a lower shadow on the daily chart. Its immediate resistance level is now placed at 22,250 while immediate support is at 22,125.

BANK NIFTY: The index opened 91 points lower at 46,444 and closed at 47,094. Bank Nifty has formed a strong bullish candlestick on the daily timeframe. Its immediate resistance level is now placed at 47,250 while support is at 46,900.

Stocks in Spotlight

▪ Ramkrishna Forgings: Stock gained 1.8% after the company secured a contract worth $220 million in the North American market.

▪ Kotak Mahindra Bank: Stock jumped over 2% after the private sector lender announced key changes to its senior management team.

▪ Zaggle Prepaid: Stock surged over 13.5% after the company announced it had entered into an agreement with Easy Trip Planners Limited (EaseMyTrip) for three years.

Global News

▪ The pan-European Stoxx 600 index was 0.1% lower in morning deals, with most sectors trading in negative territory. Mining stocks sunk 2.2% while chemicals were a rare outlier, adding 1.2%.

▪ Asian shares were pinned below 1-1/2 month highs on Tuesday as even a larger-than-expected interest rate cut in China failed to excite investors jaded at the lack of bigger stimulus measures. China's five-year loan prime rate was lowered by 25 basis points to 3.90%

▪ U.S. Treasury yields were mostly lower on Tuesday as uncertainty about the outlook for the economy and interest rates lingered. The 2-year Treasury yield was 5 basis points lower at 4.606% while the 10-year Treasury yield was last off nearly 2 basis points to 4.279%.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.