POST-MARKET SUMMARY 20 June 2023

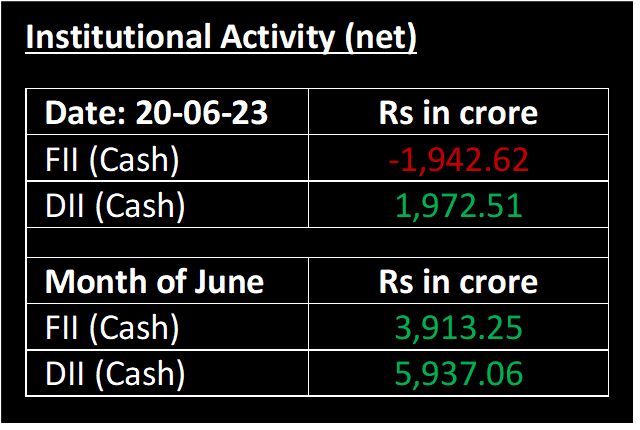

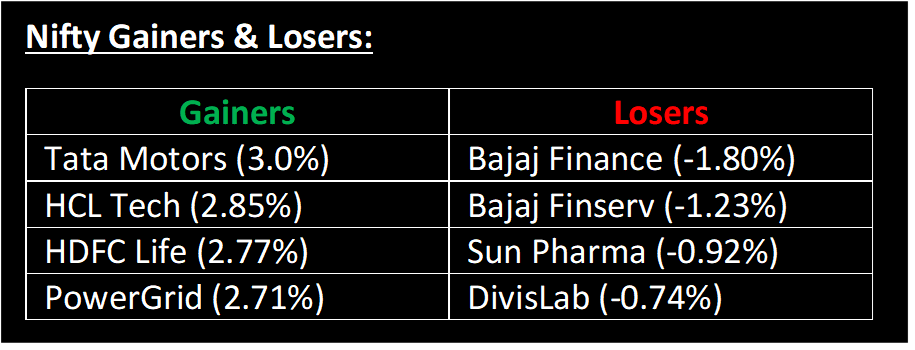

On June 20, the Indian stock market ended in the green amid a volatile trading session. Benchmark indices opened flat but witnessed profit-booking as the day advanced, influenced by weak global cues. However, during the second half of the trading session, buying activity reversed the earlier losses, resulting in a positive close for the day.

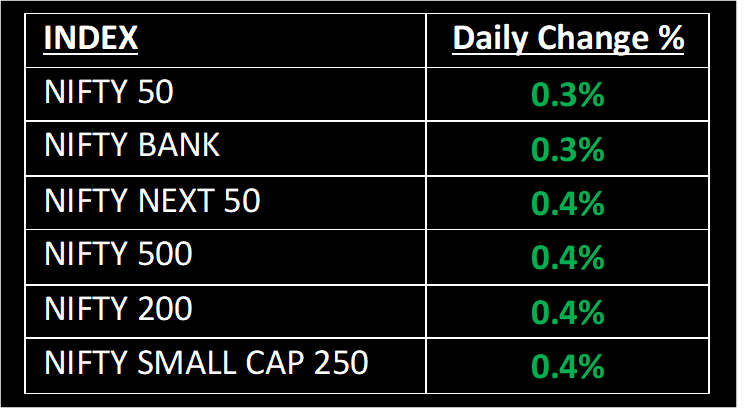

NIFTY: The index opened flat at 18,752 and made a high of 18,839 before closing at 18,816. Nifty has formed a bullish candle on the daily chart with a long lower shadow, which indicates a near-term uptrend. Its immediate resistance level is now placed at 18,900 while support is at 18,690.

BANK NIFTY: The index opened 36 points lower at 43,597 and closed at 43,766. Bank Nifty has formed a bullish candlestick pattern after taking support at the recent low of around 43,400. Its immediate resistance level is now placed at 44,000 while support is at 43,250.

Stocks in Spotlight

▪ Thyrocare Technologies: Stock jumped nearly 7% after 29.11 lakh shares, representing 5.5% equity, changed hands on the BSE at an average price of Rs 488/share.

▪ Dynacons Systems & Solutions: Stock gained 5% after the company received a Rs 79.47-crore order from Union Bank of India.

▪ Zee Entertainment Enterprises: Stock fell over 6%, a day after the Securities Appellate Tribunal (SAT) adjourned the Zee plea against a Sebi order till June 26, delaying the entertainment major's merger with Sony Pictures Networks India.

Global News

▪ People's Bank of China cut key policy rates for the first time in 10 months.

▪ Investors exhibited caution on Tuesday, leading to a decline in European stock markets, amid concerns about the global economic outlook. Recent data from China has heightened apprehensions, further contributing to the cautious sentiment among investors.

▪ All eyes now on UK's upcoming inflation data and monetary policy announcement.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.