POST-MARKET SUMMARY 20 July 2023

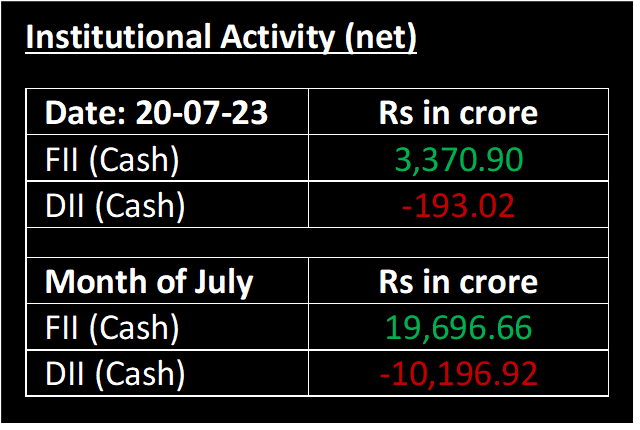

During the week, we've seen an impressive rally in the stock market, driven by relentless buying. Although the day started on a flat note amid mixed signals from the global markets, the Nifty managed to gain momentum and move towards the significant milestone of 20,000 today, which also happens to be the weekly expiry day. The rally was supported by stocks from banking and financial services, FMCG sectors, and heavyweight stock Reliance Industries (RIL).

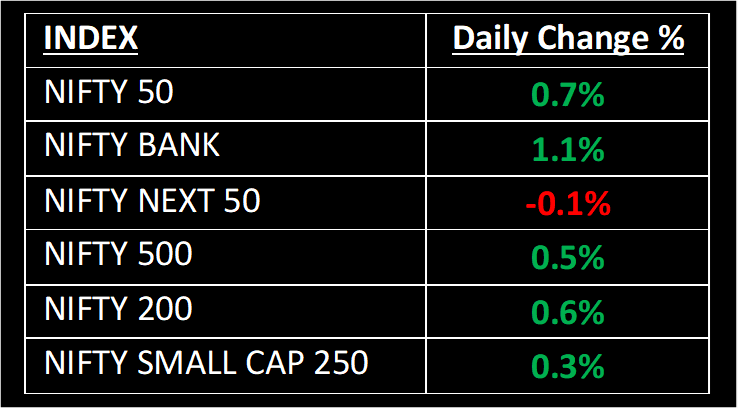

NIFTY: The index opened flat at 19,831 and made a high of 19,991 before closing at 19,979. Nifty has formed a long bullish candlestick pattern on the daily charts, with continuing higher highs and higher lows formation for the 6th consecutive session, which is a positive sign. Its immediate resistance level is now placed at 20,000 while immediate support is at 19,800.

BANK NIFTY: The index opened 20 points higher at 45,689 and closed at 46,186. Bank Nifty formed higher high and higher low formations, which is a bullish pattern that confirms the strength of the uptrend. Its immediate resistance level is now placed at 46,400 while support is at 45,800.

Stocks in Spotlight

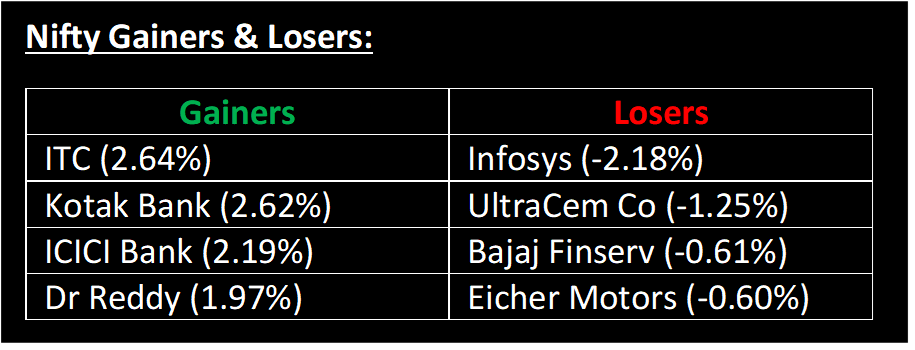

▪ ITC Ltd: Stock was up nearly 3% as it became the 7th Indian listed company to cross the Rs 6 lakh crore market cap mark for the first time after its shares rallied over 48% so far this year.

▪ ABB India Ltd: Stock tumbled 6.5% after the Swedish automation major's order inflows declined 2% to $8,667 million as against $8,807 million in the same quarter last year.

▪ Dish TV India Ltd: Stock jumped 3.76% after reports suggested that JC Flowers ARC may sell its entire stake in the company.

Global News

▪ European Stoxx 600 index slightly increased by 0.2%. However, tech stocks experienced a decline of 2% due to disappointing US earnings results. On the other hand, mining stocks performed well, gaining 2% during this period.

▪ Asia-Pacific markets were mixed on Thursday as investors digested a slew of economic data across the region. China kept its one and five-year loan prime rates unchanged, days after China’s second quarter GDP came in below expectations.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.