POST-MARKET SUMMARY 02 November 2023

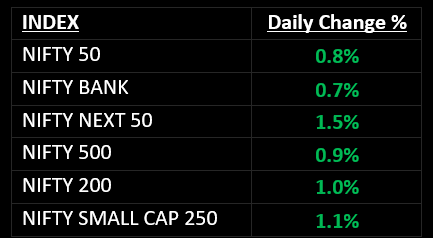

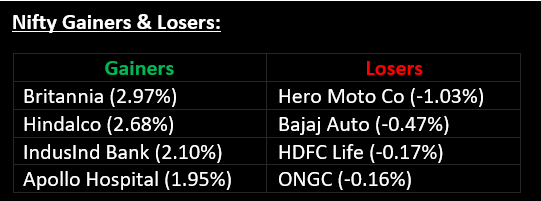

On November 2, the Indian benchmark indices rebounded from their losses over the previous two sessions, closing with gains and the Nifty comfortably surpassing the 19,100 mark. Top Gainer: Britannia | Top Loser: Hero Moto Co

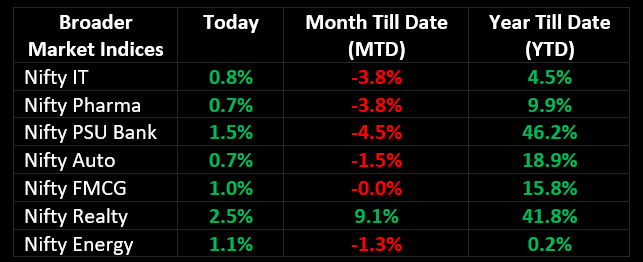

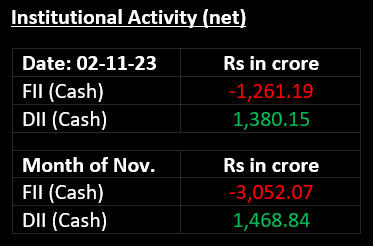

On November 2, the Indian benchmark indices rebounded from their losses over the previous two sessions, closing with gains and the Nifty comfortably surpassing the 19,100 mark. This positive performance was driven by favourable factors such as the US Federal Reserve's decision to hold interest rates, declining US bond yields, and lower crude oil prices. Furthermore, all sectoral indices finished in the positive territory, with the metal, auto, capital goods, FMCG, power, oil & gas, and realty sectors each posting gains of 1-2%.

NIFTY: The index opened 131 points higher at 19,120 and made a high of 19,175 before closing at 19,133. Nifty has formed a small-bodied bullish candlestick pattern with upper and lower shadow, which resembles a High Wave pattern on the daily chart. Its immediate resistance level is now placed at 19,230 while immediate support is at 19,060.

BANK NIFTY: The index opened 318 points higher at 43,018 and closed at 43,017. Bank Nifty tried crossing the 200-day SMA on the higher side but failed. Its immediate resistance level is now placed at 43,100 while support is at 42,800.

Stocks in Spotlight

▪ REC: Stock surged 6.8% a day after the company reported a 30.72% year-on-year increase in profit at Rs 3,789.90 crore.

▪ Kansai Nerolac Paints: Stock fell 1.1% with higher volumes despite the company announcing a 56% year-on-year jump in profit in the September quarter at Rs 177 crore.

▪ Triveni Turbine: Stock went up 9.4% after the company reported its highest-ever revenue and EBITDA in the July-September quarter of the current fiscal.

Global News

▪ European markets were sharply higher on Thursday as investors reacted positively to the US Federal Reserve’s decision to hold interest rates steady.

▪ Oil gained 1% to snap its three-day decline, as risk appetite returned to financial markets after the US Federal Reserve kept benchmark interest rates on hold.

▪ Gold prices edged up on Thursday, buoyed by a weaker US dollar and Treasury yields as investors stepped up bets that the central bank may be done with rate hikes.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.