POST-MARKET SUMMARY 19 July 2023

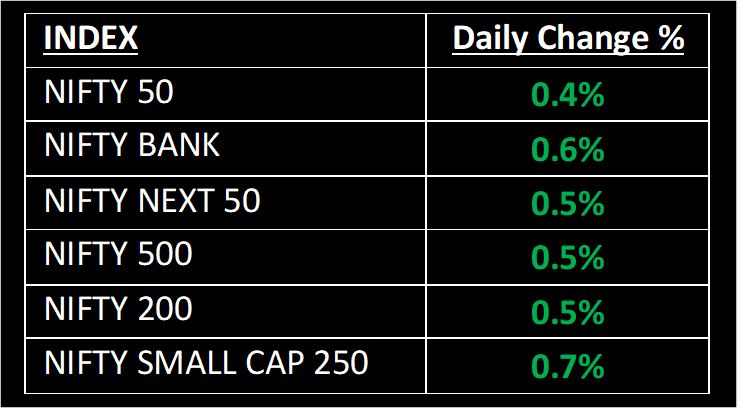

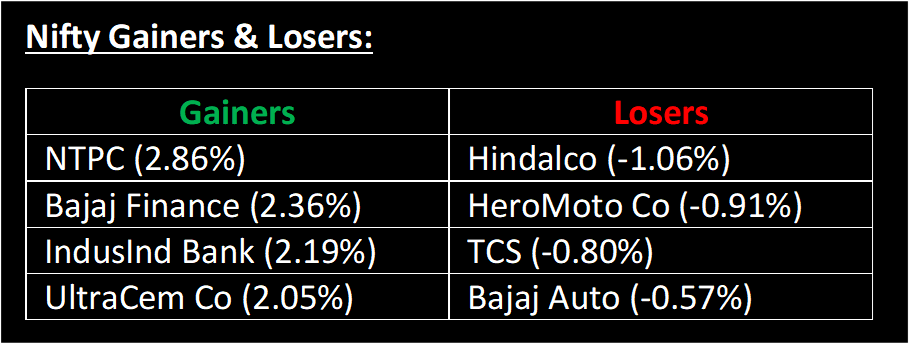

Despite intermittent attempts by bears, the bulls continued to dominate the market, driving the Nifty to a new milestone of 19,800 on July 19, closing above this level for the first time ever. Today's rally was mainly supported by the strong performance of banking and financial services sectors, as well as the significant contribution of index heavyweight, Reliance Industries.

NIFTY: The index opened 53 points higher at 19,802 and made a high of 19,851 before closing at 19,833. Nifty has formed a bullish candlestick pattern with a long lower shadow and small upper shadow on the daily chart, with continuing higher highs and higher lows formation for the 5th consecutive session. Its immediate resistance level is now placed at 19,900 while immediate support is at 19,600.

BANK NIFTY: The index opened 212 points higher at 45,622 and closed at 45,669. Bank Nifty formed a bullish candlestick pattern with a long lower shadow on the daily chart. This can also be seen as an Inside Bar candlestick pattern, as the index traded within the previous day's range. Its immediate resistance level is now placed at 45,800 while support is at 45,200.

Stocks in Spotlight

▪ Bikaji Foods International Ltd: Stock surged over 5%, following the company's acquisition of a 49% stake in snack maker Bhujialalji.

▪ TV18 Broadcast Ltd: Stock jumped 9% after the company reported a bumper performance for the June quarter.

▪ Sportking India Ltd: Stock rallied nearly 8% after a series of bulk purchases of stakes by some marquee investors in the counter.

Global News

▪ On Wednesday, gold prices remained stable, hovering around the eight-week highs achieved in the previous session. This came in response to economic data that heightened expectations of the US Federal Reserve nearing the conclusion of its interest rate hiking cycle.

▪ The British pound slipped lower following the release of lower-than-expected inflation data in the UK, which indicated that the Bank of England might not need to raise interest rates in the future.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.