POST-MARKET SUMMARY 18th April 2024

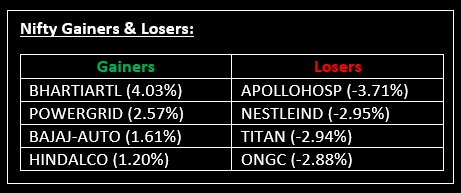

On April 18, Indian equity indices struggled to maintain their initial gains amidst significant volatility, concluding lower for the fourth consecutive day, with the Nifty falling below the 22,000 mark. Top Gainer: BHARTIARTL | Top Loser: APOLLOHOSP

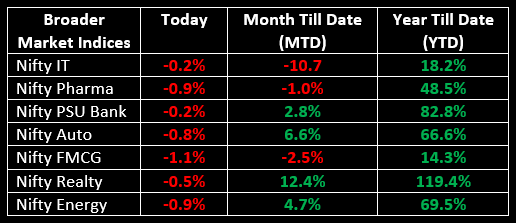

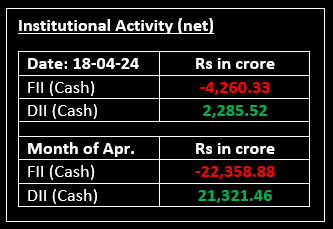

On April 18, Indian equity indices struggled to maintain their initial gains amidst significant volatility, concluding lower for the fourth consecutive day, with the Nifty falling below the 22,000 mark. Despite a mixed picture in global markets, trading began positively and retained momentum during the first half. However, the latter half of the session saw intense fluctuations before settling near the day's lowest point. Barring the telecom and media sectors, all other sectoral indices experienced losses.

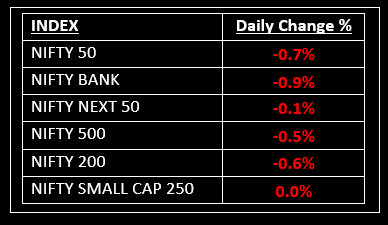

NIFTY: The index opened 65 points higher at 22,212 and made a high of 22,326 before closing at 21,995. Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 22,100 while immediate support is at 21,950.

BANK NIFTY: The index opened 108 points higher at 47,592 and closed at 47,069. Bank Nifty has formed a long bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 47,250 while support is at 47,000.

Stocks in Spotlight

▪ Bharti Airtel: Stock jumped 4% on expectations of higher-than-expected Tariff hikes.

▪ Nestle India: Stock slumped nearly 3% after a report by Public Eye called out the FMCG major for adding sugar and honey to its best-selling infant milk and cereal products in developing countries like India but not in the European markets.

▪ Sterling Tools: Stock zoomed 7% after the company signed a pact with South Korea's Yongin Electronics Co for electric vehicles component facility.

Global News

▪ The benchmark Stoxx 600 index was down 0.05% by 1:40 p.m. in London, with sectors trading mixed. Utilities led with a 1.1% gain while oil and gas stocks dropped 0.9% following a sharp fall in oil prices on Wednesday.

▪ Gold prices climbed on Thursday, as risks of a widening Middle East conflict raised bullion’s safe-haven appeal, overshadowing pressures from prospects of higher-for-longer U.S. interest rates.

▪ The dollar was soft on Thursday as traders assessed the U.S. interest rates outlook in the wake of comments from Federal Reserve officials that cemented expectation of monetary settings remaining restrictive for a while longer.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.