POST-MARKET SUMMARY 17 January 2024

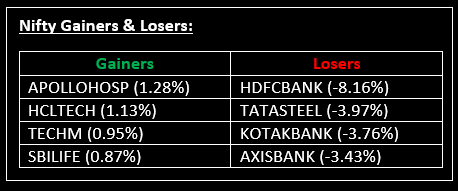

On January 17, the equity benchmarks experienced their biggest single-day decline in 19 months due to HDFC Bank's disappointing Q3 performance, which triggered a slump in the banking sector. This downturn was exacerbated by weak global cues. Top Gainer: APOLLOHOSP | Top Loser: DIVISLAB

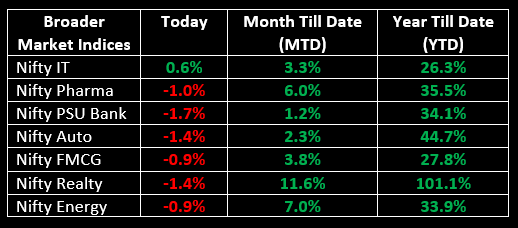

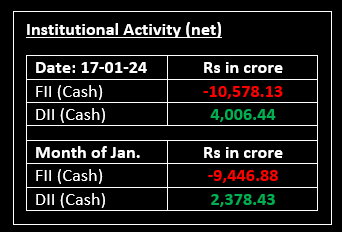

On January 17, the equity benchmarks experienced their biggest single-day decline in 19 months due to HDFC Bank's disappointing Q3 performance, which triggered a slump in the banking sector and unsettled the market. This downturn was exacerbated by weak global cues. Comments from US Federal Reserve Governor Christopher Waller further contributed to the market turmoil by dampening expectations of a March rate cut, causing 10-year treasury yields and the dollar index to rise and sending ripples across various sectors. Except for IT, all indices concluded the day in the red, with auto, metal, oil & gas, and realty sectors witnessing a decline of 1-2%. Both BSE midcap and smallcap indices fell 1%.

NIFTY: The index opened 385 points lower at 21,647 and made a high of 21,851 before closing at 21,571. Nifty has formed a bearish candlestick with long upper shadow on the daily chart. Its immediate resistance level is now placed at 21,680 while immediate support is at 21,550.

BANK NIFTY: The index opened 1,552 points lower at 46,573 and closed at 46,064. Bank Nifty has formed a bearish candlestick pattern with long upper shadow on the daily chart. Its immediate resistance level is now placed at 46,400 while support is at 45,900.

Stocks in Spotlight

▪ HDFC Bank: Stock plunged over 8% after its Q3 results disappointed investors. Although net profit grew 33% and met expectations, it was powered by a one-off tax gain.

▪ ICICI Lombard: Stock gained 5% after the company’s Q3 results beat market expectations. The company reported a net premium income of Rs 4,690 crore vs estimates of Rs 4,376 crore.

▪ IREDA: Stock gained 5% after the company announced partnership with Indian Overseas Bank (IOB) to co-finance renewable energy projects in India.

Global News

▪ Gold prices were flat on Wednesday after hitting an almost one-week low, pressured by a stronger dollar as hawkish comments from a Federal Reserve official diminished hopes of a U.S. interest rate cut in March.

▪ European markets were in negative territory for a third straight session, while regional focus remains on the World Economic Forum in Davos, Switzerland.

▪ Oil fell more than $1 on Wednesday as economic growth in China, the world’s second-largest crude user, slightly missed expectations, raising concerns about future demand, while U.S. dollar strength dented investor’s risk appetite.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.